Insider Sell Alert: President & COO Brenton Turner Unloads 60,000 Shares of Rover Group Inc ...

In the world of stock market investments, insider trading activities often serve as a barometer for a company's health and future prospects. Recently, Brenton Turner, the President & COO of Rover Group Inc (NASDAQ:ROVR), made a significant move by selling 60,000 shares of the company. This transaction, executed on December 5, 2023, has caught the attention of investors and market analysts alike.

Who is Brenton Turner?

Brenton Turner has been a key figure at Rover Group Inc, holding the position of President & COO. His role in the company involves overseeing the day-to-day operations and contributing to the strategic direction of the business. Turner's insider perspective on the company's performance and his decision to sell a substantial number of shares is a point of interest for those following Rover Group Inc's stock.

Rover Group Inc's Business Description

Rover Group Inc is a technology-driven company that operates an online marketplace for pet care services. The platform connects pet owners with service providers who offer dog walking, pet sitting, boarding, and grooming services. Rover's mission is to make pet care safe, easy, and affordable while providing a community for pet lovers to connect. The company has been expanding its reach and services, aiming to become the go-to platform for pet owners' needs.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, such as buys and sells, can provide valuable insights into a company's internal perspective. A consistent pattern of insider selling could indicate that those with the most intimate knowledge of the company's workings believe the stock may not have much room to grow. On the other hand, insider buying might suggest that those in the know see undervalued potential in the stock.

According to the data, Brenton Turner has been on a selling streak over the past year, offloading a total of 399,421 shares and not purchasing any. This one-sided activity could be interpreted in several ways. It might reflect Turner's personal financial planning or a lack of confidence in the company's short-term growth prospects. However, without additional context, it's challenging to draw definitive conclusions.

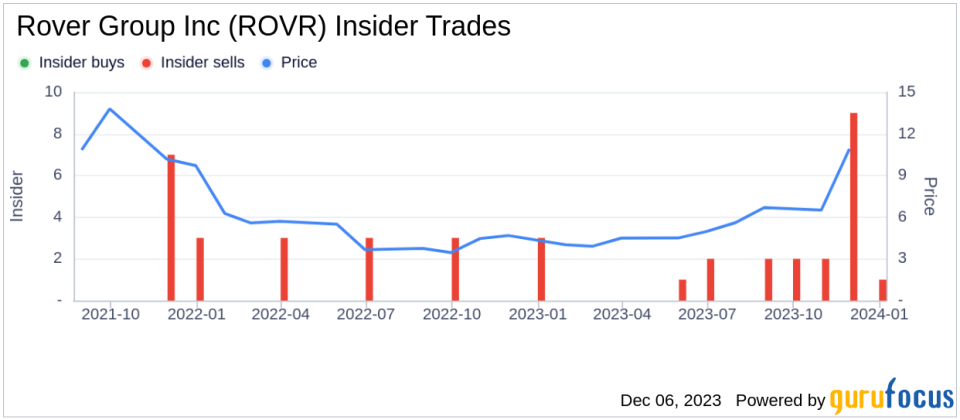

When examining the insider trends for Rover Group Inc, we see a clear pattern: there have been zero insider buys and 24 insider sells over the past year. This trend could be a red flag for potential investors, as it suggests that insiders are more inclined to reduce their holdings than increase them.

On the valuation front, Rover Group Inc's shares were trading at $10.9 each on the day of the insider's recent sell, giving the stock a market cap of $1.963 billion. The price-earnings ratio stands at a lofty 222.04, significantly higher than both the industry median of 20.94 and the company's historical median price-earnings ratio. This high P/E ratio could imply that the stock is overvalued compared to its peers and its own historical standards, potentially justifying the insider's decision to sell.

The insider trend image above provides a visual representation of the selling pattern. It's important to note that while insider selling can be a useful indicator, it should not be the sole factor in making investment decisions. Market conditions, company performance, and broader economic factors also play critical roles in stock valuation.

Conclusion

Brenton Turner's recent sale of 60,000 shares of Rover Group Inc is a significant event that warrants attention. While the insider's actions may raise questions about the company's valuation and future prospects, investors should consider the broader context and conduct thorough research before making any investment decisions. As always, insider trading is just one piece of the puzzle when it comes to evaluating a stock's potential.

For those interested in Rover Group Inc, it will be crucial to monitor the company's performance, industry trends, and future insider transactions to gain a more comprehensive understanding of where the stock might be headed. As the market continues to evolve, staying informed and vigilant remains the best strategy for investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.