Insider Sell Alert: PTC Inc's President and COO Michael Ditullio Sells 10,613 Shares

In a notable insider transaction, Michael Ditullio, President and Chief Operating Officer of PTC Inc, sold 10,613 shares of the company on November 16, 2023. This sale has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's prospects and the sentiment of its top executives.

Who is Michael Ditullio?

Michael Ditullio has been a key figure at PTC Inc, serving as the President and COO. His role involves overseeing the company's day-to-day operations and executing its strategic initiatives. Ditullio's insider perspective on the company's performance and his decision to sell a significant number of shares can be an important indicator for investors.

About PTC Inc

PTC Inc is a global software company that provides technology solutions enabling companies to achieve product and service advantage. The company's portfolio includes solutions for computer-aided design (CAD), product lifecycle management (PLM), application lifecycle management (ALM), and the Internet of Things (IoT). PTC's software and services empower businesses to design, manufacture, operate, and service things for a smart, connected world.

Analysis of Insider Buy/Sell and Relationship with Stock Price

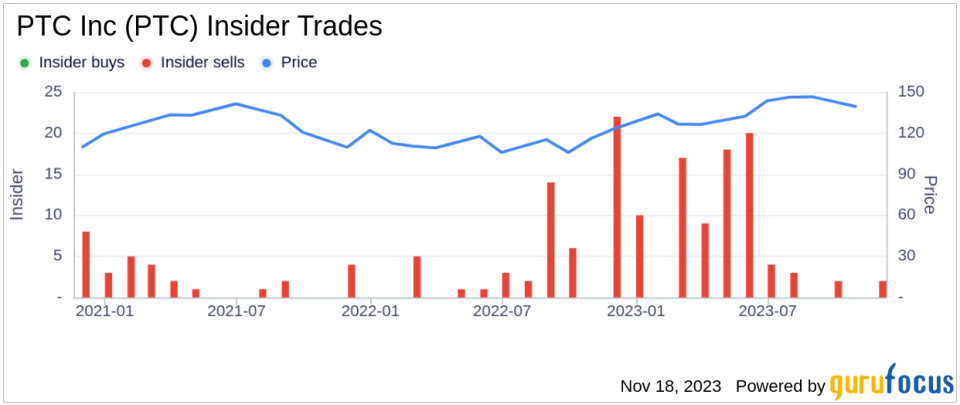

The insider's recent transaction follows a pattern observed over the past year, where Michael Ditullio has sold 37,698 shares in total and has not made any purchases. This consistent selling activity could be interpreted in various ways. On one hand, it might suggest that the insider is taking profits or diversifying their investment portfolio. On the other hand, it could raise questions about the insider's confidence in the company's future growth prospects.The broader insider transaction history for PTC Inc shows a lack of insider buying, with 0 insider buys over the past year, contrasted with 94 insider sells in the same timeframe. This trend of insider selling could be a signal that those with the most intimate knowledge of the company see limited upside potential or consider the current stock valuation to be high.

Valuation and Market Response

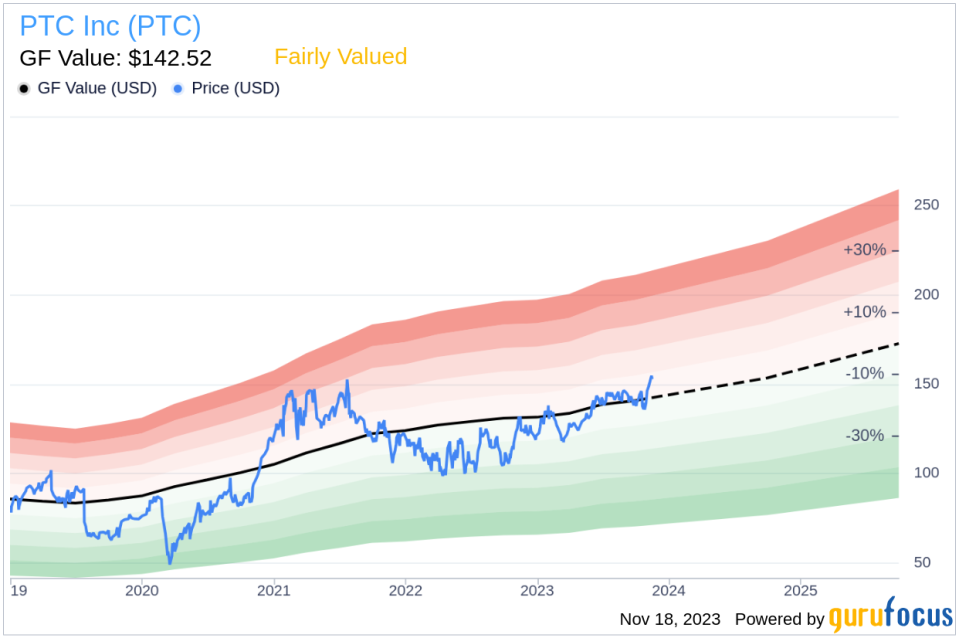

On the day of the insider's recent sale, shares of PTC Inc were trading at $154.01, giving the company a market cap of $18.293 billion. The price-earnings ratio stands at 75.09, which is higher than both the industry median of 26.59 and the company's historical median price-earnings ratio. This elevated P/E ratio could suggest that the stock is priced optimistically relative to its earnings, a factor that might have influenced the insider's decision to sell.Considering the GF Value, with a price of $154.01 and a GuruFocus Value of $142.52, PTC Inc has a price-to-GF-Value ratio of 1.08, indicating that the stock is Fairly Valued based on its intrinsic value estimate. The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

Conclusion

The recent insider sell by Michael Ditullio may raise questions among PTC Inc's investors. While the company's market cap and valuation suggest a solid financial standing, the consistent pattern of insider selling, coupled with a high price-earnings ratio, could be a cause for a more cautious approach. Investors should consider these insider transactions as part of a broader investment analysis, keeping in mind the company's performance, industry trends, and overall market conditions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.