Insider Sell Alert: Rollins Inc's President & CEO Jerry Gahlhoff Sells 7,000 Shares

Rollins Inc (NYSE:ROL), a global consumer and commercial services company, has recently witnessed a significant insider sell by its President & CEO, Jerry Gahlhoff. On November 21, 2023, Gahlhoff sold 7,000 shares of the company, a move that has caught the attention of investors and market analysts alike.Who is Jerry Gahlhoff?Jerry Gahlhoff serves as the President and CEO of Rollins Inc. His leadership role places him at the helm of the company's strategic direction and operational execution. Gahlhoff's insider position provides him with a deep understanding of the company's performance, future prospects, and the value of its stock.Rollins Inc's Business DescriptionRollins Inc is a premier global consumer and commercial services company. Through its subsidiaries, Rollins provides essential pest control services and protection against termite damage, rodents, and insects to more than two million customers in the United States, Canada, Central America, South America, the Caribbean, the Middle East, Asia, the Mediterranean, Europe, Africa, Mexico, and Australia from over 700 locations. The company is known for its trusted brands, including Orkin, HomeTeam Pest Defense, Clark Pest Control, and other regional brands.Analysis of Insider Buy/Sell and Relationship with Stock PriceThe insider transaction history for Rollins Inc shows a pattern that leans more towards selling than buying over the past year. With Jerry Gahlhoff's recent sale of 7,000 shares, the total number of shares he has sold in the past year amounts to 14,000, with no recorded purchases. This could signal various things to investors, such as personal financial management or a belief that the stock may be fully valued.

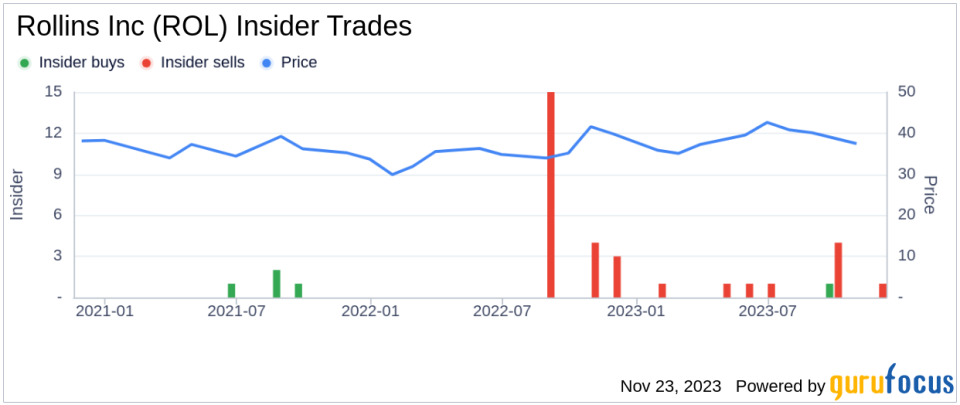

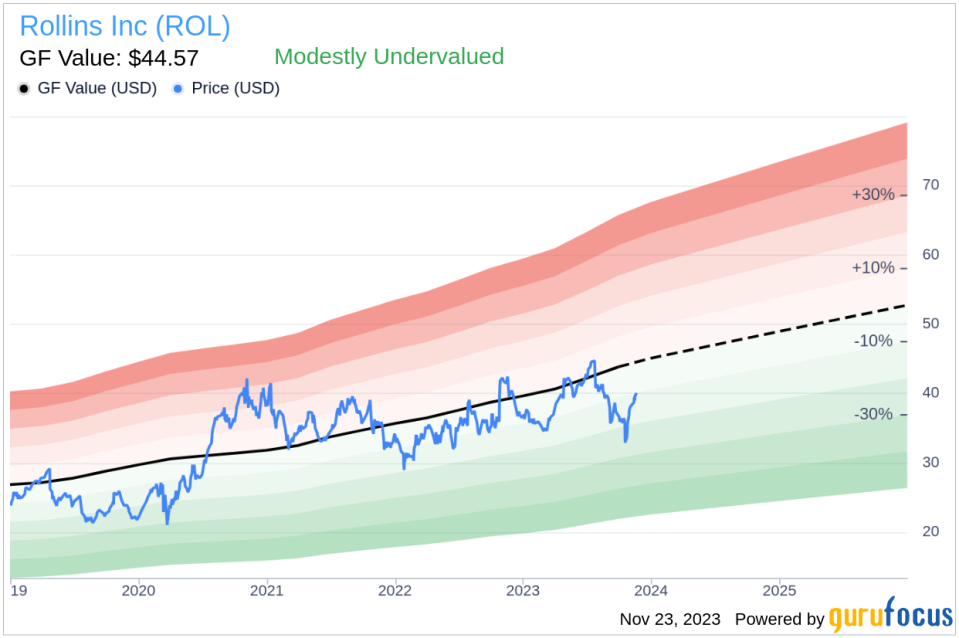

The insider trend image above provides a visual representation of the buying and selling activities. A consistent pattern of insider selling, especially by high-level executives like the CEO, can sometimes raise concerns among investors. However, it is essential to consider the context of these sales, as they may not always indicate a lack of confidence in the company's future.Rollins Inc's Valuation and Market CapOn the day of the insider's recent sell, shares of Rollins Inc were trading at $40, giving the company a market cap of $19.371 billion. The price-earnings ratio stands at 48.22, which is above the industry median of 19.19 but below the company's historical median price-earnings ratio. This suggests that while the stock may be trading at a premium compared to the industry, it is relatively lower than its historical valuation.

The GF Value image above provides an insight into the intrinsic value of Rollins Inc's stock. With a price of $40 and a GuruFocus Value of $44.57, Rollins Inc has a price-to-GF-Value ratio of 0.9, indicating that the stock is modestly undervalued based on its GF Value. The GF Value is calculated considering historical multiples, a GuruFocus adjustment factor, and future business performance estimates.ConclusionThe insider sell by Jerry Gahlhoff may prompt investors to scrutinize the reasons behind the transaction and its implications for the stock's future performance. While insider sells can sometimes be perceived negatively, they do not always suggest a lack of confidence in the company. In the case of Rollins Inc, the stock appears modestly undervalued, and the company's strong market position and brand recognition may continue to drive its performance. Investors should consider the broader context of the insider's actions, the company's valuation, and market conditions before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.