Insider Sell Alert: President and CEO Russell Diez-Canseco Sells 26,505 Shares of Vital Farms ...

Recent insider trading activity has caught the attention of market analysts as Russell Diez-Canseco, the President and CEO of Vital Farms Inc (NASDAQ:VITL), sold a significant number of shares in the company. On November 13, 2023, the insider executed a sale of 26,505 shares, which has prompted a closer look into the implications of such a move for investors and the company's stock performance.

Who is Russell Diez-Canseco?

Russell Diez-Canseco serves as the President and CEO of Vital Farms Inc, a position that places him at the helm of the company's strategic direction and operational execution. His role is critical in steering the company towards its mission and ensuring that its business objectives align with shareholder interests. With a deep understanding of the company's operations and market position, Diez-Canseco's trading activities are often scrutinized for insights into the company's health and future prospects.

About Vital Farms Inc

Vital Farms Inc, traded under the ticker VITL on the NASDAQ, is a company that specializes in ethical food production, particularly in the pasture-raised egg and dairy sectors. The company prides itself on its commitment to humane animal treatment, sustainable farming practices, and transparency in its operations. Vital Farms has established a reputation for providing high-quality, ethically produced products that cater to a growing consumer base concerned with food origins and production methods.

Analysis of Insider Buy/Sell and Stock Price Relationship

Insider trading patterns, such as buys and sells, can provide valuable clues about a company's internal perspective on its stock's valuation and future performance. Over the past year, Russell Diez-Canseco has sold a total of 106,789 shares and has not made any purchases. This one-sided activity could signal a lack of confidence in the company's short-term growth potential or a personal financial decision by the insider.

The absence of insider buys over the past year, coupled with six insider sells during the same period, may raise questions among investors. However, it is essential to consider these transactions within the broader context of the company's performance and market conditions.

On the day of Diez-Canseco's recent sale, Vital Farms Inc shares were trading at $11.85, giving the company a market cap of $532.509 million. This valuation reflects the market's current assessment of the company's worth, but it is also crucial to consider the stock's price-earnings ratio. With a P/E ratio of 28.44, Vital Farms Inc is trading above the industry median of 19.08, suggesting a higher valuation compared to its peers. However, it is trading below its historical median P/E ratio, indicating that the stock may be undervalued based on its own trading history.

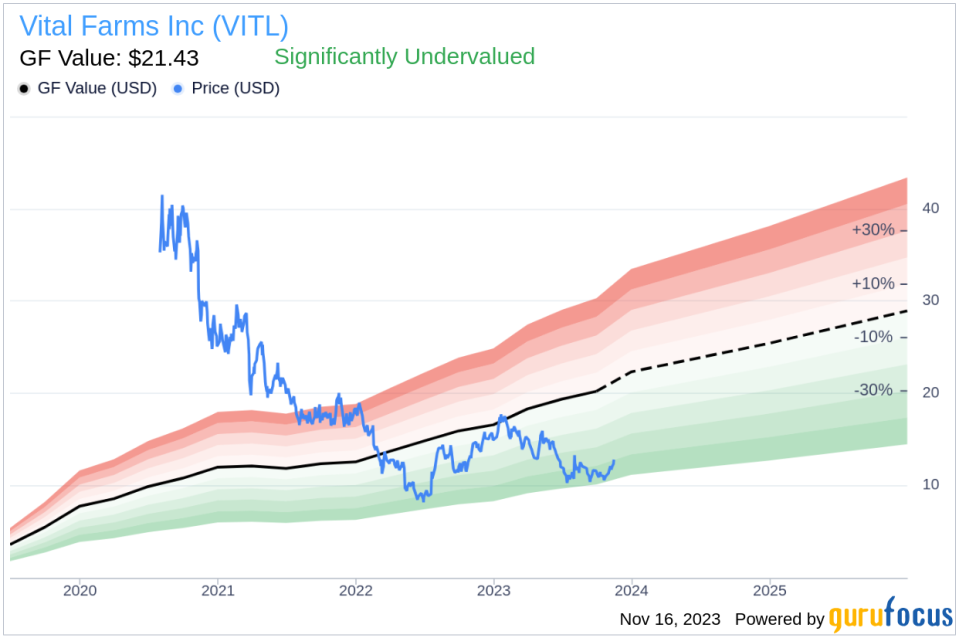

When examining the price-to-GF-Value ratio, which stands at 0.55, it becomes evident that Vital Farms Inc is significantly undervalued based on its GF Value of $21.43. This discrepancy suggests that the stock may have considerable upside potential, according to the intrinsic value estimate developed by GuruFocus.

The insider trend image above provides a visual representation of the insider trading activities, highlighting the recent sell transactions. This trend can be a critical factor for investors to consider when evaluating their investment decisions.

The GF Value image further illustrates the stock's valuation status, reinforcing the notion that Vital Farms Inc is currently undervalued. This valuation model takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

Conclusion

The recent insider sell by Russell Diez-Canseco may prompt investors to delve deeper into Vital Farms Inc's financial health and future outlook. While insider sells can sometimes be perceived negatively, it is essential to analyze these actions within the context of the company's valuation, industry performance, and intrinsic value estimates. With Vital Farms Inc's stock appearing significantly undervalued based on the GF Value, there may be opportunities for investors to capitalize on potential market mispricing. As always, investors should conduct thorough research and consider a multitude of factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.