Insider Sell Alert: President Daniel Drees Sells 11,021 Shares of AvidXchange Holdings Inc (AVDX)

In a notable insider transaction, President Daniel Drees of AvidXchange Holdings Inc (NASDAQ:AVDX) parted with 11,021 shares of the company on November 15, 2023. This sale has caught the attention of investors and analysts, as insider activity can often provide valuable insights into a company's prospects and the sentiment of its leadership.

Who is Daniel Drees?

Daniel Drees is a key figure at AvidXchange Holdings Inc, serving as the company's President. His role involves overseeing the strategic direction and operational execution of the company. Drees's insider status makes his trading activities particularly noteworthy, as they may reflect his informed perspective on the company's performance and future.

About AvidXchange Holdings Inc

AvidXchange Holdings Inc is a leading provider of accounts payable and payment automation solutions for midsize companies. The company's suite of products and services is designed to streamline and automate the entire invoice-to-pay process, helping businesses improve efficiency, reduce costs, and enhance visibility into their financial operations. AvidXchange's technology is trusted by thousands of customers across various industries, reflecting the company's commitment to innovation and customer service.

Analysis of Insider Buy/Sell and Stock Price Relationship

Insider transactions, such as those executed by Daniel Drees, can be a double-edged sword when it comes to interpreting their impact on stock prices. On one hand, a sell-off by an insider might signal a lack of confidence in the company's near-term prospects, potentially leading to bearish sentiment among investors. On the other hand, insiders may sell shares for a variety of reasons unrelated to their outlook on the company, such as personal financial planning or diversifying their investment portfolio.

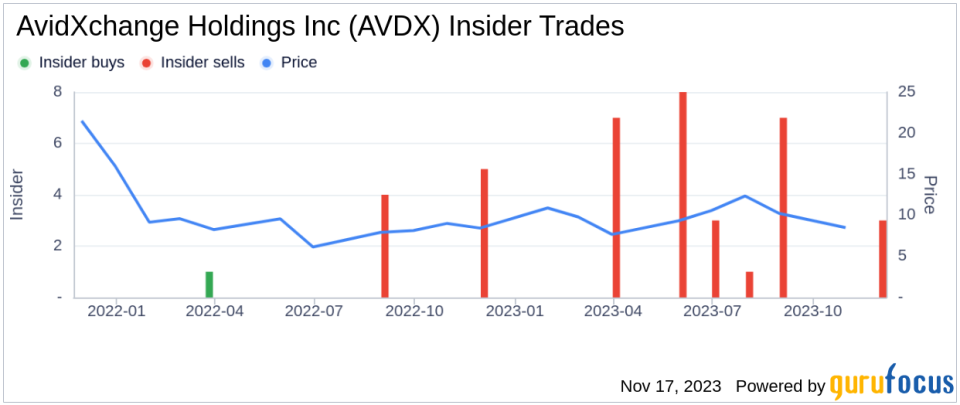

When analyzing the relationship between insider activity and stock price, it's essential to consider the context and magnitude of the transactions. In the case of Drees's recent sale of 11,021 shares, it's part of a broader pattern of insider selling at AvidXchange Holdings Inc over the past year. With 0 insider buys and 31 insider sells during this period, the trend appears to lean towards selling. However, without additional context, it's challenging to draw definitive conclusions about the implications for the stock price.

Shares of AvidXchange Holdings Inc were trading at $9.74 on the day of the insider's recent sale, giving the company a market cap of $1.966 billion. This valuation reflects the market's current assessment of the company's worth, taking into account its financial performance, growth prospects, and other relevant factors.

It's also important to consider the overall market conditions and sector performance when evaluating insider transactions. If the broader market or the technology sector is experiencing a downturn, insider sales might be more prevalent as executives look to lock in gains or mitigate risk.

Insider Trends

The insider transaction history for AvidXchange Holdings Inc reveals a distinct pattern of insider selling, with no insider buys recorded over the past year. This trend could suggest that insiders, including Daniel Drees, may perceive the stock to be fully valued or are taking advantage of a higher share price to realize gains.

However, it's crucial to note that insider selling does not always presage a decline in stock price. Insiders might have personal reasons for selling that are not indicative of their confidence in the company's future. Moreover, insider selling can sometimes occur in a rising market, where stock prices continue to climb despite the sell-off.

Here is a visual representation of the insider transaction trend at AvidXchange Holdings Inc:

This chart provides a snapshot of the insider selling activity, which can be a useful tool for investors when combined with other analytical methods.

Conclusion

While insider transactions like those of Daniel Drees can offer valuable clues about a company's internal perspective, they should not be the sole basis for investment decisions. Investors should consider a wide range of factors, including company fundamentals, industry trends, and broader market conditions, before making any moves.

For those closely monitoring AvidXchange Holdings Inc, the insider selling trend may warrant further investigation to understand the underlying reasons for the sales. As always, a well-rounded approach to investment analysis is recommended to navigate the complexities of the stock market.

Investors and analysts will continue to watch insider activity at AvidXchange Holdings Inc for any signs that might indicate a shift in the company's trajectory or sentiment among its top executives.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.