Insider Sell Alert: Senior Executive VP and CFO Jason Darby Sells 4,000 Shares of Amalgamated ...

Amalgamated Financial Corp (NASDAQ:AMAL) has recently witnessed a notable insider transaction. Senior Executive Vice President and Chief Financial Officer Jason Darby sold 4,000 shares of the company on December 13, 2023. This move has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is Jason Darby of Amalgamated Financial Corp?

Jason Darby is a key figure at Amalgamated Financial Corp, serving as the Senior Executive Vice President and Chief Financial Officer. His role at the company involves overseeing the financial operations, including financial planning and analysis, accounting, and reporting. Darby's decisions and insights are crucial for the financial health and strategic direction of Amalgamated Financial Corp. His insider status provides him with a deep understanding of the company's financial position and future prospects.

Amalgamated Financial Corp's Business Description

Amalgamated Financial Corp is a financial institution that operates primarily through its banking subsidiary, Amalgamated Bank. The company provides a wide range of financial services, including commercial banking, trust, and investment management to its clients. It caters to a diverse clientele, including individuals, businesses, and non-profit organizations. Amalgamated Financial Corp prides itself on being an ethical bank, committed to socially responsible practices and sustainability.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions are often scrutinized by investors as they can provide insights into the company's internal perspective on its stock's value. Over the past year, Jason Darby has sold a total of 4,000 shares and has not made any purchases. This could signal that the insider believes the stock may be fully valued or has limited upside potential in the near term.

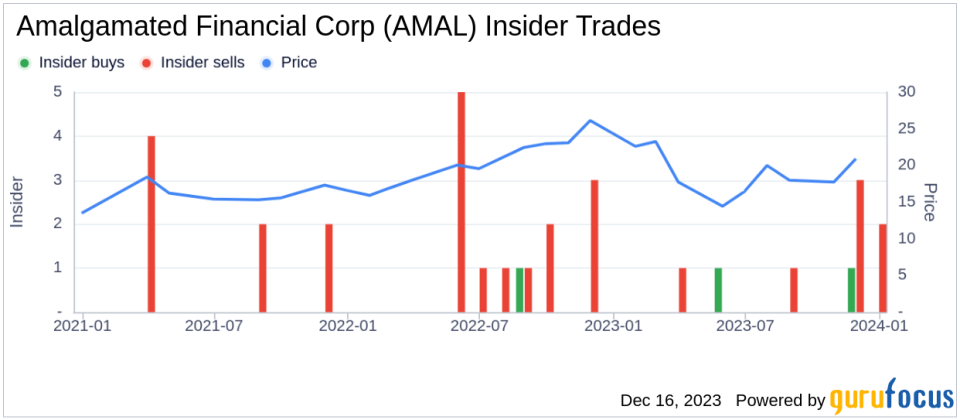

The insider transaction history for Amalgamated Financial Corp shows a pattern of more insider sells than buys over the past year, with 7 insider sells and only 2 insider buys. This trend could suggest that insiders, on balance, are taking the opportunity to liquidate some of their holdings when they perceive the stock price to be favorable.

On the day of Darby's recent sale, shares of Amalgamated Financial Corp were trading at $25.59, giving the company a market cap of $790.842 million. The price-earnings ratio stood at 8.94, slightly higher than the industry median of 8.74 but lower than the company's historical median price-earnings ratio. This indicates that the stock was trading at a reasonable valuation relative to its earnings.

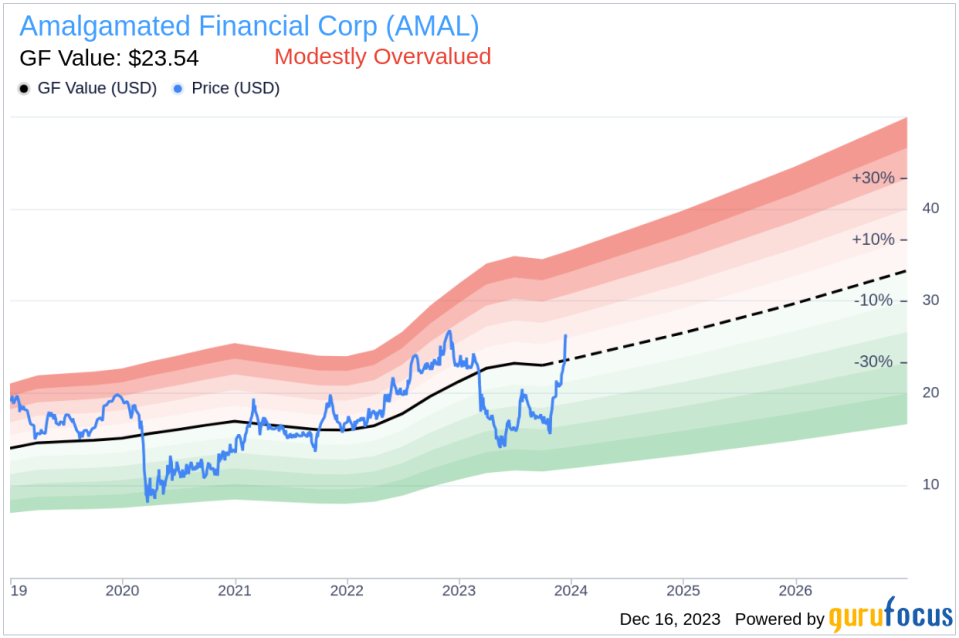

However, with a price of $25.59 and a GuruFocus Value of $23.54, Amalgamated Financial Corp has a price-to-GF-Value ratio of 1.09, suggesting that the stock is modestly overvalued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the insider buying and selling activities over time. It is important for investors to consider these trends in the context of the stock's performance and valuation metrics.

The GF Value image offers a perspective on the stock's valuation relative to its intrinsic value estimate. When the stock's price exceeds the GF Value, as it does in this case, it may indicate that the stock is overvalued, which could be a factor in the insider's decision to sell.

Conclusion

The recent insider sell by Jason Darby, the Senior Executive VP and CFO of Amalgamated Financial Corp, is a development that warrants attention. While insider sells are not always indicative of a stock's future performance, they can provide valuable context, especially when analyzed alongside the company's valuation and market performance. Investors should consider these factors, along with their own research and investment goals, when assessing the potential impact of insider transactions on their investment decisions.

It is also crucial to note that insider selling can be motivated by various personal reasons and does not necessarily reflect a negative outlook on the company's future. Therefore, while insider activity is an important piece of the puzzle, it should be viewed as part of a broader investment analysis.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.