Insider Sell Alert: Nutanix Inc's CEO Rajiv Ramaswami Offloads 87,174 Shares

In a notable insider transaction, President and CEO Rajiv Ramaswami of Nutanix Inc (NASDAQ:NTNX) sold a substantial number of shares in the company. On December 11, 2023, the insider executed a sale of 87,174 shares, a move that has caught the attention of investors and market analysts alike.

Who is Rajiv Ramaswami?

Rajiv Ramaswami is the President and CEO of Nutanix Inc, a position he has held since December 2020. With a rich background in technology and business, Ramaswami has been instrumental in steering Nutanix through the competitive landscape of cloud computing and enterprise infrastructure solutions. His leadership is pivotal in the company's strategic initiatives and growth trajectory.

About Nutanix Inc

Nutanix Inc is a leader in the cloud computing industry, providing an enterprise cloud platform that converges silos of servers, virtualization, and storage into one integrated solution. This approach simplifies data center operations and allows businesses to focus on their applications and services. Nutanix's innovative technology is designed to be scalable, resilient, and user-friendly, making it a popular choice for companies undergoing digital transformation.

Analysis of Insider Buy/Sell and Stock Price Relationship

The insider's recent sale is part of a broader pattern observed over the past year. Rajiv Ramaswami has sold a total of 491,475 shares and has not made any purchases. This one-sided transaction history could signal various things to investors. While insider sales can sometimes indicate a lack of confidence in the company's future prospects, they can also be motivated by personal financial planning or diversification strategies.The insider transaction history for Nutanix Inc shows a clear trend of more insider selling than buying over the past year, with 20 insider sells and no insider buys. This could be interpreted as insiders taking profits or managing their investment portfolios, rather than a negative outlook on the company's valuation.

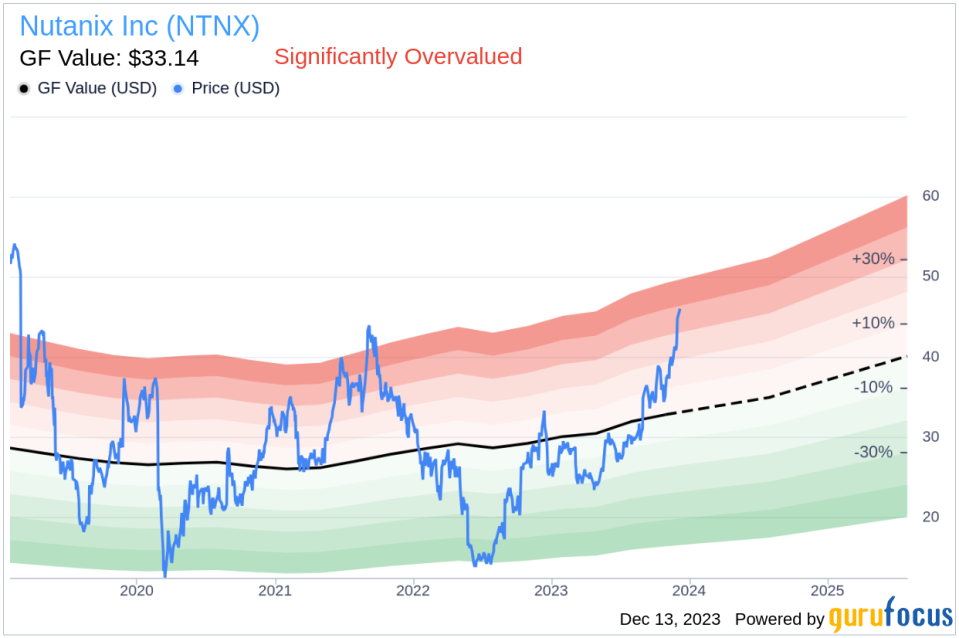

When analyzing the relationship between insider transactions and stock price, it's important to consider the context of each sale. In the case of Nutanix Inc, the stock was trading at $46.04 on the day of the insider's recent sale, giving the company a market cap of $11.151 billion. This price point is significantly higher than the GuruFocus Value (GF Value) of $33.14, suggesting that the stock is currently Significantly Overvalued.

GF Value Analysis

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. For Nutanix Inc, the price-to-GF-Value ratio stands at 1.39, indicating that the stock's market price is considerably above its estimated intrinsic value.

This disparity between the market price and the GF Value could be a contributing factor to the insider's decision to sell shares. If the insider believes that the stock's current valuation is unsustainable, selling at a high price-to-GF-Value ratio would be a prudent financial move.

Conclusion

The recent insider sale by Nutanix Inc's CEO Rajiv Ramaswami is a significant event that warrants attention from investors. While the reasons behind the sale are not publicly disclosed, the transaction occurs at a time when the stock is deemed Significantly Overvalued according to the GF Value metric. Investors should consider the insider's trading history, the company's valuation, and the broader market context when making investment decisions. As always, insider transactions are just one piece of the puzzle, and a comprehensive analysis should include a review of the company's fundamentals, competitive position, and growth prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.