Insider Sell Alert: SVP, Chief People Officer Richard Jacquet Sells 9,373 Shares of Coursera ...

In a notable insider transaction, Richard Jacquet, the Senior Vice President and Chief People Officer of Coursera Inc, sold 9,373 shares of the company on November 15, 2023. This move has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's prospects and the sentiment of its top executives.

Who is Richard Jacquet?

Richard Jacquet has been serving as the Chief People Officer at Coursera Inc, a role that places him at the helm of the company's human resources and talent management strategies. His responsibilities include overseeing employee engagement, recruitment, and organizational development, which are critical components for the growth and success of Coursera. Jacquet's decisions and actions are reflective of the company's culture and values, making his insider transactions particularly noteworthy for investors.

About Coursera Inc

Coursera Inc is a leading online learning platform that offers a wide range of courses, specializations, certificates, and degrees to a global audience. The company partners with universities and other educational institutions to provide accessible and flexible learning options for individuals looking to enhance their skills or pursue new career opportunities. Coursera's business model is centered around providing high-quality educational content and fostering a community of lifelong learners.

Analysis of Insider Buy/Sell and Stock Price Relationship

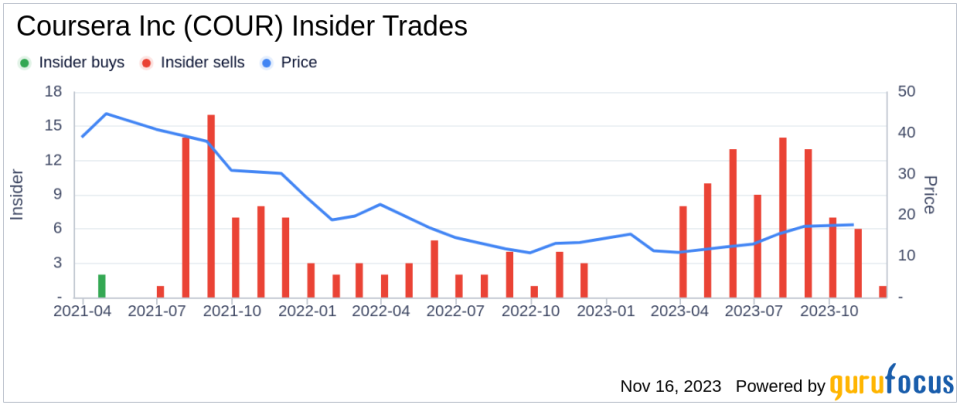

The recent sale by Richard Jacquet of 9,373 shares is part of a larger pattern observed over the past year. Jacquet has sold a total of 216,652 shares and has not made any purchases. This could be interpreted in several ways; however, without additional context, it is challenging to determine the exact motivation behind these sales. It is important to consider that insiders may sell shares for various reasons, including personal financial planning, diversification, and other non-company related factors.The insider transaction history for Coursera Inc shows a significant imbalance between insider sells and buys, with 84 insider sells and no insider buys over the past year. This trend could suggest that insiders, including Richard Jacquet, may believe that the stock is fully valued or that they are taking profits off the table.

Valuation and Market Cap

On the day of the sale, Coursera Inc's shares were trading at $19.88, giving the company a market cap of $2.991 billion. This valuation places the company in the mid-cap category, which can offer a balance between growth potential and stability.

GF Value and Fair Valuation

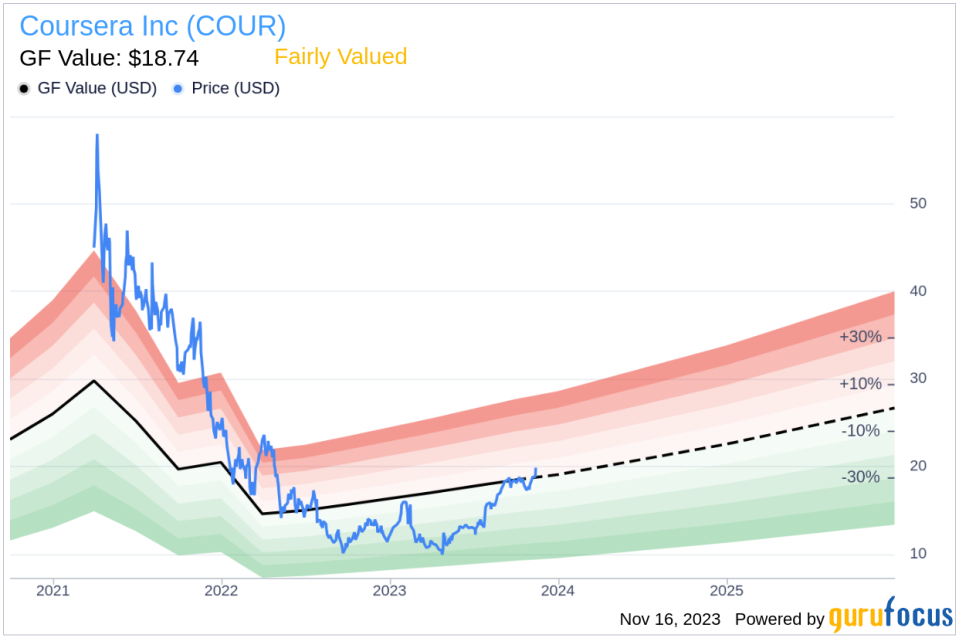

According to the GF Value, an intrinsic value estimate developed by GuruFocus, Coursera Inc has a price-to-GF-Value ratio of 1.06, indicating that the stock is Fairly Valued. The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The GF Value suggests that Coursera's stock price is in line with its intrinsic value, which may explain the lack of insider buying activity. If insiders believed the stock was undervalued, we might expect to see more insider purchases as a sign of confidence in the company's future prospects.

Conclusion

The sale of shares by Richard Jacquet is a significant event that investors should consider in the context of Coursera Inc's overall insider trading trends and valuation. While the stock is currently deemed Fairly Valued based on the GF Value, the lack of insider buying could be a signal for investors to watch the company closely for further developments or changes in insider sentiment. As always, it is crucial for investors to conduct their own due diligence and consider multiple factors when making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.