Insider Sell Alert: SVP, CHIEF HR OFFICER Krista Davis Sells Shares of ANI Pharmaceuticals Inc

ANI Pharmaceuticals Inc (NASDAQ:ANIP) has recently witnessed an insider sell that has caught the attention of investors and market analysts. Krista Davis, the Senior Vice President and Chief Human Resources Officer of ANI Pharmaceuticals, sold 2,622 shares of the company on November 15, 2023. This transaction has prompted a closer look into the insider's trading history, the company's business description, and the potential implications of such insider activities on the stock's performance.

Who is Krista Davis?

Krista Davis serves as the Senior Vice President and Chief Human Resources Officer at ANI Pharmaceuticals Inc. In her role, Davis is responsible for overseeing the company's human resources strategies, including talent management, leadership development, and organizational effectiveness. Her position places her in the upper echelons of the company's management, giving her a unique perspective on the company's operations and potential growth trajectories.

ANI Pharmaceuticals Inc: A Brief Business Description

ANI Pharmaceuticals Inc is a specialty pharmaceutical company engaged in the development, manufacturing, and marketing of branded and generic prescription pharmaceuticals. The company's focus is on producing high-quality products in niche markets with high barriers to entry. ANI Pharmaceuticals prides itself on its ability to navigate complex manufacturing processes and regulatory landscapes, which has allowed it to build a robust product portfolio and pipeline.

Analysis of Insider Buy/Sell and Relationship with Stock Price

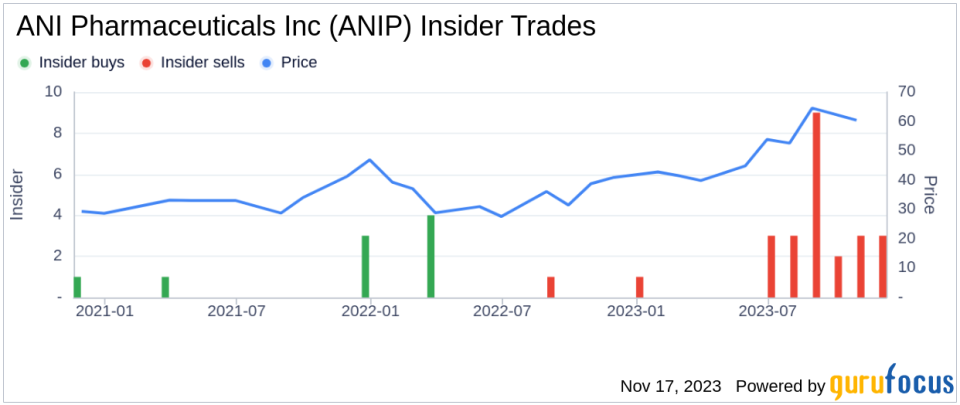

Insider trading activities, particularly sells, can provide valuable insights into a company's internal perspective on its stock's valuation and future prospects. Krista Davis's decision to sell 2,622 shares could be interpreted in various ways. Over the past year, Davis has sold a total of 2,622 shares and has not made any purchases. This one-sided activity might suggest that the insider believes the stock may be fully valued or that they are diversifying their personal portfolio.

When examining the broader insider trends at ANI Pharmaceuticals Inc, it becomes evident that there have been no insider buys over the past year, while there have been 25 insider sells in the same timeframe. This pattern of insider selling could indicate that those with intimate knowledge of the company's workings are taking profits or have concerns about the company's future growth potential.

On the day of the insider's recent sell, shares of ANI Pharmaceuticals Inc were trading at $53.81, giving the company a market cap of $1.046 billion. The price-earnings ratio stands at a lofty 98.56, significantly higher than the industry median of 23.36 and above the company's historical median price-earnings ratio. This elevated P/E ratio could be a contributing factor to the insider's decision to sell, as it may suggest that the stock is overvalued relative to its earnings.

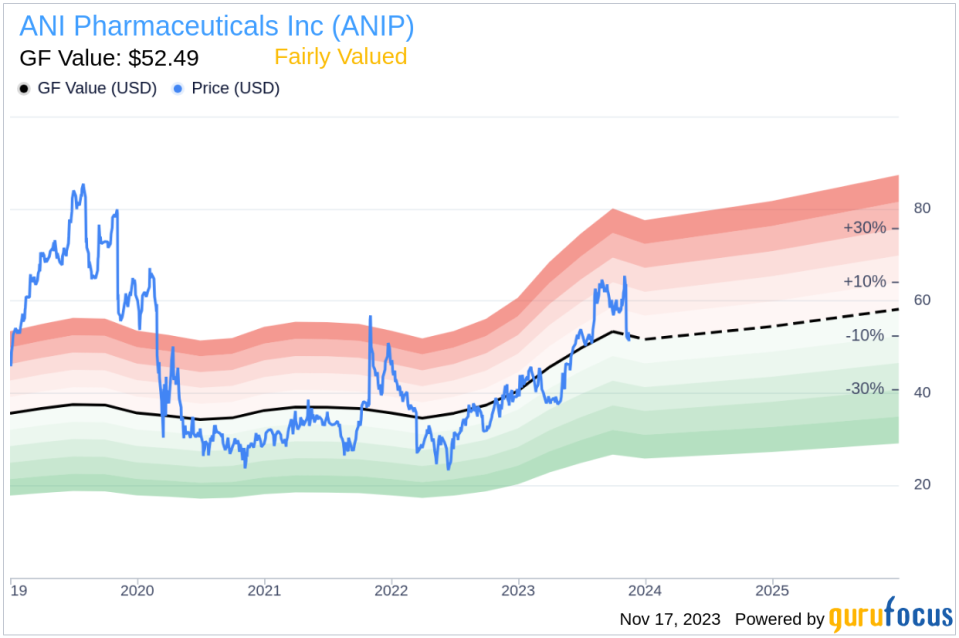

However, with a price of $53.81 and a GuruFocus Value of $52.49, ANI Pharmaceuticals Inc has a price-to-GF-Value ratio of 1.03, indicating that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The GF Value is calculated considering the following factors:

Historical multiples such as price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow.

A GuruFocus adjustment factor based on the company's past returns and growth.

Future estimates of business performance from Morningstar analysts.

Given the stock's Fairly Valued status, the insider's sell does not necessarily signal an overvaluation but could be more related to personal financial planning or portfolio management strategies.

It is also important to consider the overall market conditions and sector performance when analyzing insider sells. If the pharmaceutical sector or the broader market is expected to face headwinds, insiders might be inclined to reduce their holdings in anticipation of a downturn.

The insider trend image above provides a visual representation of the insider trading activities at ANI Pharmaceuticals Inc, highlighting the absence of buys and the prevalence of sells over the past year.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value, supporting the notion that the stock is currently trading at a fair value.

Conclusion

While insider sells can often raise red flags for investors, the context of these transactions is crucial. In the case of Krista Davis's recent sell of ANI Pharmaceuticals Inc shares, the activity appears to be part of a broader pattern of insider selling at the company. Despite the high price-earnings ratio, the stock's GF Value suggests that it is fairly valued. Investors should consider these factors, along with their own research and investment goals, when making decisions about ANI Pharmaceuticals Inc. As always, insider trading is just one piece of the puzzle when evaluating a stock's potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.