Insider Sell Alert: SEVP Alexander Hadjipateras of Dorian LPG Ltd Unloads 6,000 Shares

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Alexander Hadjipateras, the Senior Executive Vice President of Dorian LPG (USA) LLC, made a notable move by selling 6,000 shares of Dorian LPG Ltd (NYSE:LPG). This transaction, executed on November 21, 2023, has caught the attention of market analysts and investors alike, prompting a closer examination of the implications of such insider activity.

Who is Alexander Hadjipateras?

Alexander Hadjipateras is a key figure at Dorian LPG Ltd, serving as the Senior Executive Vice President. His role at the company involves overseeing various strategic initiatives and operations, making his trading activities particularly noteworthy. With a deep understanding of the company's inner workings and market position, Hadjipateras's decision to sell shares could be interpreted in multiple ways by the investment community.

About Dorian LPG Ltd

Dorian LPG Ltd is a leading liquefied petroleum gas shipping company that operates globally. The company specializes in transporting LPG across the world's oceans, utilizing a fleet of modern, fuel-efficient vessels. Dorian LPG's commitment to safety, environmental responsibility, and operational excellence has positioned it as a prominent player in the LPG shipping industry.

Analysis of Insider Buy/Sell and Stock Price Relationship

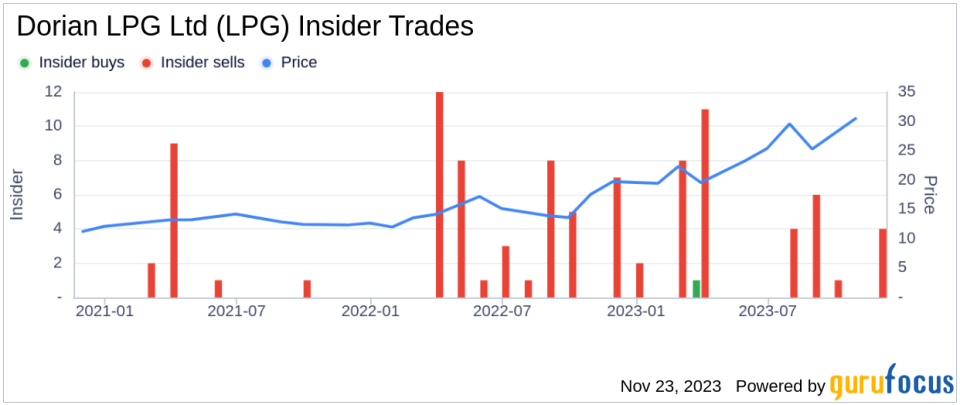

Insider trading patterns, such as those demonstrated by the insider at Dorian LPG Ltd, can provide valuable insights into a company's health and future prospects. Over the past year, Alexander Hadjipateras has sold a total of 26,000 shares and has not made any purchases. This one-sided activity could suggest a lack of confidence in the company's short-term growth potential or simply a personal financial decision.

When examining the broader insider transaction history for Dorian LPG Ltd, we observe that there has been only 1 insider buy compared to 36 insider sells over the past year. This trend may raise questions about the insiders' collective outlook on the stock's future performance.

On the day of the insider's recent sale, shares of Dorian LPG Ltd were trading at $41.62, giving the company a market cap of $1.717 billion. The price-earnings ratio stood at 6.68, which is lower than both the industry median of 9.17 and the company's historical median price-earnings ratio. This could indicate that the stock is undervalued based on earnings potential.

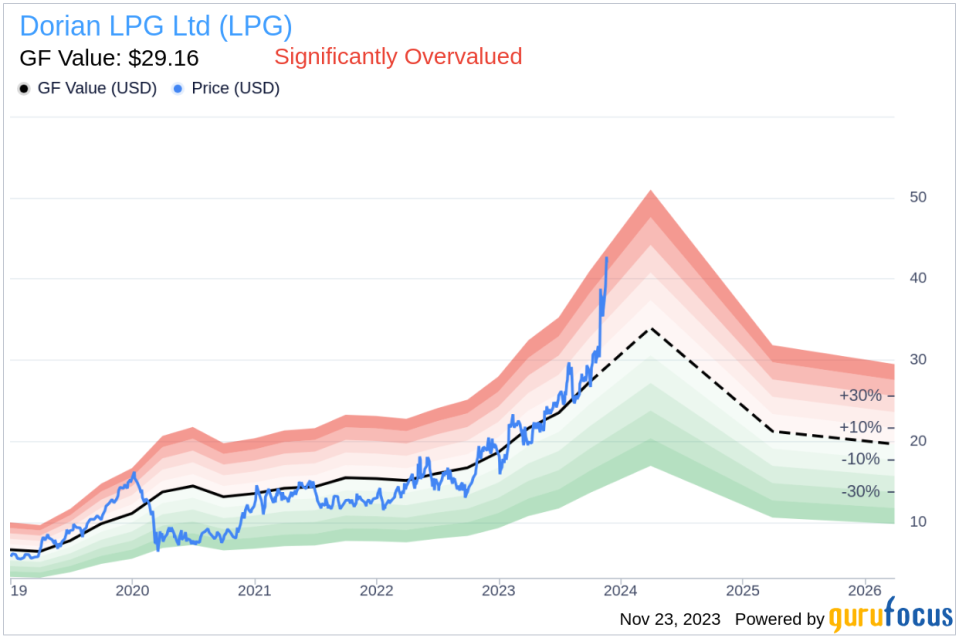

However, with a price of $41.62 and a GuruFocus Value of $29.16, Dorian LPG Ltd has a price-to-GF-Value ratio of 1.43, signaling that the stock is Significantly Overvalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, factoring in historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The insider trend image above illustrates the recent insider selling activity, which could be interpreted as a bearish signal by investors. The consistent selling might suggest that insiders believe the stock is fully valued or potentially overvalued at current levels.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value estimate. The current price-to-GF-Value ratio above 1 indicates that the stock is trading at a premium to what GuruFocus considers its fair value.

Conclusion

The recent insider sell by Alexander Hadjipateras at Dorian LPG Ltd, coupled with the overall trend of insider selling and the stock's valuation metrics, presents a complex picture for investors. While the low price-earnings ratio could suggest an undervalued stock based on earnings, the price-to-GF-Value ratio indicates that the stock may be overvalued when considering the company's intrinsic value.

Investors should weigh these factors, along with their own research and risk tolerance, when considering the implications of insider trading activity on their investment decisions. As always, insider trades should not be the sole factor in making investment choices, but rather one of many tools used to gauge the potential direction of a stock.

For those closely monitoring Dorian LPG Ltd, the actions of insiders like Alexander Hadjipateras will continue to be a focal point, as they may provide valuable clues to the company's future trajectory in the competitive landscape of the LPG shipping industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.