Insider Sell Alert: PTC Inc's President and COO Michael Ditullio Sells 6,978 Shares

In a notable insider transaction, Michael Ditullio, President and Chief Operating Officer of PTC Inc, sold 6,978 shares of the company on December 1, 2023. This sale is part of a series of transactions over the past year, where the insider has sold a total of 29,591 shares and made no purchases. This activity has caught the attention of investors and analysts who closely monitor insider behaviors as indicators of a company's financial health and future performance.

Who is Michael Ditullio of PTC Inc?

Michael Ditullio has been serving as the President and COO of PTC Inc, a role that places him at the helm of the company's daily operations and strategic direction. His position grants him an intimate understanding of PTC's business model, market challenges, and growth opportunities. Ditullio's decisions to sell shares are often scrutinized for insights into his confidence in the company's future prospects.

PTC Inc's Business Description

PTC Inc is a global software company that provides technology solutions enabling companies to achieve product and service advantage. The company's portfolio includes computer-aided design (CAD) software, product lifecycle management (PLM) software, application lifecycle management (ALM) software, and Internet of Things (IoT) and augmented reality (AR) platforms. PTC's solutions are designed to help manufacturers optimize their product development processes and bring innovative products to market faster.

Analysis of Insider Buy/Sell and Relationship with Stock Price

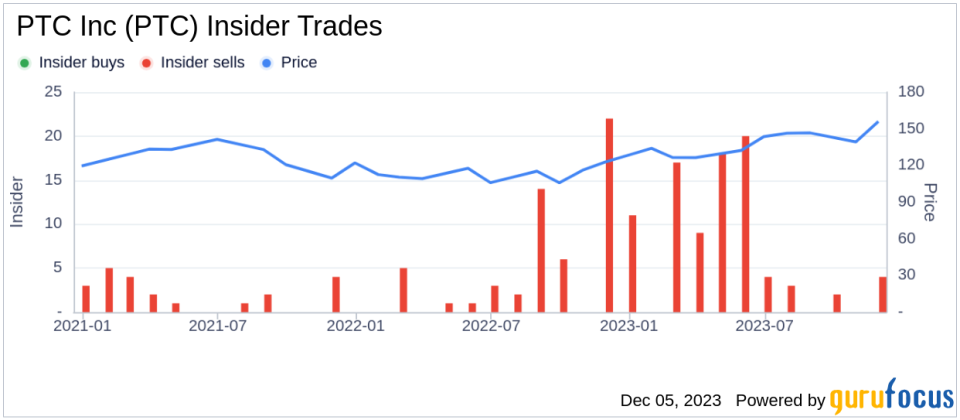

The insider transaction history for PTC Inc shows a significant imbalance between insider sells and buys over the past year, with 86 insider sells and no insider buys. This trend can be interpreted in various ways. On one hand, insiders might sell shares for personal financial planning reasons that do not necessarily reflect their outlook on the company's future. On the other hand, a lack of insider buying could signal a cautious or neutral stance from those with the most knowledge of the company's inner workings.

The relationship between insider selling and the stock price is not always straightforward. While extensive selling could suggest that insiders believe the stock is overvalued or that growth prospects are dimming, it is essential to consider the broader context, including the company's valuation metrics and market conditions.

Valuation and Market Cap

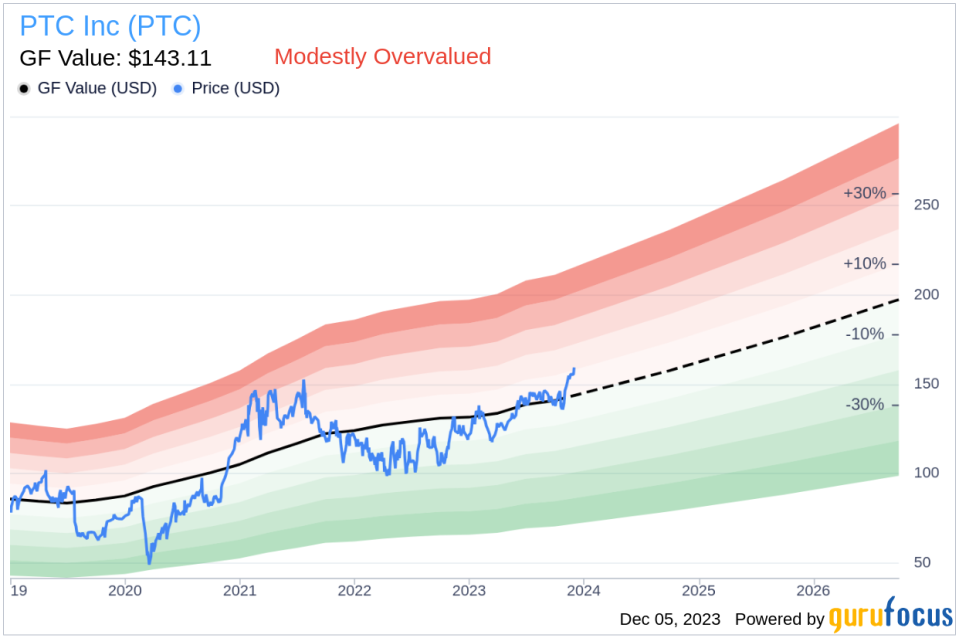

On the day of Michael Ditullio's recent sale, PTC Inc's shares were trading at $159.43, giving the company a market cap of $19.067 billion. The price-earnings ratio of 78.00 is significantly higher than the industry median of 26.87 and above the company's historical median, suggesting a premium valuation compared to its peers.With a price of $159.43 and a GuruFocus Value of $143.11, PTC Inc has a price-to-GF-Value ratio of 1.11, indicating that the stock is modestly overvalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The current price-to-GF-Value ratio suggests that investors are paying a slight premium for PTC Inc shares relative to the company's estimated intrinsic value.

Conclusion

The insider selling activity by Michael Ditullio, particularly in the absence of insider purchases, may raise questions among investors about the insider's confidence in PTC Inc's future performance. However, it is crucial to consider the broader context, including the company's valuation, market conditions, and the potential personal financial planning motives behind the insider's decision to sell.Investors should monitor further insider transactions and look for additional signals that could provide a clearer picture of the company's trajectory. While insider selling alone is not a definitive indicator of a company's health, it is an important piece of the puzzle that, when combined with other financial analyses, can help investors make more informed decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.