Insider Sell Alert: President & CEO Douglas Godshall Sells 5,000 Shares of ShockWave ...

ShockWave Medical Inc (NASDAQ:SWAV) has recently witnessed a significant insider sell by its President & CEO, Douglas Godshall. On November 15, 2023, the insider executed a sale of 5,000 shares of the company, stirring interest among investors and market analysts. This transaction is particularly noteworthy as it adds to a series of insider sales over the past year, with Douglas Godshall having sold a total of 35,000 shares and not having purchased any.

Who is Douglas Godshall?

Douglas Godshall has been at the helm of ShockWave Medical Inc as the President and CEO, bringing with him a wealth of experience in the medical device industry. His leadership has been instrumental in steering the company through various stages of growth and innovation. Godshall's tenure has seen the company make significant strides in its operational and financial performance, which makes his trading activities in the company's stock a focal point for investors seeking insights into the company's health and future prospects.

ShockWave Medical Inc's Business Description

ShockWave Medical Inc is a pioneer in the medical device sector, specializing in the development and commercialization of intravascular lithotripsy technology. This innovative approach is designed to treat calcified plaque in patients with peripheral artery disease and coronary artery disease. The company's technology has been a game-changer in the field, offering a less invasive treatment option compared to traditional surgical procedures. ShockWave Medical's commitment to improving patient outcomes has positioned it as a leader in the cardiovascular market.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

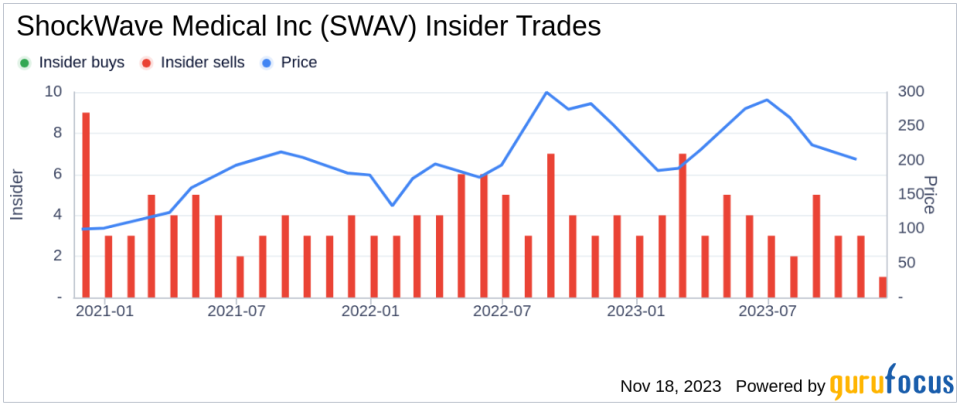

Insider trading activities, such as those of Douglas Godshall, can provide valuable clues about a company's internal perspective on its stock's value. Over the past year, ShockWave Medical Inc has seen a total of 45 insider sells and no insider buys. This trend could suggest that insiders, including Godshall, may believe that the stock is fully valued or potentially overvalued at current prices, prompting them to lock in gains.

On the day of the insider's recent sale, shares of ShockWave Medical Inc were trading at $174.08, giving the company a market cap of $6.351 billion. The price-earnings ratio stood at 26.81, which is lower than both the industry median of 28.64 and the company's historical median price-earnings ratio. This could indicate that the stock is reasonably valued compared to its peers and its own trading history.

However, the price-to-GF-Value ratio of 0.35, with a GF Value of $502.03, labels the stock as a 'Possible Value Trap, Think Twice' according to GuruFocus's valuation. This assessment suggests that despite the stock's current price being lower than its intrinsic value estimate, investors should be cautious due to other potential risks or uncertainties surrounding the company.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The insider trend image above reflects the recent insider selling pattern, which could be interpreted as a signal that insiders are taking profits or reallocating their investments. While insider selling does not always indicate a lack of confidence in the company's future, the absence of insider buying over the past year could raise questions among investors.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. The current price-to-GF-Value ratio below 1 suggests that the stock is undervalued based on GuruFocus's model. However, given the insider selling trend, investors might question whether the model fully captures all relevant factors affecting the stock's true value.

Conclusion

The recent insider sell by President & CEO Douglas Godshall is a significant event for ShockWave Medical Inc and its investors. While the company's business model and technology remain strong, the insider selling trend and the valuation metrics present a mixed picture. Investors should consider these insider activities as part of a broader investment analysis, taking into account the company's financial health, market position, and growth prospects. As always, due diligence is key when interpreting insider trading signals and assessing a stock's potential as an investment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.