Insider Sell Alert: President and CEO HULL THOMAS DAVID III Sells 6,000 Shares of Kewaunee ...

In a recent transaction on December 13, 2023, HULL THOMAS DAVID III, the President and CEO of Kewaunee Scientific Corp (NASDAQ:KEQU), sold 6,000 shares of the company's stock. This move has caught the attention of investors and market analysts, as insider selling can often provide valuable insights into a company's financial health and future prospects.

Who is HULL THOMAS DAVID III?

HULL THOMAS DAVID III is the President and CEO of Kewaunee Scientific Corp, a company that specializes in the design, manufacture, and installation of laboratory, healthcare, and technical furniture products. The insider's role places them in a position of significant influence and responsibility, overseeing the strategic direction and operational execution of the company's initiatives.

Kewaunee Scientific Corp's Business Description

Kewaunee Scientific Corp is an established player in the laboratory and technical furniture market. The company offers a comprehensive range of products and services, including laboratory casework, fume hoods, adaptable modular systems, moveable workstations, stand-alone benches, biological safety cabinets, and epoxy resin work surfaces and sinks. Kewaunee's products are essential in various settings, including education, healthcare, government, and pharmaceutical and biotech industries.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, particularly those involving high-ranking executives, can be a strong indicator of a company's internal perspective on its stock's value. Over the past year, HULL THOMAS DAVID III has sold a total of 10,500 shares and has not made any purchases. This pattern of selling without corresponding buys may lead some investors to question the insider's confidence in the company's future growth.

It is important to consider the context of these sales. Insiders may sell shares for various reasons unrelated to their outlook on the company, such as diversifying their personal portfolio, tax planning, or other personal financial considerations. However, consistent selling over time could suggest that the insider believes the stock may be fully valued or that there are better investment opportunities elsewhere.

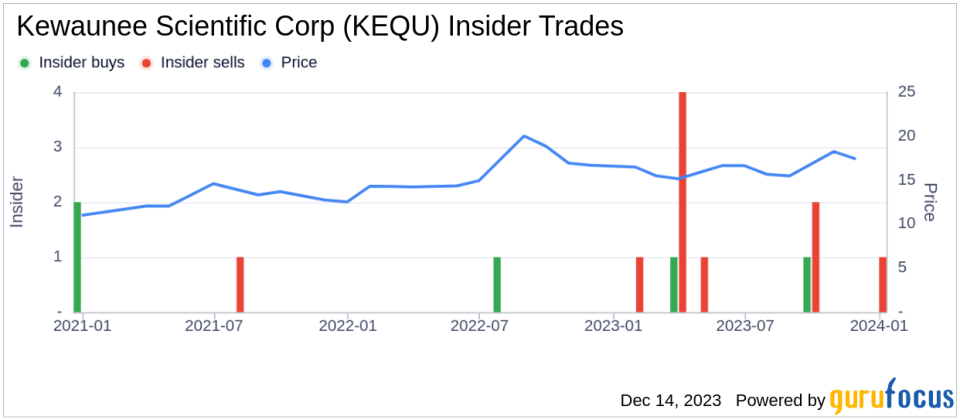

The insider transaction history for Kewaunee Scientific Corp shows a trend of more insider sells (9) than buys (2) over the past year. This could be interpreted as a bearish signal by market participants, as it appears that those with the most intimate knowledge of the company's workings are choosing to reduce their holdings.

On the day of the insider's recent sell, shares of Kewaunee Scientific Corp were trading at $22.8, giving the stock a market cap of $67.754 million. The price-earnings ratio of 9.81 is lower than both the industry median of 18.76 and the company's historical median, suggesting that the stock may be undervalued based on earnings.

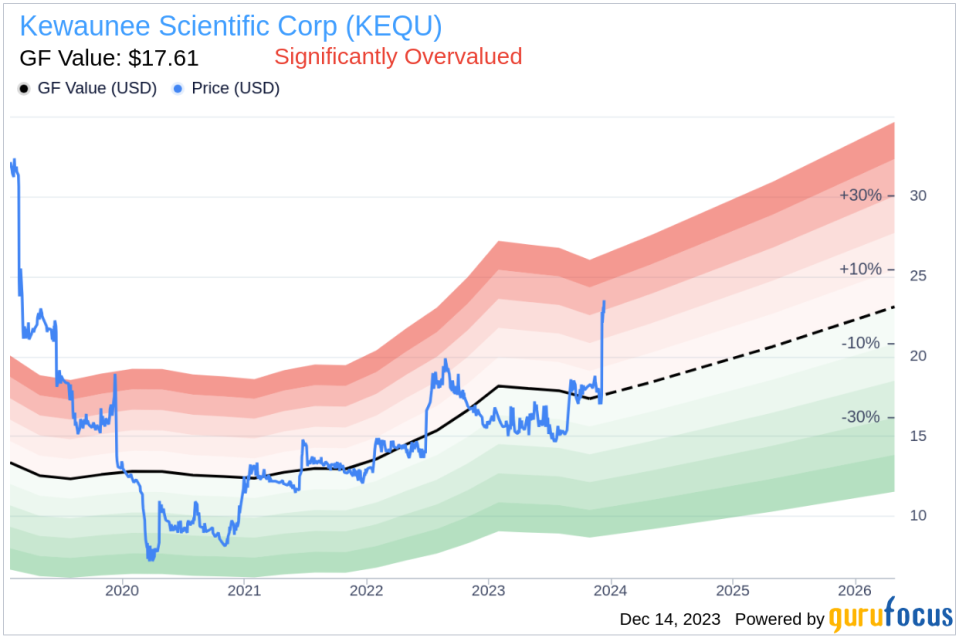

However, the price-to-GF-Value ratio of 1.29 indicates that the stock is significantly overvalued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the buying and selling patterns of Kewaunee Scientific Corp's insiders. The predominance of sell transactions could be a point of concern for potential investors.

The GF Value image further illustrates the discrepancy between the current stock price and the estimated intrinsic value. When a stock trades above its GF Value, it is often considered overvalued, which may suggest that the stock's current price reflects an optimistic scenario and that there is limited upside potential.

Conclusion

The recent insider sell by HULL THOMAS DAVID III, along with the overall trend of insider selling at Kewaunee Scientific Corp, may raise questions among investors. While the company's low price-earnings ratio could be attractive, the price-to-GF-Value ratio suggests that the stock is significantly overvalued. Investors should consider these factors, along with the broader market conditions and the company's fundamentals, before making investment decisions.

As always, insider transactions are just one piece of the puzzle when evaluating a stock. They should be weighed alongside other financial data and market analysis to gain a comprehensive understanding of a company's potential investment value.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.