Insider Sell Alert: President Benjamin Jackson Sells 10,100 Shares of Intercontinental Exchange ...

Intercontinental Exchange Inc (NYSE:ICE), a leading operator of global exchanges and clearing houses and provider of mortgage technology, data and listings services, has witnessed a significant insider sell by President Benjamin Jackson. On December 4, 2023, Jackson sold 10,100 shares of the company, a transaction that has caught the attention of investors and market analysts alike.

Who is Benjamin Jackson?

Benjamin Jackson is a prominent figure within Intercontinental Exchange Inc, serving as the President of the company. His role involves overseeing and steering the strategic direction of the firm, ensuring that it remains at the forefront of the financial services industry. Jackson's insider status provides him with a deep understanding of the company's operations, making his trading activities particularly noteworthy to those following ICE's stock.

Intercontinental Exchange Inc's Business Description

Intercontinental Exchange Inc is a titan in the financial market infrastructure sector. The company operates exchanges, including the New York Stock Exchange, and clearinghouses that help market participants trade and manage risk. ICE also offers a wide range of data services and technology solutions for the mortgage industry, making it a diversified and integral player in the financial ecosystem.

Analysis of Insider Buy/Sell and Relationship with Stock Price

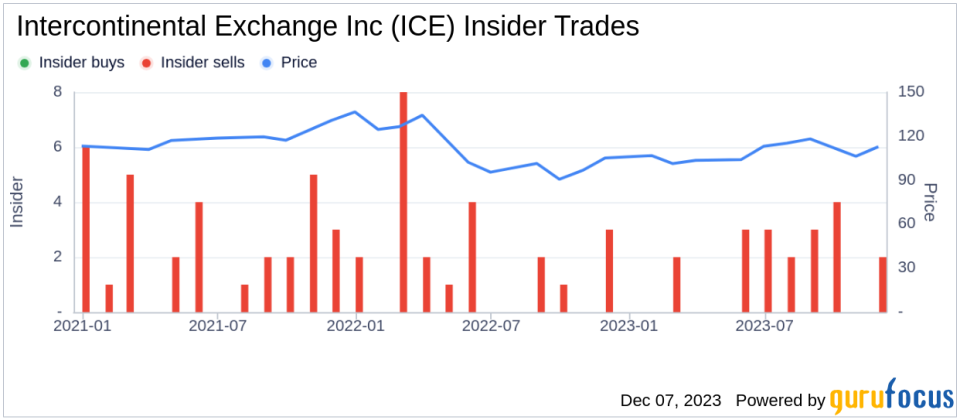

Insider trading activities, such as those of Benjamin Jackson, can provide valuable insights into a company's health and future prospects. Over the past year, Jackson has sold a total of 22,100 shares and has not made any purchases. This one-sided activity could signal a lack of confidence in the company's short-term growth potential or could be a part of personal financial planning. It's important to consider that insiders may sell shares for various reasons unrelated to their outlook on the company, such as diversifying their investments or funding personal expenses.

The broader insider trend at Intercontinental Exchange Inc over the past year shows a total absence of insider buys, contrasted with 20 insider sells. This pattern may raise questions about the internal perspective on the stock's valuation or future performance.

On the day of Jackson's recent sell, shares of Intercontinental Exchange Inc were trading at $114.78, giving the company a substantial market cap of $64.722 billion. The price-earnings ratio stands at 26.24, which is above both the industry median of 18.07 and the company's historical median. This elevated P/E ratio could suggest that the stock is priced on the higher end of its value range, potentially justifying insider selling activity.

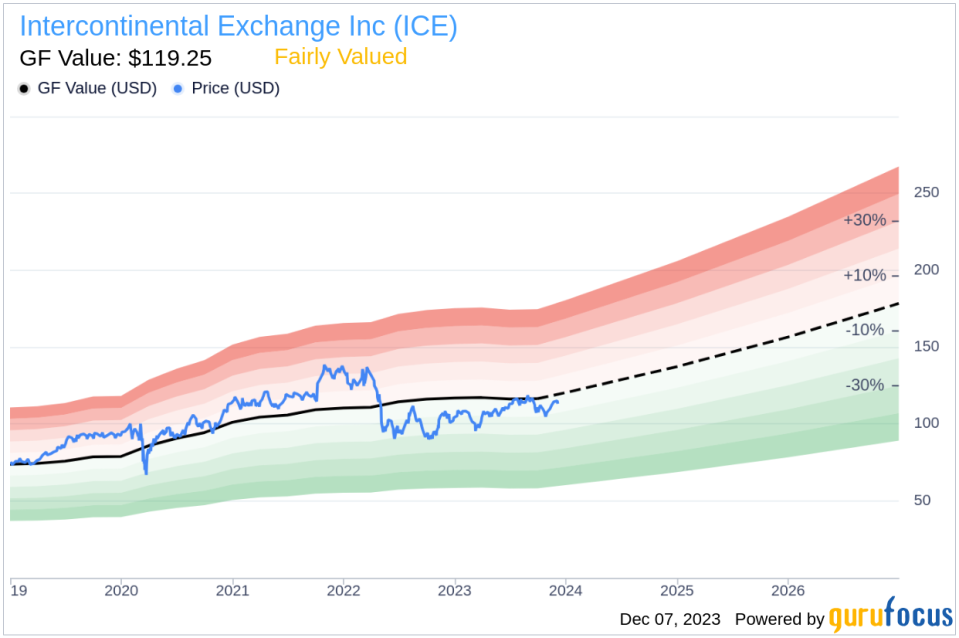

However, when considering the GuruFocus Value (GF Value) of $119.25, Intercontinental Exchange Inc appears to be Fairly Valued with a price-to-GF-Value ratio of 0.96. The GF Value is a proprietary intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This fair valuation might indicate that the insider's decision to sell does not necessarily reflect a belief that the stock is overvalued.

The insider trend image above provides a visual representation of the selling and buying activities of insiders over time, which can be a useful tool for investors trying to gauge market sentiment.

The GF Value image offers a snapshot of the stock's valuation relative to its intrinsic value, helping investors determine if the stock is trading at a discount or premium.

Conclusion

While insider sells can be interpreted in various ways, it is essential for investors to consider the context of these transactions. Benjamin Jackson's recent sell of 10,100 shares of Intercontinental Exchange Inc does not occur in isolation but is part of a broader pattern of insider selling over the past year. Despite this, the company's fair valuation according to the GF Value suggests that the stock may still be priced appropriately in the market.

Investors should weigh insider trading patterns alongside other financial metrics and market analyses before making investment decisions. As always, a diversified approach to investing and thorough due diligence are prudent strategies in navigating the complexities of the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.