Insider Sell Alert: President and CEO Russell Diez-Canseco Sells 26,069 Shares of Vital Farms ...

Recent filings with the SEC have revealed that Russell Diez-Canseco, the President and CEO of Vital Farms Inc (NASDAQ:VITL), has sold a significant number of shares in the company. On December 13, 2023, the insider executed a sale of 26,069 shares, a move that has caught the attention of investors and market analysts alike. This article delves into the details of the transaction, the insider's history, and what it could mean for the future of Vital Farms Inc.

Who is Russell Diez-Canseco?

Russell Diez-Canseco serves as the President and CEO of Vital Farms Inc, a position that places him at the helm of the company's strategic direction and operational execution. His role is pivotal in steering the company towards its mission and ensuring that its business objectives are met. Diez-Canseco's decisions and actions are closely watched by investors, as they can have a significant impact on the company's performance and stock valuation.

About Vital Farms Inc

Vital Farms Inc, traded under the ticker VITL on the NASDAQ, is a company that specializes in ethically produced food. With a focus on animal welfare and sustainable farming practices, Vital Farms has established itself as a leader in the pasture-raised egg and dairy products market. The company's commitment to transparency and ethical sourcing resonates with a growing consumer base that values responsible food production.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions are often scrutinized for insights into a company's health and future prospects. Over the past year, Russell Diez-Canseco has sold a total of 132,858 shares and has not made any purchases. This pattern of behavior could suggest a variety of things, including personal financial management or a lack of confidence in the company's short-term growth potential. However, without additional context, it is difficult to draw definitive conclusions.

The insider transaction history for Vital Farms Inc shows a trend of more insider sells than buys over the past year, with 9 insider sells and 0 insider buys. This could indicate that insiders, including Diez-Canseco, may believe that the stock is currently overvalued or that they are taking profits off the table.

On the day of Diez-Canseco's recent sale, shares of Vital Farms Inc were trading at $15.12, giving the company a market cap of $599.905 million. The price-earnings ratio of 32.04 is higher than the industry median of 18.58, suggesting that the stock may be more expensive compared to its peers. However, it is lower than the company's historical median price-earnings ratio, which could imply that the stock is undervalued based on its own historical performance.

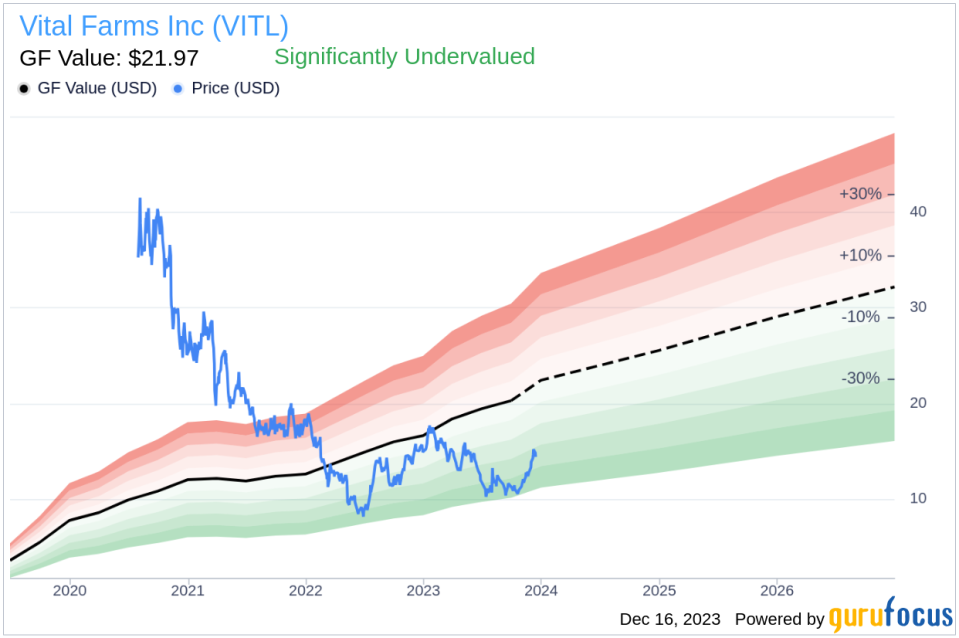

According to the GuruFocus Value, with a price of $15.12 and a GF Value of $21.97, Vital Farms Inc has a price-to-GF-Value ratio of 0.69. This indicates that the stock is significantly undervalued based on its GF Value. The GF Value is calculated considering historical multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the selling and buying patterns of insiders at Vital Farms Inc. The absence of insider buys in the past year, coupled with the consistent selling, could be a signal to investors to approach the stock with caution.

The GF Value image further illustrates the discrepancy between the current stock price and the estimated intrinsic value. Despite the insider selling trend, the stock appears to be undervalued, which could present an opportunity for investors who believe in the long-term prospects of the company.

Conclusion

The recent insider sell by Russell Diez-Canseco is a significant event that warrants attention. While the insider's actions may raise questions, the valuation metrics suggest that Vital Farms Inc is undervalued. Investors should consider the insider trends, the company's business model, and the broader market conditions when making investment decisions. As always, it is recommended to conduct thorough research and consider multiple factors before buying or selling any securities.

It's important to note that insider transactions are not always indicative of the future performance of a company's stock. They can be influenced by personal financial needs, tax planning strategies, or diversification purposes. Therefore, while insider activity is a valuable piece of information, it should be one of many factors in an investor's analysis.

For those interested in Vital Farms Inc, keeping an eye on future insider transactions, as well as the company's performance in terms of earnings, growth, and its adherence to ethical practices, will be key in assessing the potential for long-term investment success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.