Insider Sell Alert: Southern Nuclear CEO Stephen Kuczynski Sells 5,000 Shares of Southern Co (SO)

In a notable insider transaction, Stephen Kuczynski, CEO of Southern Nuclear, a subsidiary of Southern Company (NYSE:SO), sold 5,000 shares of Southern Co on November 10, 2023. This sale is part of a series of transactions over the past year, where the insider has sold a total of 54,546 shares and made no purchases. This activity raises questions about the insider's sentiment towards the stock and its valuation.

Who is Stephen Kuczynski?

Stephen Kuczynski is the Chairman, President, and CEO of Southern Nuclear, a premier nuclear energy company that operates as part of Southern Company. Kuczynski has been at the helm of Southern Nuclear since 2011 and has played a pivotal role in the development and operation of Southern Company's nuclear energy facilities. His leadership is critical in ensuring the safe, reliable, and efficient production of nuclear energy, which is a significant component of Southern Company's electricity generation portfolio.

About Southern Co

Southern Company is one of the largest energy providers in the United States, serving 9 million customers through its subsidiaries. The company generates electricity through various sources, including nuclear, coal, natural gas, and renewables. Southern Co is known for its commitment to innovation and sustainability, as it seeks to provide clean, safe, reliable, and affordable energy to its customers. With a market cap of $73.442 billion, Southern Co is a significant player in the energy sector.

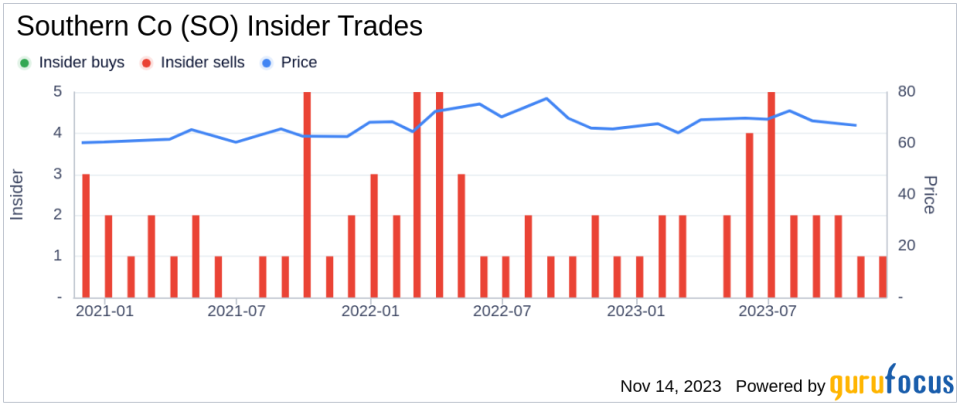

Analysis of Insider Buy/Sell and Relationship with Stock Price

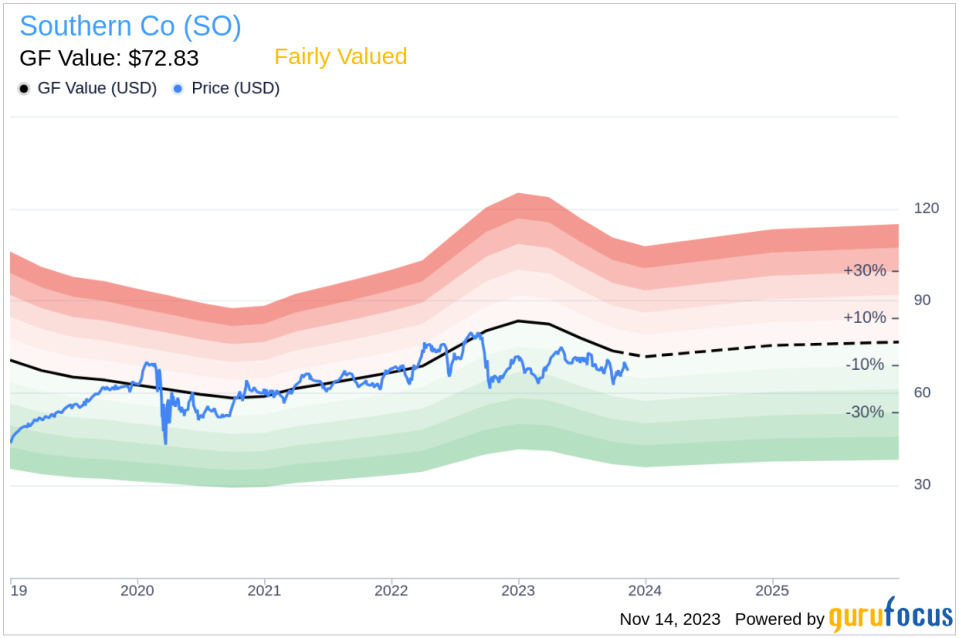

The insider transaction history for Southern Co reveals a pattern of insider selling, with 24 insider sells and no insider buys over the past year. This trend could be interpreted as a lack of confidence among insiders in the stock's future performance or as part of regular profit-taking and portfolio management strategies.On the day of Kuczynski's recent sale, Southern Co shares were trading at $68.39, which is below the GuruFocus Value (GF Value) of $72.83. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. With a price-to-GF-Value ratio of 0.94, the stock is considered Fairly Valued.

The insider's decision to sell at a price below the GF Value suggests that the insider might perceive the stock's current price as a reasonable exit point, despite the stock being fairly valued. It is also important to note that the price-earnings ratio of Southern Co is 24.40, higher than both the industry median of 14.35 and the company's historical median. This higher valuation could be another factor influencing the insider's decision to sell.

Insider Trends

The absence of insider buys over the past year, coupled with consistent selling, may suggest that insiders are taking a cautious stance on the stock's growth prospects or valuation. However, insider selling can be motivated by various factors, including personal financial planning, diversification of assets, or other non-company-specific reasons. Therefore, while insider trends can provide valuable insights, they should not be the sole basis for investment decisions.

Valuation

Southern Co's current valuation metrics indicate a company that is trading at a premium compared to the industry median, which could be justified by its stable earnings, diversified energy mix, and strong market position. However, investors should consider whether the premium is warranted based on the company's growth prospects and the broader market conditions.In conclusion, the recent insider sell by Stephen Kuczynski may signal various things to investors. While the stock is deemed Fairly Valued based on the GF Value, the higher price-earnings ratio and the pattern of insider selling warrant a closer examination of the company's fundamentals and potential headwinds. As always, investors should conduct thorough research and consider a multitude of factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.