Insider Sell Alert: President & CEO Patrick Bowe Sells 16,658 Shares of Andersons Inc (ANDE)

Patrick Bowe, the President and CEO of Andersons Inc, has recently made a significant stock transaction, selling 16,658 shares of the company on December 15, 2023. This move has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's financial health and future prospects.

Who is Patrick Bowe of Andersons Inc?

Patrick Bowe is a seasoned executive with extensive experience in the agribusiness industry. As the President and CEO of Andersons Inc, Bowe has been at the helm of the company, steering it through the dynamic and often challenging landscape of the agriculture sector. His leadership has been instrumental in guiding Andersons Inc's strategic initiatives and operational performance.

Andersons Inc's Business Description

Andersons Inc is a diversified company rooted in agriculture that conducts business across North America in the grain, ethanol, plant nutrient, and rail sectors. The company is known for its robust supply chain management, which includes grain storage, marketing, and distribution. Additionally, Andersons Inc has a significant presence in the production of ethanol and related by-products, as well as in the distribution of plant nutrients and railcar leasing and repair.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

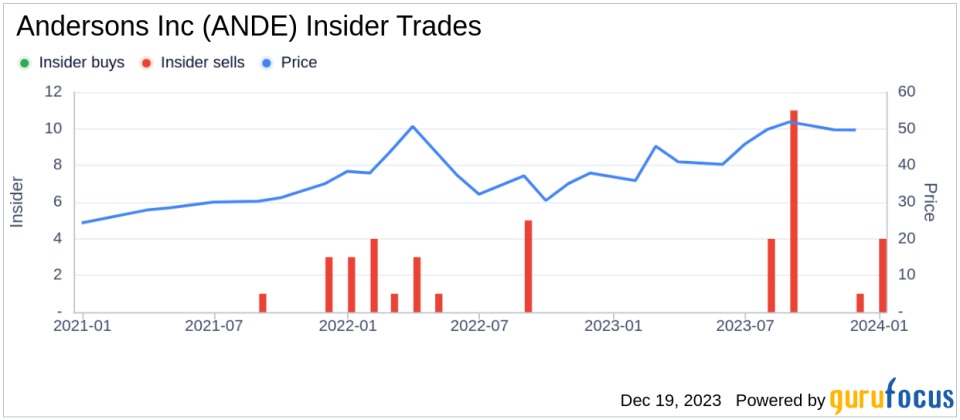

Insider transactions, particularly those involving high-ranking executives like Patrick Bowe, can be a strong indicator of a company's internal perspective on its stock's value. Over the past year, Patrick Bowe has sold a total of 104,960 shares and has not made any purchases. This pattern of selling without corresponding buys could signal that the insider may perceive the stock's current price as being on the higher end of its value spectrum.

When examining the insider transaction history for Andersons Inc, it is notable that there have been no insider buys over the past year, while there have been 20 insider sells during the same timeframe. This trend suggests that insiders might believe the stock is fully valued or potentially overvalued at current prices.

On the day of the insider's recent sale, shares of Andersons Inc were trading at $54.82, giving the company a market cap of $1.897 billion. This price point is significantly higher than the industry median price-earnings ratio of 16.04 and also exceeds the company's historical median price-earnings ratio. Such a high price-earnings ratio could imply that the stock is priced optimistically relative to its earnings potential.

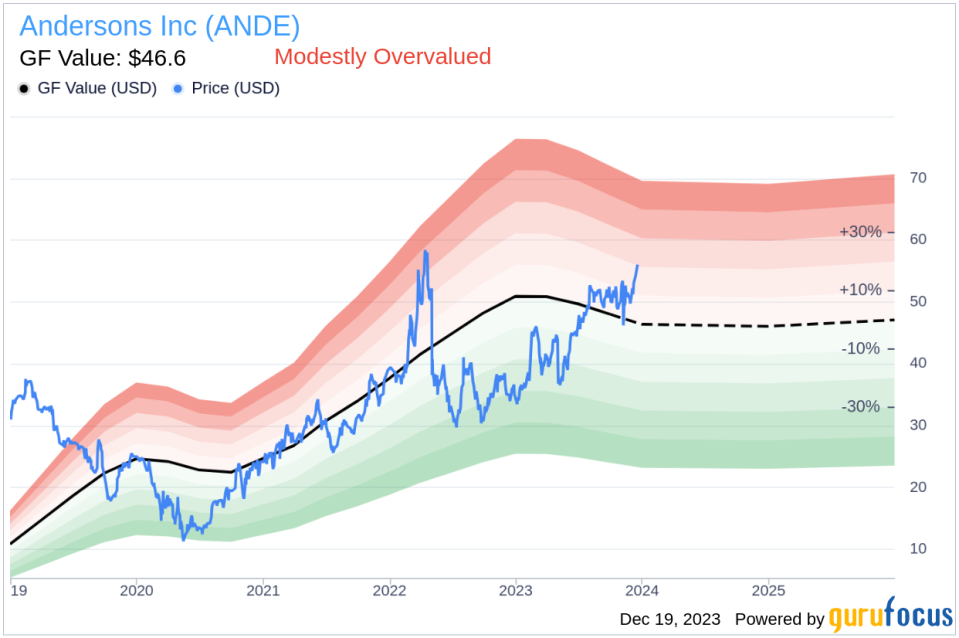

Furthermore, with a price of $54.82 and a GuruFocus Value of $46.60, Andersons Inc has a price-to-GF-Value ratio of 1.18, categorizing the stock as modestly overvalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the selling pattern by insiders, which could be interpreted as a lack of confidence in the stock's ability to provide significant returns in the near future.

The GF Value image further supports the notion that Andersons Inc's stock might be trading above its intrinsic value, as calculated by GuruFocus. This assessment is based on historical trading multiples, adjustments for the company's past performance, and analyst estimates for future business outcomes.

Conclusion

The recent insider sell by Patrick Bowe, along with the broader trend of insider sells and the absence of insider buys over the past year, could be indicative of a belief among those with intimate knowledge of Andersons Inc that the stock's current valuation is stretched. While insider selling is not always a definitive sign of a stock's future movement, it is an important factor for investors to consider, especially when it is coupled with valuation metrics that suggest the stock is trading at a premium to its intrinsic value.

Investors should keep a close eye on further insider transactions and other fundamental developments at Andersons Inc to better understand the potential direction of the stock. As always, it is recommended to look at a comprehensive set of factors, including financial performance, industry trends, and broader market conditions, when evaluating an investment decision.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.