Insider Sell Alert: President, North/Canada Div. ...

Beacon Roofing Supply Inc (NASDAQ:BECN), a leading distributor of roofing materials and complementary building products, has recently witnessed an insider sell transaction that has caught the attention of market analysts and investors. James Gosa, the President of the North/Canada Division, sold 2,250 shares of the company on December 11, 2023. This transaction has prompted a closer look into the insider's trading history, the company's business operations, and the potential implications for Beacon Roofing Supply's stock price.

Who is James Gosa?

James Gosa has been an integral part of Beacon Roofing Supply Inc, serving as the President of the North/Canada Division. His role involves overseeing the company's operations and strategic direction in these regions, which are key markets for Beacon Roofing Supply. Gosa's insider position provides him with a deep understanding of the company's performance, market dynamics, and growth opportunities, making his trading activities particularly noteworthy to investors and market watchers.

Beacon Roofing Supply Inc's Business Description

Beacon Roofing Supply Inc is a prominent player in the distribution of roofing materials and complementary building products. The company operates across the United States and Canada, providing a wide range of products, including residential and commercial roofing materials, waterproofing products, and exterior building materials. Beacon Roofing Supply's extensive network of branches ensures timely and efficient delivery of products, catering to contractors, home builders, and building owners. The company's commitment to service excellence and product availability has established it as a trusted name in the building materials industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, such as the recent sell by James Gosa, can offer valuable insights into a company's internal perspective on its stock's valuation and future prospects. Over the past year, Gosa has sold a total of 2,250 shares and has not made any purchases. This could be interpreted in various ways; however, without additional context, it is challenging to draw definitive conclusions about the insider's sentiment towards the company's future.

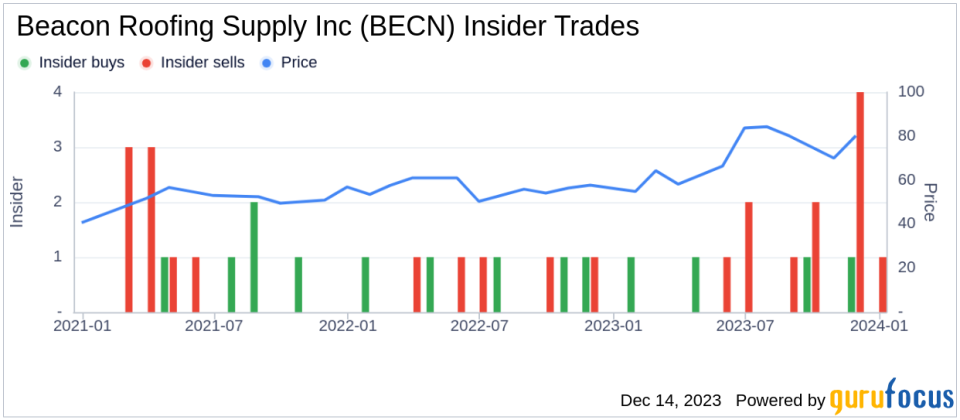

The insider transaction history for Beacon Roofing Supply Inc shows a pattern of more insider sells (12) than buys (4) over the past year. This trend could suggest that insiders, on balance, may believe that the stock has been adequately valued or potentially overvalued at recent prices, prompting them to lock in profits.

On the day of Gosa's recent sell, shares of Beacon Roofing Supply Inc were trading at $80.38, giving the company a market cap of $5,443,929,000. This valuation places the company in a significant position within the industry, reflecting investor confidence and market recognition of its business model and growth potential.

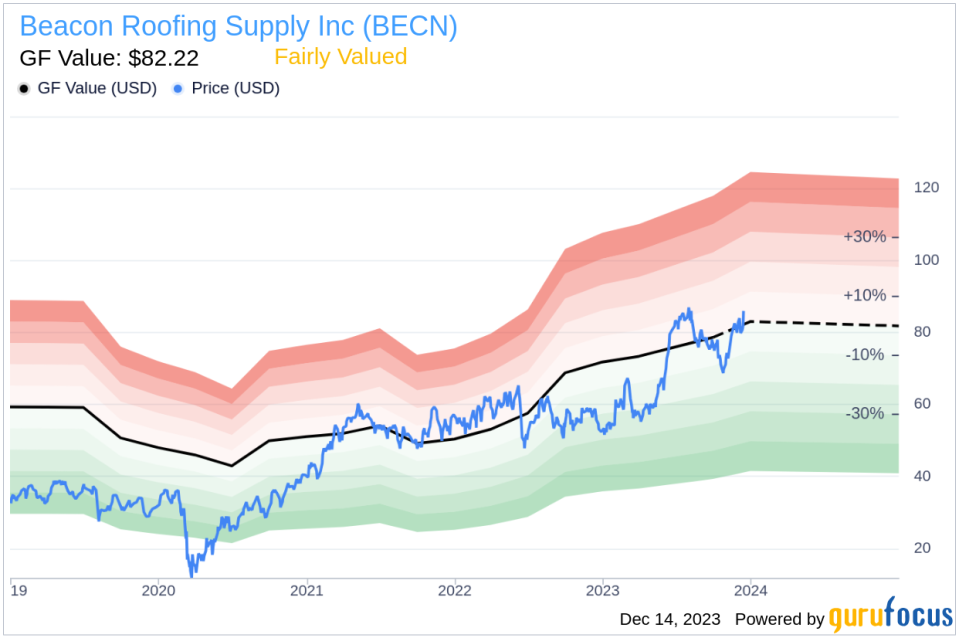

Regarding the stock's valuation, the price-to-GF-Value ratio stands at 0.98, indicating that the stock is Fairly Valued based on its GF Value of $82.22. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

While the insider's sell activity does not necessarily predict a downturn in the stock's price, it is essential for investors to consider this information alongside broader market trends, the company's financial performance, and industry-specific developments.

The insider trend image above provides a visual representation of the buying and selling patterns of insiders at Beacon Roofing Supply Inc. This graphical analysis can help investors discern whether insider trading activities align with their investment strategies and expectations for the stock.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value, offering another layer of analysis for investors to consider. When combined with insider trading data, these tools can provide a more comprehensive understanding of the stock's potential direction.

Conclusion

James Gosa's recent insider sell transaction at Beacon Roofing Supply Inc raises questions about the stock's future performance and valuation. While the insider's actions alone do not dictate the stock's trajectory, they are a piece of the puzzle that investors must consider when evaluating their positions. With the stock currently deemed Fairly Valued and the insider trend showing more sells than buys, market participants will be watching closely to see how these factors play out in the stock's price movement in the coming months.

Investors are encouraged to conduct their due diligence, considering insider trading activities, valuation metrics, and broader market conditions before making investment decisions. As always, a well-informed and balanced approach to stock analysis is key to successful investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.