Insider Sell Alert: Southern Nuclear CEO Stephen Kuczynski Sells 5,000 Shares of Southern Co (SO)

Stephen Kuczynski, the CEO of Southern Nuclear, a subsidiary of Southern Company, has recently made a significant change to his investment portfolio. On December 11, 2023, Stephen Kuczynski sold 5,000 shares of Southern Co (NYSE:SO), a major move that has caught the attention of investors and market analysts alike. This transaction is particularly noteworthy given Kuczynski's role and influence within the company.

Who is Stephen Kuczynski? He is the Chairman, President, and CEO of Southern Nuclear, a premier energy company that operates a fleet of nuclear power plants and is a leader in providing clean and safe energy. His leadership is critical in steering the company through the complex landscape of energy production, regulation, and innovation.

Southern Co, the parent company of Southern Nuclear, is a renowned energy company based in the United States. It operates primarily in the Southeast, providing electricity to millions of customers. Southern Co is known for its diversified mix of natural gas, coal, nuclear, and renewable energy resources. The company's commitment to innovation and sustainability has made it a key player in the energy sector.

The recent insider sell by the CEO raises questions about the potential implications for Southern Co's stock price and the company's valuation. Insider transactions can provide valuable insights into a company's health and future prospects. When an insider sells a significant amount of shares, it can sometimes signal a lack of confidence in the company's future performance or suggest that the insider believes the stock is currently overvalued.

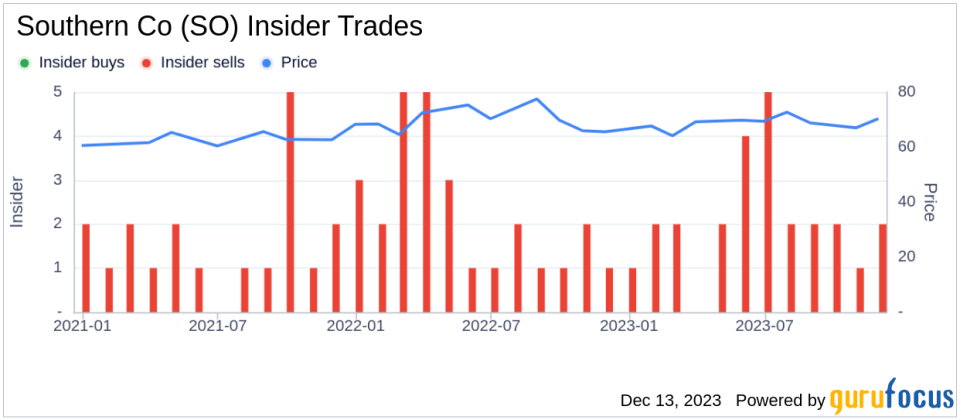

However, it's important to consider the broader context of insider activity. According to the data, Stephen Kuczynski has sold a total of 59,546 shares over the past year and has not made any purchases. This pattern of selling without corresponding buys could be interpreted in various ways, but without additional information, it's difficult to draw definitive conclusions.

Looking at the insider trends for Southern Co, there have been no insider buys and 25 insider sells over the past year. This trend suggests that insiders, on balance, have been more inclined to sell their shares rather than acquire more. This could be due to a variety of reasons, including personal financial planning or portfolio diversification, rather than a negative outlook on the company's future.

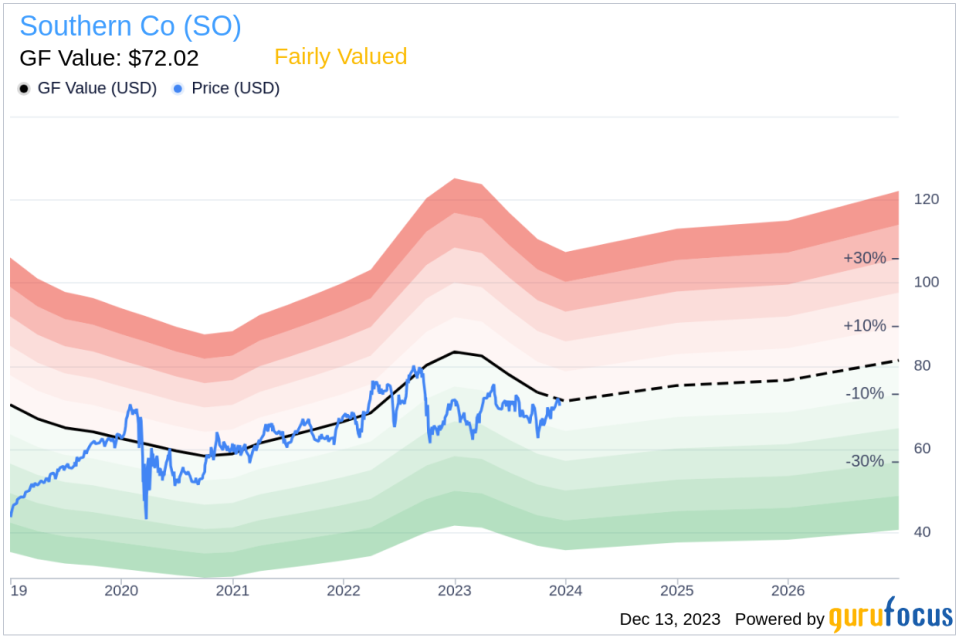

On the valuation front, Southern Co's shares were trading at $71.23 on the day of Kuczynski's sell, giving the company a market cap of $77.56 billion. The price-earnings ratio stands at 25.77, which is higher than both the industry median of 14.5 and the company's historical median. This indicates that the stock may be trading at a premium compared to its peers and its own historical valuation.

Despite this, the stock appears to be Fairly Valued based on the GuruFocus Value, with a price-to-GF-Value ratio of 0.99. The GF Value of $72.02 is slightly above the current trading price, suggesting that the stock is not significantly over or undervalued.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. This comprehensive approach to valuation provides a balanced view of the stock's intrinsic value.

When analyzing the relationship between insider selling and stock price, it's crucial to remember that many factors can influence a stock's price. While insider transactions can be a piece of the puzzle, they should not be viewed in isolation. Market conditions, company performance, industry trends, and broader economic factors all play a role in determining a stock's price.

It's also worth noting that insiders may sell shares for reasons unrelated to their outlook on the company. These can include personal financial planning, tax considerations, or diversifying their investments. Therefore, while insider sells can be a signal worth monitoring, they are not always indicative of a company's future performance.

In conclusion, the recent insider sell by Stephen Kuczynski is a significant event that warrants attention. However, investors should consider the full context of insider activity, the company's valuation, and other market factors before making any investment decisions. As always, a well-rounded approach that includes multiple data points will provide the most reliable basis for investment analysis.

Below are the insider trend and GF Value images that provide a visual representation of the insider transaction history and the stock's valuation, respectively.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.