Insider Sell Alert: President and CEO M Ball Sells 13,102 Shares of Koppers Holdings Inc (KOP)

In a notable insider transaction, President and CEO M Ball of Koppers Holdings Inc (NYSE:KOP) sold 13,102 shares of the company's stock on December 1, 2023. This sale is part of a series of transactions over the past year, where M Ball has sold a total of 34,269 shares and made no purchases. The insider's recent sell has sparked interest among investors, as insider transactions can provide valuable insights into a company's prospects and valuation.

Who is M Ball of Koppers Holdings Inc?

M Ball serves as the President and CEO of Koppers Holdings Inc, a position that places the insider at the helm of the company's strategic direction and operational execution. As a key executive, M Ball's actions, including stock transactions, are closely monitored for indications of the insider's confidence in the company's future performance.

Koppers Holdings Inc's Business Description

Koppers Holdings Inc is a global provider of treated wood products, wood treatment chemicals, and carbon compounds. The company operates through multiple segments, including Railroad and Utility Products and Services, Performance Chemicals, and Carbon Materials and Chemicals. Koppers serves a diverse range of markets, including the railroad, specialty chemical, utility, residential lumber, agriculture, aluminum, steel, rubber, and construction industries. With a commitment to sustainability and innovation, Koppers aims to deliver quality products and services while maintaining a focus on safety and environmental stewardship.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

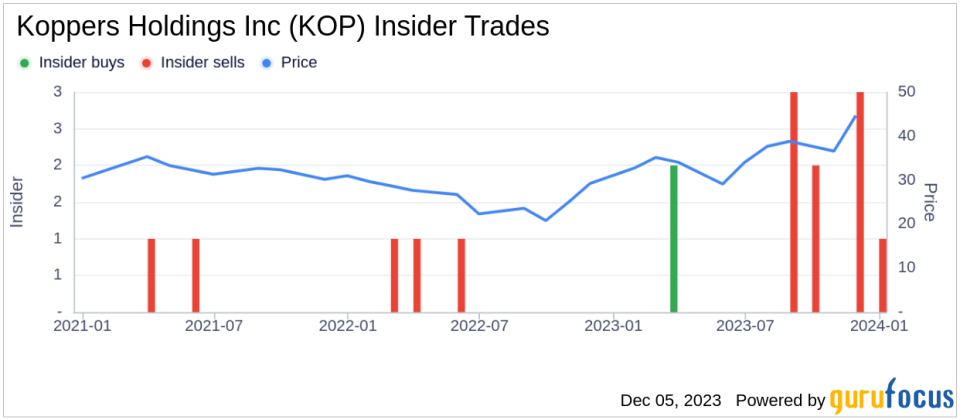

Insider transactions can be a valuable indicator of a company's health and future performance. Over the past year, Koppers Holdings Inc has seen 2 insider buys and 9 insider sells. This pattern of more frequent selling than buying by insiders may raise questions among investors about the insider's outlook on the company's valuation and future prospects.

On the day of M Ball's recent sell, shares of Koppers Holdings Inc were trading at $44.6, giving the company a market cap of $952.655 million. The price-earnings ratio of 10.87 is lower than both the industry median of 22.68 and the company's historical median, suggesting that the stock may be undervalued based on earnings.

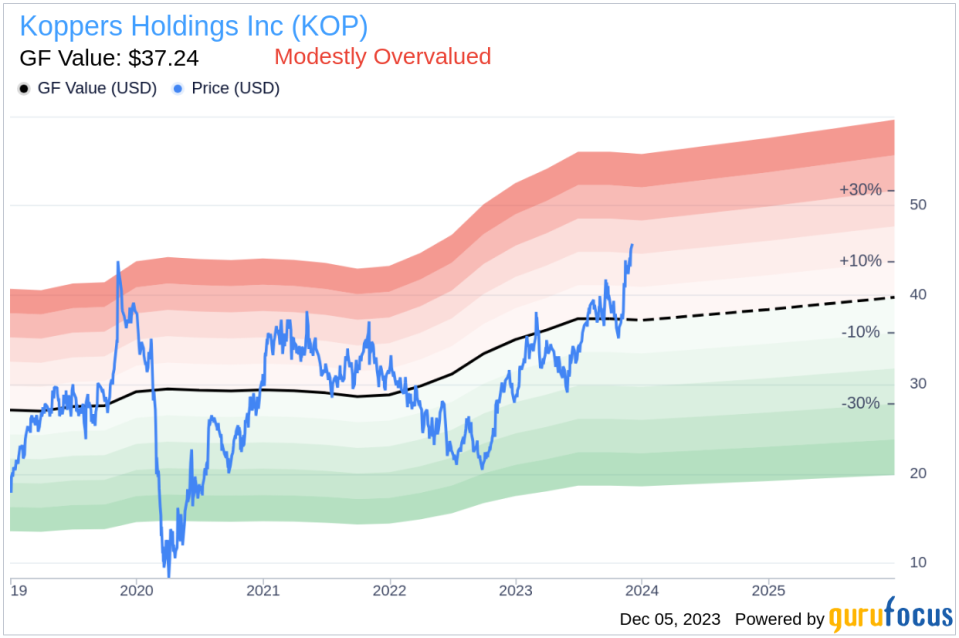

However, with a price-to-GF-Value ratio of 1.2, Koppers Holdings Inc is considered Modestly Overvalued according to the GF Value, which is an intrinsic value estimate developed by GuruFocus. This valuation takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider's decision to sell shares could be interpreted in several ways. It may reflect a belief that the stock is currently overvalued or it could be related to personal financial planning or diversification needs. Without additional context, it is challenging to determine the exact motivation behind the insider's sell.

The insider trend image above provides a visual representation of the buying and selling patterns of insiders at Koppers Holdings Inc. A predominance of selling activity, especially from high-level executives like M Ball, may suggest that insiders believe the stock's current price does not fully reflect potential headwinds or limitations in growth.

The GF Value image further illustrates the stock's valuation relative to its intrinsic value. The modest overvaluation indicated by the price-to-GF-Value ratio aligns with the insider's decision to sell, potentially signaling that the stock's current price exceeds its estimated fair value.

Conclusion

Insider transactions, such as the recent sale by President and CEO M Ball, offer valuable data points for investors. While the lower price-earnings ratio of Koppers Holdings Inc suggests a potential undervaluation based on earnings, the GF Value indicates that the stock is modestly overvalued. The insider's sell, in the context of this mixed valuation picture, may prompt investors to take a closer look at the company's fundamentals and market position.

As with any insider transaction, it is important to consider the broader market conditions, the company's strategic initiatives, and other potential factors that could influence an insider's decision to buy or sell shares. Investors should conduct their own due diligence and consider multiple data sources when evaluating the investment potential of Koppers Holdings Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.