Insider Sell Alert: PowerSchool Holdings Inc's CMO Fred Studer Offloads 5,697 Shares

In a notable insider transaction, Fred Studer, the Chief Marketing Officer of PowerSchool Holdings Inc (NYSE:PWSC), sold 5,697 shares of the company on December 5, 2023. This move has caught the attention of investors and market analysts, as insider sales can provide valuable insights into a company's internal perspective.

Who is Fred Studer?

Fred Studer is the Chief Marketing Officer at PowerSchool Holdings Inc, a leading provider of K-12 education technology solutions. With a rich background in marketing and business development, Studer has been instrumental in shaping PowerSchool's brand and expanding its market presence. His role involves overseeing the company's marketing strategies, product branding, and customer engagement initiatives. Studer's expertise in the tech industry and his strategic vision have been pivotal in PowerSchool's growth trajectory.

About PowerSchool Holdings Inc

PowerSchool Holdings Inc is at the forefront of K-12 education technology, offering innovative solutions that empower teachers, students, and administrators. The company's comprehensive suite of software addresses various aspects of education management, including student information systems, classroom collaboration, and performance analytics. PowerSchool's mission is to transform the educational experience through technology, making learning more accessible, efficient, and effective for everyone involved.

Analysis of Insider Buy/Sell and Stock Price Relationship

Insider transactions, particularly sales, can be a double-edged sword when it comes to stock price implications. On one hand, insiders may sell shares for personal financial planning reasons that are not directly related to their outlook on the company's future. On the other hand, large or frequent sales by insiders can sometimes be perceived as a lack of confidence in the company's prospects, potentially leading to negative investor sentiment.

In the case of Fred Studer's recent sale of 5,697 shares, it is important to consider the context of his past transactions. Over the past year, the insider has sold a total of 50,489 shares and has not made any purchases. This pattern of selling could suggest that Studer is taking profits or reallocating his personal investment portfolio. However, without additional information, it is difficult to ascertain the exact motivation behind these sales.

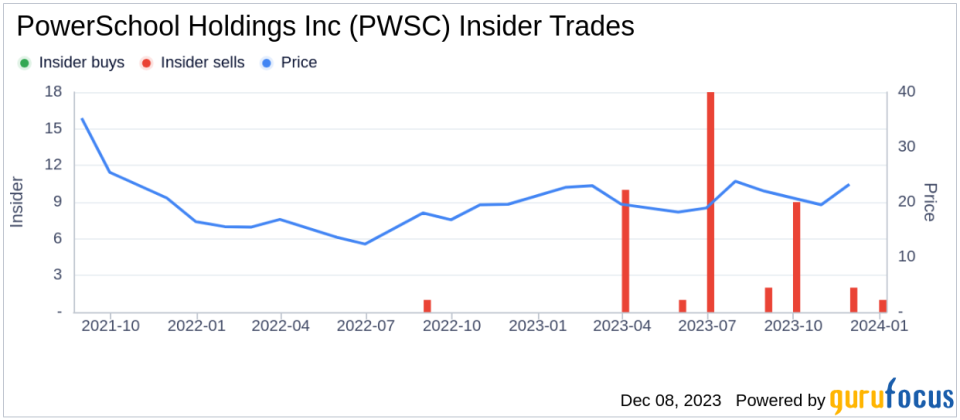

The insider transaction history for PowerSchool Holdings Inc shows a trend of more insider selling than buying over the past year, with 44 insider sells and no insider buys. This trend could be a signal to investors to monitor the stock closely, as it may indicate that those with the most intimate knowledge of the company's workings are choosing to reduce their holdings.

On the valuation front, PowerSchool Holdings Inc's shares were trading at $23 on the day of Studer's recent sale, giving the company a market cap of $4.501 billion. This valuation places the company among the mid-cap stocks, which are often subject to more volatility and can be more sensitive to insider trading activity.

It is also crucial to analyze the stock's performance in relation to insider selling. If the stock price has been declining prior to the insider sales, it could reinforce investor concerns. Conversely, if the stock has been stable or appreciating, insider sales might not carry as much weight in the investment decision-making process.

The above insider trend image provides a visual representation of the selling pattern at PowerSchool Holdings Inc. Investors should consider this information alongside other fundamental and technical analysis to make informed decisions.

Conclusion

Insider sales, such as the recent transaction by Fred Studer, are important events that warrant attention from the investment community. While they do not always signify a negative outlook on the company, they do require a careful analysis of the possible reasons behind the sales and their potential impact on the stock price. For PowerSchool Holdings Inc, the pattern of insider selling over the past year suggests that investors should remain vigilant and consider the broader context when evaluating the company's stock as a potential investment.

As always, investors are encouraged to look beyond insider transactions and consider a wide array of factors, including company performance, industry trends, and macroeconomic conditions, before making investment decisions. Keeping an eye on insider trends can be a valuable piece of the puzzle, but it should be just one of many considerations in a comprehensive investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.