Insider Sell Alert: KalVista Pharmaceuticals Inc's Benjamin Palleiko Sells 13,008 Shares

In a notable insider transaction, Benjamin Palleiko, the President, CFO, CBO & Sec'y of KalVista Pharmaceuticals Inc (NASDAQ:KALV), sold 13,008 shares of the company on November 20, 2023. This sale is part of a series of transactions over the past year, where Palleiko has sold a total of 35,066 shares and made no purchases. This insider activity raises questions about the executive's confidence in the company's future prospects and its current valuation.

Who is Benjamin Palleiko of KalVista Pharmaceuticals Inc?

Benjamin Palleiko is a seasoned executive with a wealth of experience in the biopharmaceutical industry. At KalVista Pharmaceuticals Inc, he holds multiple key positions, including President, Chief Financial Officer, Chief Business Officer, and Secretary. His role in the company is critical, overseeing financial operations, business development, and strategic planning. Palleiko's decisions and insider transactions are closely watched by investors as they can provide insights into the company's internal dynamics and future direction.

KalVista Pharmaceuticals Inc's Business Description

KalVista Pharmaceuticals Inc is a biopharmaceutical company focused on the discovery, development, and commercialization of small molecule protease inhibitors for diseases with significant unmet medical need. The company's portfolio primarily targets hereditary angioedema (HAE) and diabetic macular edema (DME), two areas where effective treatment options are limited. KalVista's approach to drug development is based on a deep understanding of protease biology, which allows for the creation of targeted therapies designed to improve patients' lives.

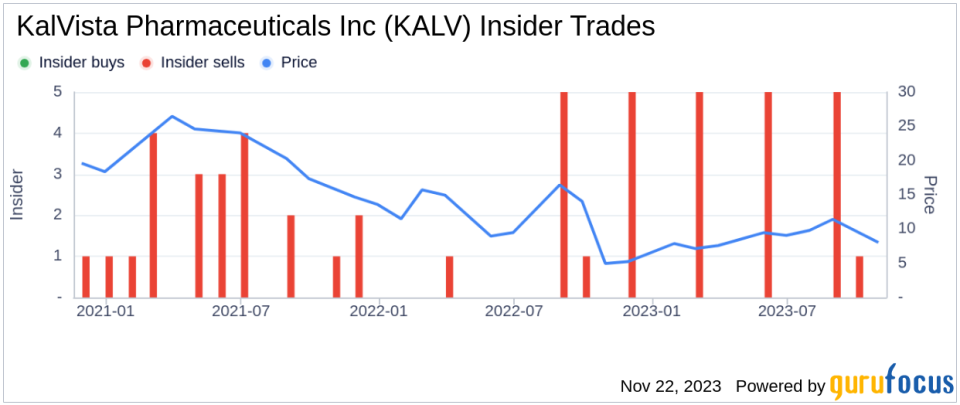

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The recent sale by Benjamin Palleiko is part of a broader trend of insider selling at KalVista Pharmaceuticals Inc. Over the past year, there have been zero insider buys and 17 insider sells. This pattern of insider selling could be interpreted in several ways. On one hand, it may suggest that insiders believe the stock is overvalued at current prices and are taking the opportunity to realize gains. On the other hand, insider sales can sometimes be motivated by personal financial planning and do not always indicate a lack of confidence in the company's prospects.

On the day of Palleiko's recent sale, shares of KalVista Pharmaceuticals Inc were trading at $8.23, giving the company a market cap of $266.283 million. This valuation places the company in the small-cap category, which is often associated with higher volatility and potential for growth.

Valuation and GF Value Analysis

The price-to-GF-Value ratio is a metric used to determine whether a stock is trading at a fair value relative to its intrinsic value. A ratio above 1 suggests that the stock may be overvalued, while a ratio below 1 indicates it could be undervalued. In the case of KalVista Pharmaceuticals Inc, the price-to-GF-Value ratio stands at 3.03, with a share price of $8.23 and a GF Value of $2.72. This significant discrepancy indicates that the stock is currently Significantly Overvalued based on its GF Value.The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The current valuation suggests that investors are pricing in optimistic future growth and performance, which may not align with the company's actual prospects.

Conclusion

The insider selling activity by Benjamin Palleiko at KalVista Pharmaceuticals Inc, particularly the recent sale of 13,008 shares, is a development that investors should monitor closely. While insider transactions are not always indicative of a company's future performance, they can provide valuable context when analyzed alongside other financial metrics and market indicators.Given the current price-to-GF-Value ratio, investors should exercise caution and conduct thorough due diligence before making investment decisions. It is essential to consider the company's fundamentals, growth potential, and the broader market environment to determine if the current stock price justifies the underlying value of the business.As always, insider trends and valuation metrics are just pieces of the investment puzzle. A comprehensive analysis that includes these factors, among others, will provide the most reliable basis for investment decisions regarding KalVista Pharmaceuticals Inc and its future trajectory.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.