Insider Sell Alert: President and CEO Michael Hartnett Sells 14,774 Shares of RBC Bearings Inc (RBC)

Michael Hartnett, the President and CEO of RBC Bearings Incorporated, has recently made a significant change to his holdings in the company. On December 8, 2023, the insider sold 14,774 shares of RBC Bearings Inc (NYSE:RBC), a notable transaction that has caught the attention of investors and market analysts alike. This sale is part of a series of transactions over the past year, where Michael Hartnett has sold a total of 62,400 shares and has not made any purchases.

Who is Michael Hartnett?

Michael Hartnett is a key figure at RBC Bearings Inc, serving as the President and CEO. His leadership and strategic decisions have been instrumental in steering the company's direction and performance. With a deep understanding of the company's operations and market position, Hartnett's trading activities are closely monitored for insights into the company's health and future prospects.

About RBC Bearings Inc

RBC Bearings Incorporated is an international manufacturer and marketer of highly engineered precision bearings and components. The company's products are integral to the manufacturing and operation of machines, aircraft, and mechanical systems, contributing to the reduction of friction and the transmission of power. RBC Bearings serves a diverse array of markets, including industrial, aerospace, and defense, and is known for its commitment to quality, innovation, and engineering excellence.

Analysis of Insider Buy/Sell and Relationship with Stock Price

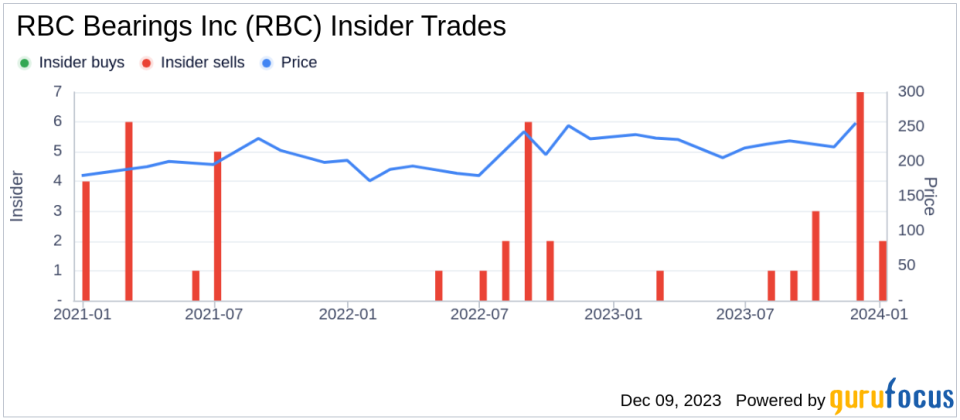

Insider trading activities, such as buys and sells, can provide valuable insights into a company's internal perspective on its stock's value. Over the past year, RBC Bearings Inc has seen a total of 15 insider sells and no insider buys, which could suggest that insiders are more inclined to take profits at current price levels or perceive the stock as being fully valued.

On the day of the insider's recent sell, shares of RBC Bearings Inc were trading at $261.55, giving the company a market cap of $7.632 billion. This price level reflects a price-earnings ratio of 46.53, which is significantly higher than the industry median of 22.32 and above the company's historical median price-earnings ratio. Such a high price-earnings ratio could indicate that the stock is priced at a premium compared to its peers and historical performance.

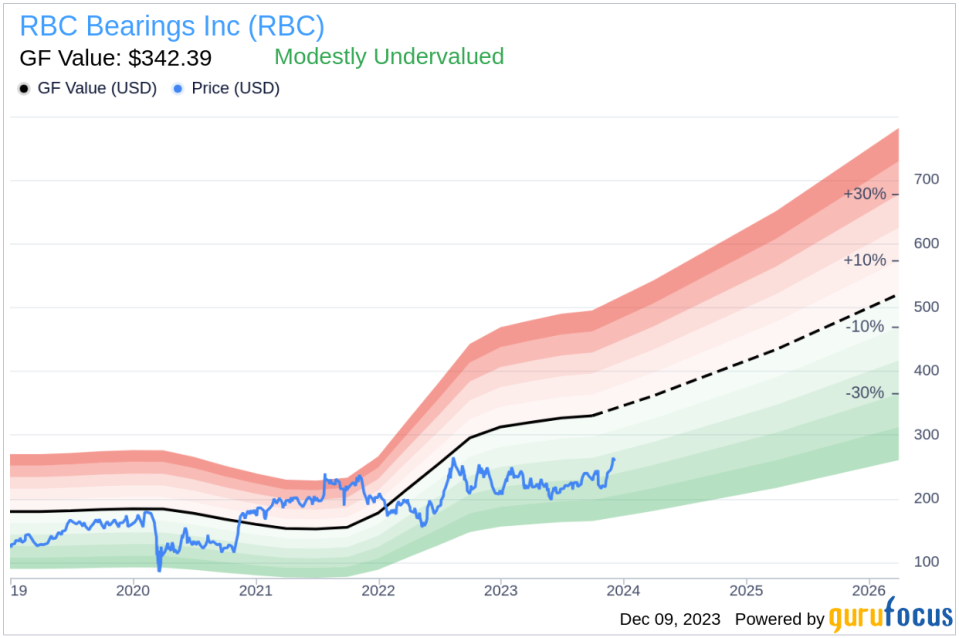

However, when considering the GuruFocus Value (GF Value) of $342.39, RBC Bearings Inc appears to be modestly undervalued with a price-to-GF-Value ratio of 0.76. The GF Value is a proprietary intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

The insider trend image above illustrates the pattern of insider transactions over time, providing a visual representation of the selling and buying activities within the company. The absence of insider buys coupled with consistent selling could be interpreted as a lack of confidence in the stock's potential for near-term appreciation or a desire to diversify personal holdings.

The GF Value image provides a graphical view of the stock's current price in relation to its estimated intrinsic value. The fact that the stock is trading below its GF Value might attract value investors who believe the market has undervalued the company's true worth. However, the insider selling activity could temper this enthusiasm, as it may signal that insiders believe the stock's growth potential is already reflected in the current price, or they have concerns about future performance.

Conclusion

Michael Hartnett's recent sale of 14,774 shares of RBC Bearings Inc is a significant transaction that warrants attention. While the company appears to be modestly undervalued based on the GF Value, the high price-earnings ratio and consistent pattern of insider selling over the past year could suggest that insiders are cautious about the company's valuation and future stock price performance. Investors should consider these insider trading trends alongside broader market analysis and individual investment strategies when evaluating RBC Bearings Inc as a potential investment.

As always, insider trading is just one piece of the puzzle when it comes to making informed investment decisions. It's important to look at a company's financial health, industry trends, and macroeconomic factors before drawing any conclusions. For those interested in RBC Bearings Inc, keeping an eye on insider transactions will continue to be an important aspect of understanding the stock's potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.