Insider Sell Alert: President & CEO Robert Johnson Sells Shares of Silicon Laboratories Inc ...

Robert Johnson, the President & CEO of Silicon Laboratories Inc, has recently made a significant change to his holdings in the company. On December 4, 2023, the insider sold 3,679 shares of Silicon Laboratories Inc (NASDAQ:SLAB), a notable transaction that has caught the attention of investors and market analysts alike.

Who is Robert Johnson of Silicon Laboratories Inc?

Robert Johnson has been serving as the President & CEO of Silicon Laboratories Inc, a leading provider of silicon, software, and solutions for a smarter, more connected world. Johnson has been at the helm of the company, steering it through the dynamic landscape of the semiconductor industry. His leadership has been pivotal in the company's strategic decisions and growth initiatives. The insider's transactions are closely watched as they can provide insights into the insider's confidence in the company's future prospects.

Silicon Laboratories Inc's Business Description

Silicon Laboratories Inc is a prominent player in the semiconductor industry, specializing in the development of mixed-signal integrated circuits (ICs). The company's products are integral to various applications, including Internet of Things (IoT) devices, industrial automation, consumer electronics, and automotive systems. Silicon Laboratories Inc prides itself on its innovation in providing solutions that enable the connectivity and performance required for the next generation of smart applications.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

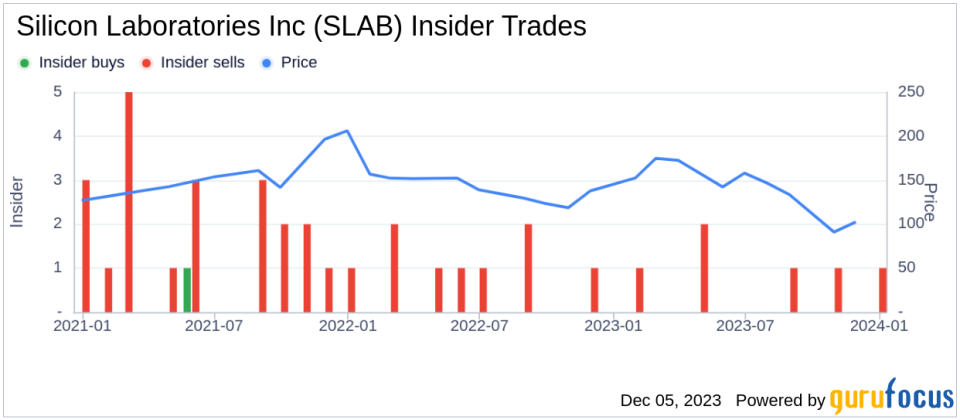

Insider transactions can be a valuable indicator of a company's health and future performance. Over the past year, Robert Johnson has sold a total of 10,711 shares and has not made any purchases. This pattern of selling without corresponding buys could signal various things, including personal financial management or a less bullish outlook on the company's valuation or future performance.

It is important to note that insiders may sell shares for numerous reasons that do not necessarily reflect a lack of confidence in the company, such as diversifying their investment portfolio, tax planning, or personal financial requirements. However, consistent selling by insiders, particularly in the absence of insider buying, can raise questions among investors.

The insider transaction history for Silicon Laboratories Inc shows a trend of more insider selling than buying over the past year, with 6 insider sells and 0 insider buys. This trend could suggest that insiders, including Robert Johnson, may believe that the shares are fully valued or that they see better investment opportunities elsewhere.

On the day of the insider's recent sell, shares of Silicon Laboratories Inc were trading at $108.22, giving the company a market cap of $3.517 billion. The price-earnings ratio of 60.80 is significantly higher than the industry median of 26.46 and also above the company's historical median price-earnings ratio. This high valuation could be one of the factors influencing the insider's decision to sell shares.

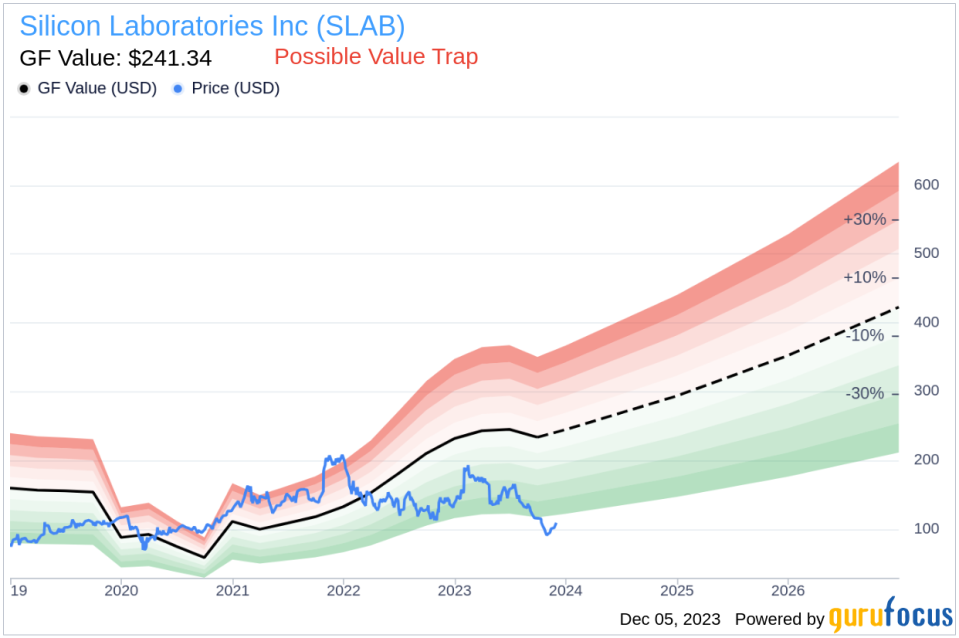

When considering the price-to-GF-Value ratio of 0.45, Silicon Laboratories Inc appears to be a Possible Value Trap, Think Twice, according to its GF Value. This assessment suggests that the stock might not be as undervalued as it seems, and investors should be cautious.

The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The current price-to-GF-Value ratio indicates that the stock may not have as much upside potential as some investors might hope.

The insider trend image above provides a visual representation of the selling and buying activities of insiders over time. The absence of buying transactions in the past year, coupled with the consistent selling, could be interpreted as a cautious signal by market observers.

The GF Value image further illustrates the valuation of Silicon Laboratories Inc relative to its intrinsic value estimate. The current market price is significantly below the GF Value, which could indicate that the stock is undervalued. However, given the insider selling activity and the high price-earnings ratio, investors may want to investigate further before making any investment decisions.

Conclusion

The recent insider sell by President & CEO Robert Johnson of Silicon Laboratories Inc is a transaction that warrants attention. While insider selling does not always indicate a problem with the company, the lack of insider buying over the past year, combined with the high price-earnings ratio and the price-to-GF-Value assessment, suggests that investors should proceed with caution. As always, it is essential for investors to conduct their own due diligence and consider the broader market context when evaluating insider transactions and their potential implications for stock performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.