Insider Sell Alert: President & CFO Joe Berchtold Sells 357,300 Shares of Live Nation ...

Joe Berchtold, the President and Chief Financial Officer of Live Nation Entertainment Inc (NYSE:LYV), has made a significant move in the stock market by selling 357,300 shares of the company on December 15, 2023. This transaction has caught the attention of investors and market analysts, as insider activity, such as sales and purchases, can provide valuable insights into a company's financial health and future prospects.

Who is Joe Berchtold of Live Nation Entertainment Inc?

Joe Berchtold holds a pivotal role at Live Nation Entertainment Inc as the President and CFO. His extensive experience in the entertainment industry and financial management has been instrumental in steering the company's strategic direction and financial planning. Berchtold's decisions and insights are closely watched by investors, as they can have a significant impact on the company's performance and stock valuation.

Live Nation Entertainment Inc's Business Description

Live Nation Entertainment Inc is a global leader in live entertainment, providing ticketing services, concert promotions, and venue operations. The company is renowned for bringing live entertainment experiences to millions of fans worldwide, with a presence in over 40 countries. Live Nation's portfolio includes Ticketmaster, one of the world's leading ticket sales and distribution companies, as well as managing the operations of numerous venues and producing some of the most well-known music festivals and concerts.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions are often considered a barometer of a company's internal perspective on its stock's value. Over the past year, Joe Berchtold has exclusively sold shares, with no recorded purchases. This pattern of behavior could suggest that the insider may perceive the stock's current price as being on the higher end of its value spectrum, or it could be part of a personal financial strategy.

The insider transaction history for Live Nation Entertainment Inc shows a lack of insider buys over the past year, with three insider sells during the same timeframe. This trend could indicate a cautious or bearish sentiment among insiders regarding the company's stock price prospects.

On the day of Berchtold's recent sale, shares of Live Nation Entertainment Inc were trading at $91.29, giving the company a market cap of $21.42 billion. The price-earnings ratio stands at 65.49, which is above the industry median of 18.095. This higher ratio could suggest that the market has high expectations for the company's future earnings growth, or it may indicate that the stock is overvalued relative to its peers.

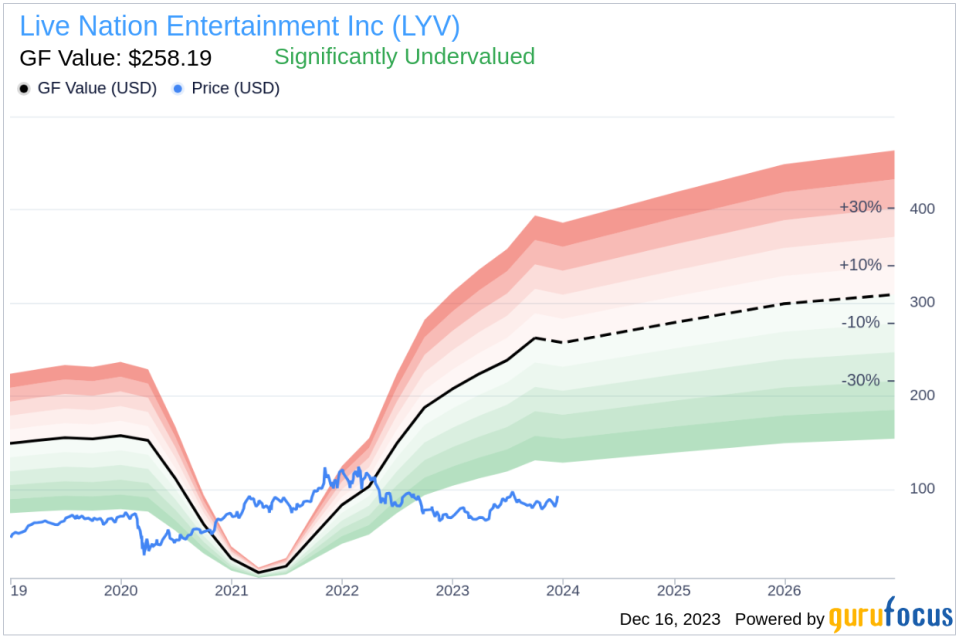

However, when considering the GuruFocus Value (GF Value) of $258.19, Live Nation Entertainment Inc appears to be Significantly Undervalued with a price-to-GF-Value ratio of 0.35. The GF Value is a proprietary intrinsic value estimate from GuruFocus, factoring in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The insider trend image above provides a visual representation of the selling pattern by insiders, which could be interpreted as a signal to investors to approach the stock with caution.

The GF Value image further illustrates the discrepancy between the current stock price and the estimated intrinsic value, suggesting that despite the insider selling trend, the stock may still be undervalued based on fundamental analysis.

Conclusion

Joe Berchtold's recent sale of 357,300 shares of Live Nation Entertainment Inc is a significant event that warrants attention from investors. While insider selling can be influenced by various personal and market factors, it is essential to consider the broader context, including the company's valuation and market performance. The current analysis suggests that despite the insider selling trend, Live Nation Entertainment Inc's stock may be undervalued when considering the GF Value. Investors should conduct their due diligence, taking into account the insider activity, the company's financials, and market conditions before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.