Insider Sell Alert: Global Chief Comm. Officer Julie Eddleman Sells 4,500 Shares of ...

Julie Eddleman, the Global Chief Communications Officer of DoubleVerify Holdings Inc (NYSE:DV), has recently sold 4,500 shares of the company's stock. The transaction took place on December 4, 2023, and has caught the attention of investors and market analysts. This sale is part of a series of transactions by Eddleman over the past year, during which the insider has sold a total of 30,071 shares and has not made any purchases.

Julie Eddleman has been a key figure at DoubleVerify Holdings Inc, a company that specializes in digital media measurement, data, and analytics. The firm provides software platforms for advertisers to authenticate the quality and effectiveness of their digital media and ensure brand safety. Eddleman's role as Global Chief Communications Officer involves overseeing the company's global marketing and communication strategies, making her an integral part of DoubleVerify's leadership team.

DoubleVerify Holdings Inc operates in a rapidly evolving industry where the integrity and performance of digital advertising are paramount. The company's services are designed to provide transparency and accountability in digital advertising, helping brands to optimize their online presence and advertising spend.

Insider Trading Analysis

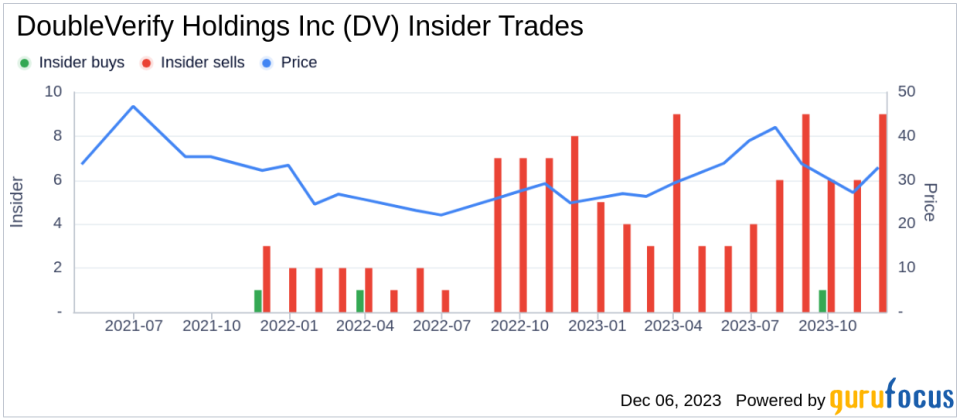

The recent sale by Julie Eddleman is part of a broader trend of insider selling at DoubleVerify Holdings Inc. Over the past year, there has been only one insider buy compared to 68 insider sells. This pattern of insider activity can sometimes raise questions about the insiders' confidence in the company's future prospects.

However, insider selling does not always indicate a lack of confidence. Insiders may sell shares for various reasons, such as diversifying their investment portfolio, tax planning, or personal financial needs. Without additional context, it is challenging to determine the exact motivation behind Eddleman's decision to sell.

On the day of the sale, DoubleVerify Holdings Inc's shares were trading at $33.37, giving the company a market capitalization of $5.674 billion. The stock's price-earnings ratio stood at 104.31, which is higher than the industry median of 26.84 but lower than the company's historical median price-earnings ratio. This suggests that, while the stock may be trading at a premium compared to the industry, it is not necessarily overvalued based on its own historical standards.

The insider trend image above provides a visual representation of the insider trading activity at DoubleVerify Holdings Inc. The predominance of selling transactions could be interpreted in various ways, but without a significant number of buys, it is difficult to assert strong insider confidence.

Valuation and Market Sentiment

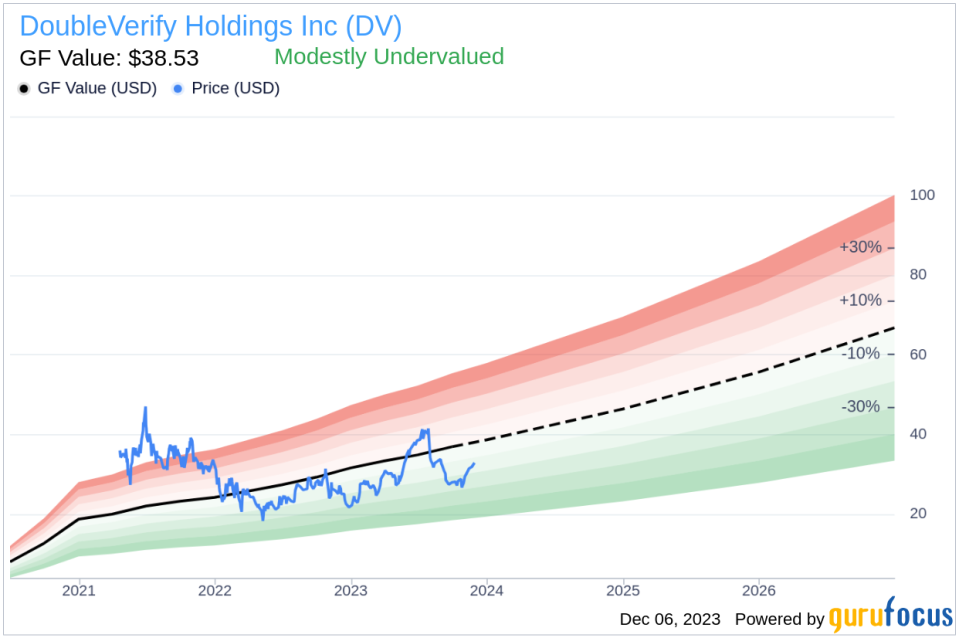

When assessing the valuation of DoubleVerify Holdings Inc, the GF Value metric offers a useful perspective. With a current price of $33.37 and a GuruFocus Value of $38.53, the stock has a price-to-GF-Value ratio of 0.87. This indicates that DoubleVerify Holdings Inc is modestly undervalued according to the GF Value, which could suggest that the stock has room for potential upside.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. This comprehensive approach to valuation provides a more nuanced view of the stock's intrinsic value, beyond the simplistic analysis of price-earnings ratios.

Despite the insider selling trend, the modest undervaluation of DoubleVerify Holdings Inc's stock could attract investors looking for growth opportunities in the digital advertising space. The company's specialized services in media measurement and analytics position it well to capitalize on the increasing demand for transparency and effectiveness in digital advertising campaigns.

Conclusion

Julie Eddleman's recent sale of 4,500 shares of DoubleVerify Holdings Inc is part of a larger pattern of insider selling at the company. While this activity may raise some concerns, the stock's modest undervaluation according to the GF Value suggests that there may still be growth potential. Investors should consider the broader context of the digital advertising industry, DoubleVerify's strategic position within it, and the company's financial metrics when evaluating the implications of insider trading activity.

As with any investment decision, it is essential to conduct thorough research and consider multiple factors, including insider transactions, company performance, industry trends, and overall market conditions. DoubleVerify Holdings Inc's future performance will ultimately depend on its ability to maintain its competitive edge and continue delivering value to advertisers in the dynamic digital landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.