Insider Sell Alert: President Eric Johnson Sells 15,325 Shares of Donnelley Financial Solutions ...

Donnelley Financial Solutions Inc (NYSE:DFIN), a company specializing in risk and compliance solutions, financial communications, and data services, has recently witnessed a significant insider sell by President Eric Johnson. On November 15, 2023, Eric Johnson sold 15,325 shares of the company, a transaction that has caught the attention of investors and market analysts alike.

Who is Eric Johnson at Donnelley Financial Solutions Inc?

Eric Johnson serves as the President of Donnelley Financial Solutions Inc, a role that places him at the helm of the company's strategic direction and operational execution. Johnson's position grants him an in-depth understanding of the company's performance, future prospects, and the value of its stock. His actions in the stock market, particularly insider sells, are closely monitored for insights into the company's health and his confidence in its future performance.

Donnelley Financial Solutions Inc's Business Description

Donnelley Financial Solutions Inc is a leader in providing software and services that facilitate content creation, management, and distribution for regulatory and financial reporting. The company's offerings are critical for organizations that need to navigate the complex landscape of compliance and communication with stakeholders. With a focus on leveraging technology to streamline processes, Donnelley Financial Solutions Inc aids its clients in achieving accuracy and efficiency in their financial transactions and reporting.

Analysis of Insider Buy/Sell and Relationship with Stock Price

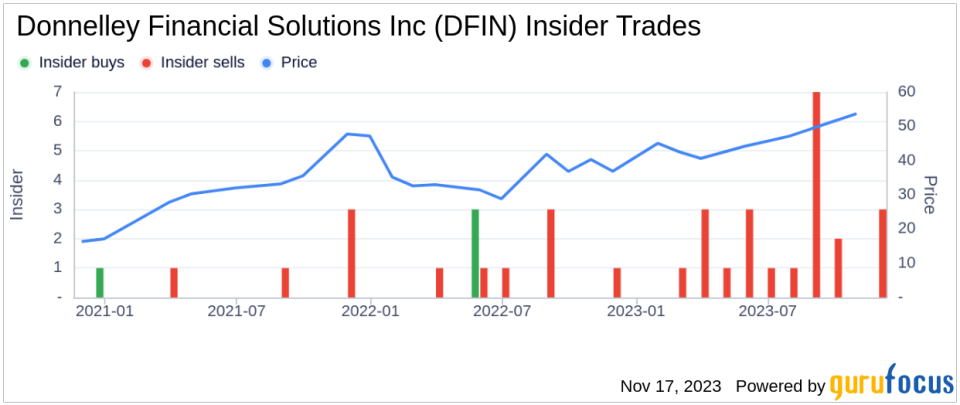

Insider transactions, particularly sells, can provide valuable clues about a company's internal perspective on its stock's value. In the case of Donnelley Financial Solutions Inc, the insider, Eric Johnson, has sold a total of 23,125 shares over the past year without purchasing any shares. This pattern of behavior could signal a belief that the stock may be fully valued or overvalued, prompting insiders to lock in profits.

On the day of the insider's recent sell, shares of Donnelley Financial Solutions Inc were trading at $56.33, giving the company a market cap of $1.626 billion. This price point is significantly higher than the company's historical median price-earnings ratio, suggesting a premium valuation compared to both the industry median and its own historical standards.

The relationship between insider selling and stock price is not always straightforward, as insiders may sell for various reasons unrelated to their outlook on the stock's value, such as personal financial planning or diversification. However, when combined with valuation metrics, insider sells can reinforce the narrative of a stock's potential overvaluation.

The insider trend image above illustrates the absence of insider buys and the prevalence of insider sells over the past year, which could be interpreted as a lack of confidence among insiders in the stock's ability to provide significant future gains.

Valuation and GF Value Analysis

With a price-earnings ratio of 20.54, Donnelley Financial Solutions Inc trades at a premium to the industry median of 18.2. This elevated ratio indicates that investors are willing to pay more for each dollar of earnings from DFIN than they are for other companies in the same industry, potentially due to perceived superior growth or stability.

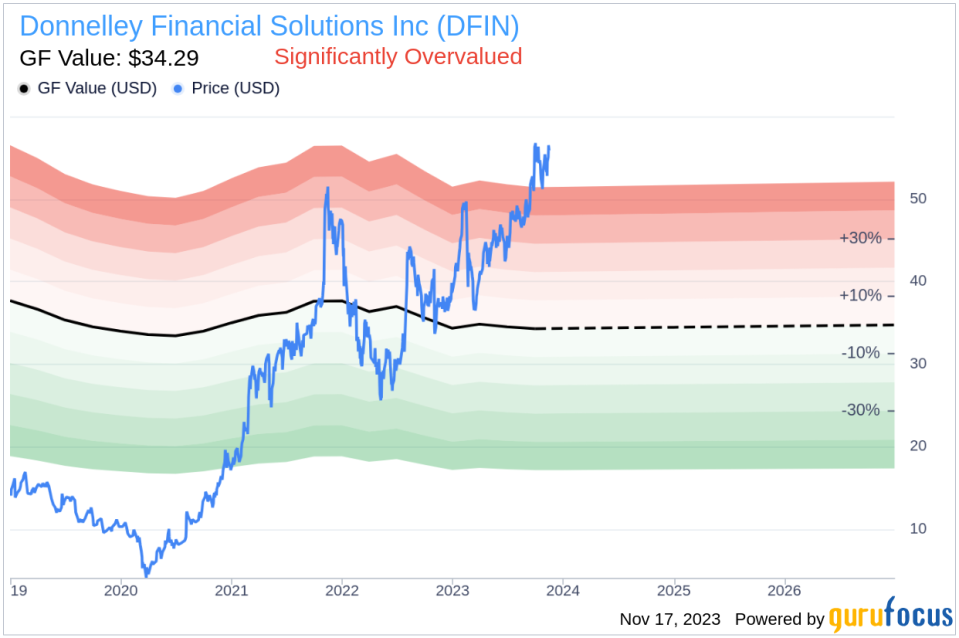

However, the price-to-GF-Value ratio stands at 1.64, with the stock's current price far exceeding the GuruFocus Value of $34.29. This significant discrepancy suggests that Donnelley Financial Solutions Inc is Significantly Overvalued based on its GF Value.

The GF Value, as shown in the image above, is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The current price-to-GF-Value ratio indicates that the market may have overly optimistic expectations for Donnelley Financial Solutions Inc, which could lead to a price correction if the company fails to meet these high expectations.

Conclusion

The recent insider sell by President Eric Johnson at Donnelley Financial Solutions Inc, along with the absence of insider buys over the past year, raises questions about the stock's current valuation. While insider sells are not always indicative of a stock's future direction, they can provide context when viewed alongside valuation metrics. The high price-earnings ratio and price-to-GF-Value ratio suggest that the stock may be overvalued, and investors should exercise caution. As always, it is essential for investors to conduct their own due diligence and consider a variety of factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.