Insider Sell Alert: Senior Vice President Steven Like Sells Shares of Cavco Industries Inc

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Senior Vice President Steven Like made headlines by selling 3,530 shares of Cavco Industries Inc (NASDAQ:CVCO) on November 17, 2023. This transaction has sparked interest among shareholders and potential investors as they try to decipher the implications of this insider move.

Before delving into the analysis of this insider sell, it is essential to understand who Steven Like is within the Cavco Industries Inc company. Steven Like serves as a Senior Vice President, a position that grants him an in-depth perspective of the company's operations and future prospects. His actions in the stock market, particularly when it involves shares of the company he helps lead, are closely monitored for insights into his confidence in Cavco's financial health and growth trajectory.

Cavco Industries Inc is a prominent player in the design, production, and retail of manufactured homes. The company's offerings also extend to modular homes, park model RVs, commercial structures, and vacation cabins. With a diverse product line and a robust distribution network, Cavco has established itself as a key figure in the housing solutions sector.

When analyzing insider buy/sell activities, one of the critical aspects to consider is the relationship between these transactions and the stock price. In the case of Steven Like's recent sell, the 3,530 shares were offloaded at a price of $281.37 each, resulting in a market capitalization of $2.351 billion for Cavco Industries Inc. This market cap reflects the aggregate value that the market places on the company, and insider sells can sometimes lead to speculation about the company's valuation and future stock price movements.

The price-earnings ratio of Cavco Industries Inc stands at 12.78, which is above the industry median of 8.9 but below the company's historical median. This suggests that while the stock is trading at a higher multiple compared to its industry peers, it may still be undervalued when considering its own historical pricing trends.

Adding another layer to the valuation analysis is the GuruFocus Value, which pegs Cavco Industries Inc's intrinsic value at $338.37 per share. With the stock trading at $281.37, the price-to-GF-Value ratio is 0.83, indicating that the stock is modestly undervalued. This assessment is based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

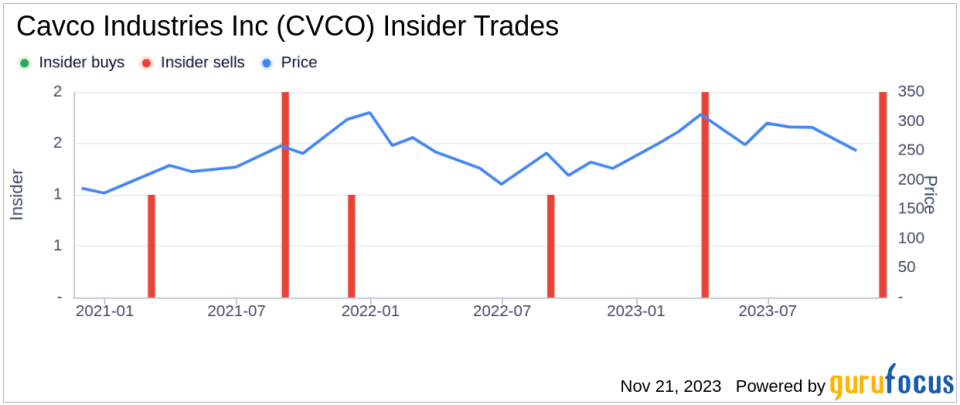

Let's take a closer look at the insider trend for Cavco Industries Inc:

The insider trend image reveals that over the past year, there have been no insider buys and four insider sells, including the recent transaction by Steven Like. This pattern of insider selling could be interpreted in various ways. On one hand, it might suggest that insiders are taking profits or reallocating their investments, which is a normal part of personal financial management. On the other hand, it could raise questions about the insiders' long-term confidence in the company's stock performance.

Furthermore, the GF Value image provides additional context for the stock's valuation:

The modestly undervalued status of Cavco Industries Inc, as indicated by the GF Value, might be a signal for value investors to consider the stock. However, the insider selling activity, particularly by a high-ranking executive like Steven Like, could give some investors pause as they weigh the potential reasons behind the sell.

In conclusion, the recent insider sell by Senior Vice President Steven Like of Cavco Industries Inc presents a complex picture for investors. While the company's valuation metrics suggest an undervalued stock, the insider selling trend could be seen as a cautionary note. Investors would be wise to consider both the quantitative data and the qualitative aspects of insider behavior when making investment decisions. As always, a thorough analysis that includes a review of the company's financials, market position, and growth prospects, in conjunction with insider trading patterns, is recommended before taking any action in the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.