Insider Sell Alert: Sr. VP and CFO Nicholas Gangestad Sells Shares of Rockwell Automation Inc

Rockwell Automation Inc (NYSE:ROK), a leader in industrial automation and digital transformation, has recently witnessed a notable insider sell by one of its top executives. Nicholas Gangestad, the Senior Vice President and Chief Financial Officer of Rockwell Automation, sold 1,004 shares of the company on December 11, 2023. This transaction has caught the attention of investors and market analysts, as insider activity can often provide valuable insights into a company's financial health and future prospects.

Who is Nicholas Gangestad?

Nicholas Gangestad has served as the Senior Vice President and Chief Financial Officer of Rockwell Automation Inc. With a strong background in finance and strategic planning, Gangestad has been instrumental in steering the company's financial operations and contributing to its growth trajectory. His role involves overseeing the company's financial strategies, including investments, capital structure, and risk management, making his insider transactions particularly noteworthy for investors.

Rockwell Automation Inc's Business Description

Rockwell Automation Inc is a global leader in industrial automation and digital transformation solutions. The company's offerings include control systems, software, and services that cater to a wide range of industries, from automotive to pharmaceuticals. Rockwell Automation's commitment to innovation and sustainability has positioned it as a key player in the Fourth Industrial Revolution, helping businesses optimize their operations and embrace the future of smart manufacturing.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, particularly sells, can be interpreted in various ways. While some may view insider selling as a lack of confidence in the company's future performance, it is also common for executives to sell shares for personal financial planning or diversification purposes. In the case of Nicholas Gangestad, the insider has sold 2,979 shares over the past year without any recorded purchases. This pattern of selling could suggest that the insider is adjusting his personal investment portfolio rather than reflecting a negative outlook on the company's future.

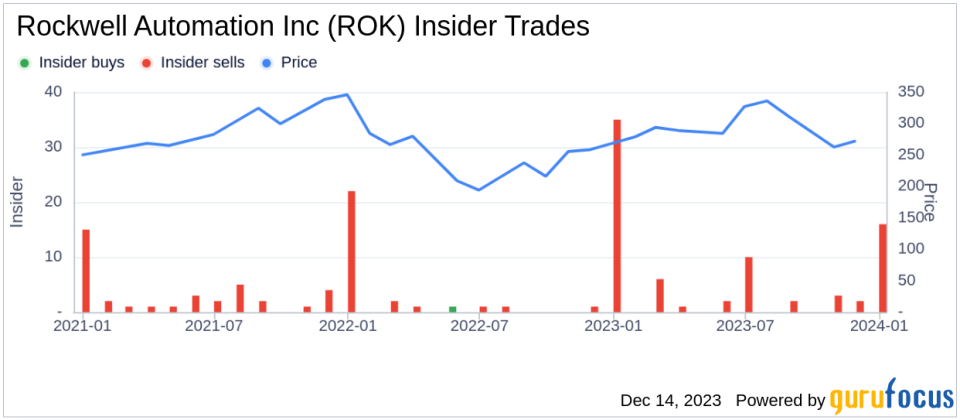

It is also important to consider the broader context of insider activity at Rockwell Automation Inc. Over the past year, there have been no insider buys but 43 insider sells. This trend might raise questions among investors about the insiders' collective sentiment towards the company's valuation and growth prospects.

On the day of Gangestad's recent sell, shares of Rockwell Automation were trading at $279.43, giving the company a market cap of $33.37 billion. The price-earnings ratio of 24.33 is slightly higher than the industry median of 22.385, indicating that the stock may be priced more richly than some of its peers. However, this higher valuation could also reflect the market's confidence in Rockwell Automation's leadership position and its potential for future growth.

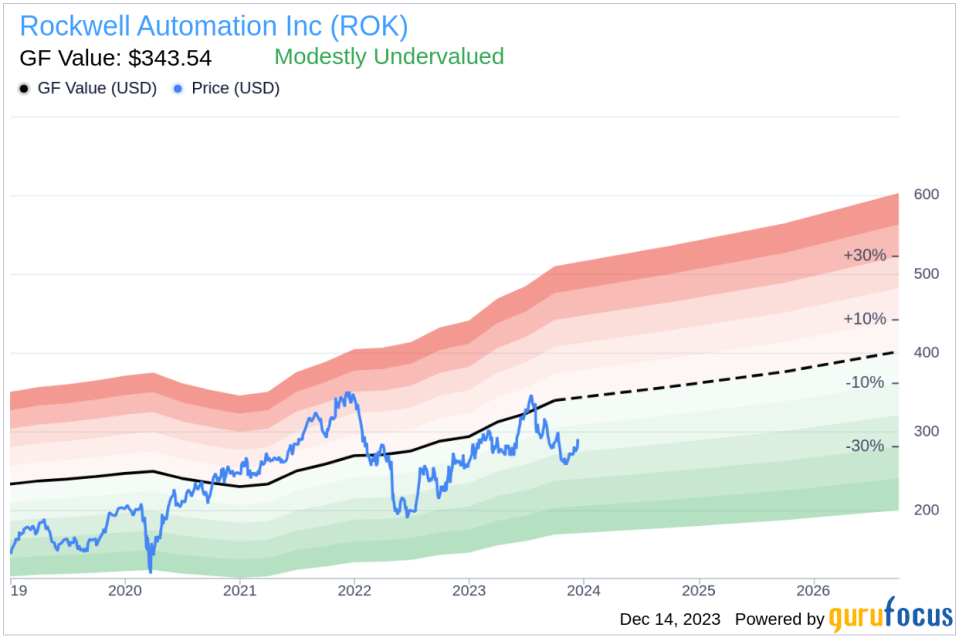

When examining the relationship between insider selling and stock price, it's crucial to consider the company's valuation metrics. With a price-to-GF-Value ratio of 0.81, Rockwell Automation Inc is considered modestly undervalued based on its GF Value. This suggests that despite the insider selling, the stock may still have room for appreciation, according to the intrinsic value estimate developed by GuruFocus.

The GF Value is determined by historical trading multiples, a GuruFocus adjustment factor based on past performance, and future business performance estimates from analysts. This comprehensive approach to valuation provides a more nuanced perspective on the stock's potential, beyond the immediate implications of insider transactions.

The insider trend image above illustrates the recent selling activity by insiders at Rockwell Automation Inc. This visual representation can help investors discern patterns and frequencies of insider transactions, which may influence investment decisions.

The GF Value image provides a graphical view of Rockwell Automation Inc's stock price in relation to its estimated intrinsic value. This comparison can be a useful tool for investors considering whether the current stock price offers a buying opportunity or if caution is warranted due to potential overvaluation.

Conclusion

While insider sells, such as the recent transaction by Nicholas Gangestad, can prompt investor scrutiny, it is essential to analyze these actions within the broader context of the company's financial health and market valuation. Rockwell Automation Inc's position as a modestly undervalued company, according to GuruFocus's GF Value, suggests that the stock may still be attractive to investors despite the insider selling trend. As always, investors should conduct their due diligence and consider multiple factors, including insider activity, valuation metrics, and the company's strategic outlook, before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.