Insider Sell Alert: Senior Vice President Kathryn Stein Sells Over 57,000 Shares of Genpact Ltd

In a notable insider transaction, Senior Vice President Kathryn Stein has sold 57,336 shares of Genpact Ltd (NYSE:G), a global professional services firm delivering digital transformation for its clients. The sale, which took place on December 4, 2023, has caught the attention of investors and market analysts, prompting a closer look at the implications of such a significant insider move.

Who is Kathryn Stein of Genpact Ltd?

Kathryn Stein holds a pivotal role at Genpact Ltd as the Senior Vice President. Her responsibilities include overseeing critical aspects of the company's operations and strategy. With a deep understanding of the company's inner workings and future prospects, Stein's actions in the stock market are closely monitored for insights into the company's health and potential future performance.

Genpact Ltd's Business Description

Genpact Ltd is a global leader in digitally-powered business process management and services. The company leverages its expertise in analytics and digital technologies to help clients drive intelligence across their enterprise processes. Genpact's approach to digital transformation is rooted in its Lean DigitalSM framework, which combines design-thinking principles and Lean approaches with digital technologies and analytics. The company serves a wide range of industries, including banking and financial services, insurance, manufacturing, and healthcare, among others.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions can provide valuable clues about a company's financial health and future prospects. Over the past year, Kathryn Stein has sold a total of 112,836 shares and has not made any purchases. This pattern of selling without corresponding buys could signal a lack of confidence in the company's future growth or a belief that the stock may be overvalued. However, it's also important to consider that insiders may sell shares for various personal reasons that do not necessarily reflect their outlook on the company.

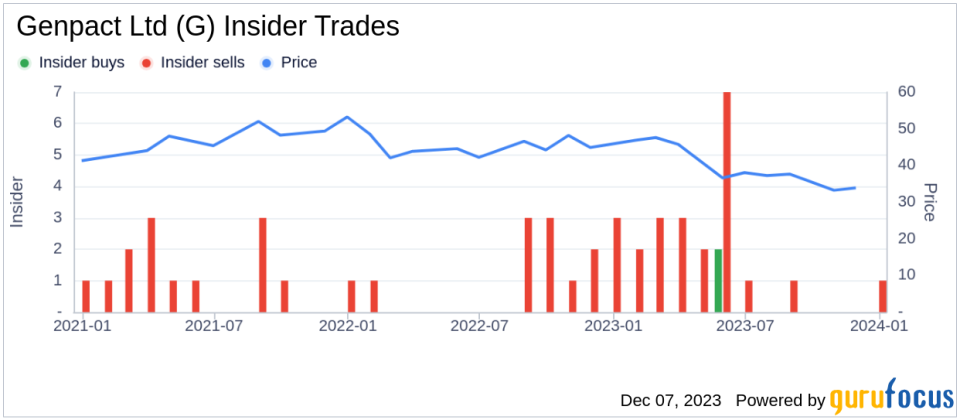

The broader insider transaction history for Genpact Ltd shows a trend of more insider selling than buying, with 22 sells and only 2 buys over the past year. This trend could suggest that insiders, on the whole, are taking profits or reallocating their investments, which might raise questions about the stock's upside potential.

On the day of Stein's recent sale, shares of Genpact Ltd were trading at $34.85, giving the company a market cap of $6.226 billion. The price-earnings ratio of 14.72 is lower than both the industry median of 26.85 and the company's historical median, indicating that the stock may be undervalued relative to its peers and its own trading history.

Adding to the valuation analysis, the price-to-GF-Value ratio stands at 0.69, with the GF Value at $50.39. This suggests that Genpact Ltd is significantly undervalued based on GuruFocus's intrinsic value estimate, which considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the selling and buying activities of Genpact Ltd's insiders. The predominance of selling transactions could be a red flag for potential investors, although the stock's undervaluation might offer a counterbalancing factor for consideration.

The GF Value image further illustrates the discrepancy between the current stock price and the estimated intrinsic value, reinforcing the notion that Genpact Ltd's shares may be trading at a discount.

Conclusion

Kathryn Stein's recent sale of 57,336 shares of Genpact Ltd is a significant insider transaction that warrants attention. While the reasons behind the insider's decision to sell are not publicly known, the aggregate insider activity suggests a trend of selling that could be interpreted as a lack of confidence by insiders in the stock's short-term growth prospects. However, the company's current valuation metrics, including a low price-earnings ratio and a price-to-GF-Value ratio indicating significant undervaluation, present a more complex picture for investors.

Investors should weigh the insider selling activity against the stock's attractive valuation and consider the broader market conditions, the company's performance, and future growth prospects before making investment decisions. As always, insider transactions are just one piece of the puzzle, and a comprehensive analysis should include a variety of financial and strategic factors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.