Insider Sell Alert: Nutanix Inc's CEO Rajiv Ramaswami Offloads 87,997 Shares

In a notable insider transaction, Rajiv Ramaswami, the President and CEO of Nutanix Inc (NASDAQ:NTNX), sold a substantial number of shares in the company. On November 14, 2023, the insider executed a sale of 87,997 shares of Nutanix Inc, a significant move that has caught the attention of investors and market analysts alike.

Who is Rajiv Ramaswami?

Rajiv Ramaswami is a seasoned executive in the technology sector, known for his strategic vision and leadership. As the President and CEO of Nutanix Inc, Ramaswami has been at the helm of the company, steering it through the competitive landscape of cloud computing and enterprise software solutions. His expertise in networking, cloud services, and enterprise infrastructure has been instrumental in Nutanix's growth and innovation strategies.

About Nutanix Inc

Nutanix Inc is a leader in the field of cloud computing, providing a comprehensive suite of solutions that streamline data center operations and cloud management. The company's software-driven platform enables businesses to modernize their IT infrastructure, enhance agility, and improve operational efficiency. Nutanix's offerings include hyper-converged infrastructure (HCI), hybrid cloud architecture, and multi-cloud management, making it a critical player in the digital transformation of enterprises around the globe.

Analysis of Insider Buy/Sell and Stock Price Relationship

Insider transactions, particularly those involving high-ranking executives, can provide valuable insights into a company's financial health and future prospects. In the case of Nutanix Inc, the insider, Rajiv Ramaswami, has been on a selling streak over the past year, offloading a total of 404,301 shares without any recorded purchases. This pattern of behavior could signal a variety of things, from personal financial planning to a lack of confidence in the company's short-term growth potential.

It's important to note that insider sells can be motivated by many factors and do not always indicate a negative outlook. Executives may sell shares for personal reasons such as diversifying their investment portfolio, funding personal expenses, or tax planning. However, consistent selling by insiders, particularly in the absence of insider buying, can raise questions among investors.

The relationship between insider transactions and stock price is complex. While a single insider sell may not significantly impact the stock price, a series of sells over time can lead to a decrease in investor confidence and potentially a decline in the stock's value. Conversely, insider buying is often viewed as a positive sign, suggesting that insiders believe the stock is undervalued and has potential for appreciation.

On the day of Ramaswami's recent sale, Nutanix Inc's shares were trading at $40, giving the company a market cap of $9.746 billion. This valuation reflects the market's current assessment of the company's worth, but it's essential to consider the broader context of the company's financial performance and growth prospects.

The insider trend image above illustrates the pattern of insider transactions over the past year. With 19 insider sells and no insider buys, the trend suggests that insiders have been consistently reducing their stakes in the company.

Valuation and GF Value Analysis

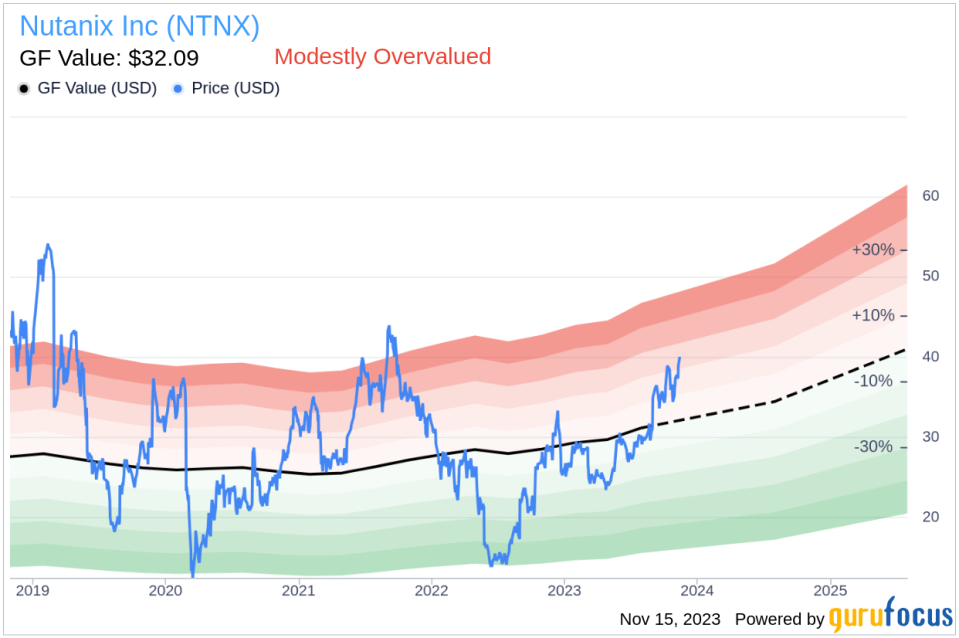

When assessing the valuation of Nutanix Inc, it's crucial to consider the GF Value, an intrinsic value estimate developed by GuruFocus. The GF Value takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

With a current trading price of $40 and a GF Value of $32.09, Nutanix Inc has a price-to-GF-Value ratio of 1.25. This indicates that the stock is modestly overvalued based on its GF Value. Investors should be cautious when the stock's price exceeds its intrinsic value, as it may suggest limited upside potential or an increased risk of price correction.

The GF Value image above provides a visual representation of Nutanix Inc's valuation relative to its intrinsic value. The modest overvaluation may be a factor for investors to consider, especially in light of the recent insider selling activity.

Conclusion

Rajiv Ramaswami's recent sale of 87,997 shares of Nutanix Inc is a significant event that warrants attention from investors. While the reasons behind the insider's decision to sell are not publicly known, the pattern of insider selling over the past year could be a signal for investors to review their investment thesis for Nutanix Inc. Additionally, the stock's modest overvaluation according to the GF Value suggests that investors should exercise caution and conduct thorough due diligence before making any investment decisions.

As always, insider transactions are just one piece of the puzzle when evaluating a stock. It's essential to consider a comprehensive range of factors, including financial performance, industry trends, and broader market conditions, before making investment choices. Nutanix Inc's role in the evolving cloud computing landscape and its potential for growth in this sector should also be factored into any investment analysis.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.