Insider Sell Alert: President Anthony Marino Sells 83,130 Shares of ThredUp Inc (TDUP)

In a notable insider transaction, President Anthony Marino of ThredUp Inc (NASDAQ:TDUP) has sold a significant number of shares in the company. On November 15, 2023, the insider executed a sale of 83,130 shares, a move that has caught the attention of investors and market analysts alike. This article delves into the details of the transaction, the insider's history, the company's business model, and the potential implications for ThredUp Inc's stock price.

Who is Anthony Marino?

Anthony Marino is a key figure at ThredUp Inc, serving as the company's President. His role involves overseeing the strategic direction and operational execution of the company. Marino's decisions and leadership are integral to ThredUp's growth and market positioning. His insider status provides him with a deep understanding of the company's challenges and opportunities, making his trading activities particularly noteworthy for investors.

ThredUp Inc's Business Description

ThredUp Inc is a leading online resale platform for women's and kids' apparel, shoes, and accessories. The company operates on a consignment model, offering a sustainable and socially responsible solution for consumers to buy and sell secondhand clothing. ThredUp's platform leverages technology and data to create a seamless experience for both buyers and sellers, contributing to the circular fashion economy and reducing textile waste.

Analysis of Insider Buy/Sell and Relationship with Stock Price

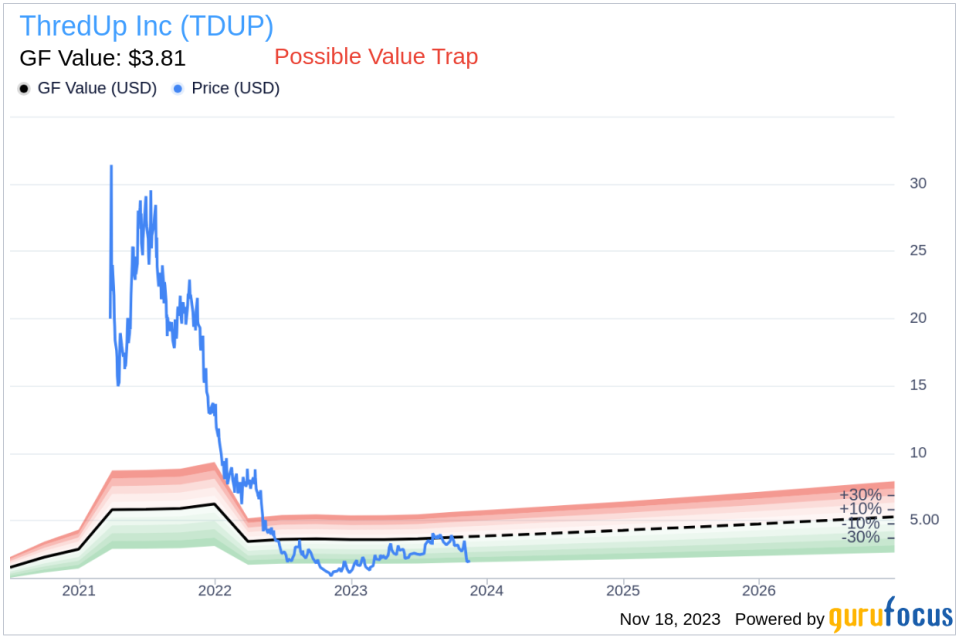

The recent sale by President Anthony Marino is part of a broader pattern of insider trading activity at ThredUp Inc. Over the past year, Marino has sold a total of 83,130 shares and has not made any purchases. This one-sided selling trend could signal a lack of confidence in the company's short-term growth prospects or simply a personal financial decision by the insider.When analyzing insider transactions, it's crucial to consider the context and timing. Marino's sale occurred when ThredUp Inc's shares were trading at $2.09, giving the company a market cap of $214.501 million. This price point is significantly below the GuruFocus Value (GF Value) of $3.81, suggesting that the stock might be undervalued.

The insider trend image above illustrates the insider trading activities over the past year. With 3 insider buys and 25 insider sells, the trend indicates a predominance of selling over buying among insiders. This pattern can sometimes be interpreted as a bearish signal, as insiders may perceive the stock to be overvalued or expect a downturn in the company's performance.However, it's important to note that insider selling can occur for various reasons unrelated to the company's health, such as diversifying personal portfolios, tax planning, or other personal financial considerations. Therefore, while insider trends are a valuable piece of the puzzle, they should not be the sole basis for investment decisions.

Valuation and GF Value Analysis

The valuation of ThredUp Inc is a critical aspect of the analysis. With the stock trading at $2.09 and a GF Value of $3.81, the price-to-GF-Value ratio stands at 0.55. This ratio indicates that the stock is a Possible Value Trap, Think Twice, according to GuruFocus's valuation model.

The GF Value is a proprietary intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The current price-to-GF-Value ratio suggests that while the stock appears undervalued, investors should exercise caution and conduct further analysis before making investment decisions.In conclusion, the insider sell activity by President Anthony Marino at ThredUp Inc is a significant event that warrants attention. While the company's stock appears undervalued based on the GF Value, the predominance of insider selling over the past year raises questions about the stock's future trajectory. Investors should consider the insider trends, the company's business model, and the broader market conditions when evaluating ThredUp Inc as a potential investment. As always, due diligence and a diversified investment strategy are recommended to mitigate risks and capitalize on opportunities in the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.