Insider Sell Alert: SVP, Chief Sustainability Officer Leslie Hyde Sells 18,383 Shares of ...

Leslie Hyde, the Senior Vice President and Chief Sustainability Officer of Koppers Holdings Inc, has recently made a significant stock transaction, selling 18,383 shares of the company on November 30, 2023. This move by the insider has caught the attention of investors and market analysts, prompting a closer look at the implications of such a sale and its potential impact on the stock's performance.

Who is Leslie Hyde of Koppers Holdings Inc?

Leslie Hyde serves as the Senior Vice President and Chief Sustainability Officer at Koppers Holdings Inc. In this role, Hyde is responsible for overseeing the company's sustainability initiatives, ensuring that Koppers operates in an environmentally responsible manner while also focusing on social governance and corporate responsibility. Hyde's position is critical in aligning the company's strategic goals with sustainable practices, which are increasingly important to investors and stakeholders in today's market.

Koppers Holdings Inc's Business Description

Koppers Holdings Inc is a global provider of treated wood products, wood treatment chemicals, and carbon compounds. The company operates through multiple segments, including Railroad and Utility Products and Services, Performance Chemicals, and Carbon Materials and Chemicals. Koppers serves a diverse range of markets, including the railroad, specialty chemical, utility, residential lumber, agriculture, aluminum, steel, rubber, and construction industries. With a commitment to safety, sustainability, and innovation, Koppers aims to deliver high-quality products and services that contribute to the success of its customers.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

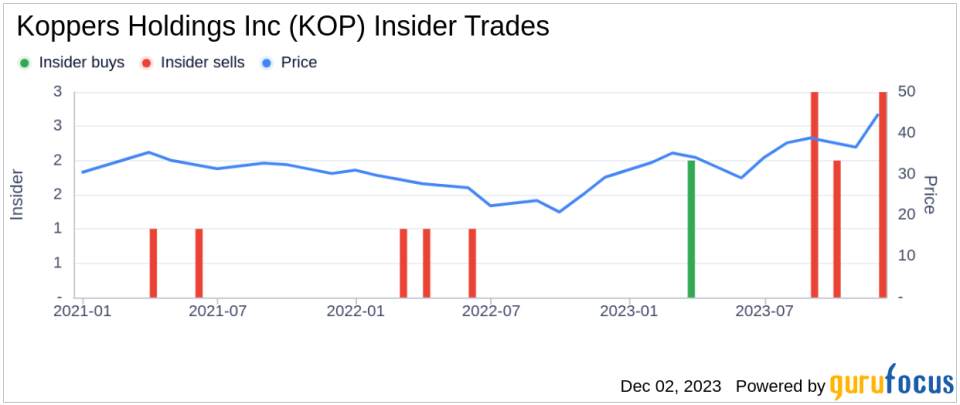

Insider transactions are often scrutinized by investors as they can provide insights into the company's internal perspective on its stock's valuation. Over the past year, Leslie Hyde has sold a total of 35,282 shares and has not made any purchases. This pattern of selling without corresponding buys could signal that the insider believes the stock may be fully valued or overvalued at current levels.

The insider transaction history for Koppers Holdings Inc shows a trend of more insider sells than buys over the past year, with 8 insider sells and only 2 insider buys. This trend could indicate that insiders are taking advantage of the stock's price to realize gains or that they anticipate a potential downturn in the stock's performance.

On the day of the insider's recent sale, shares of Koppers Holdings Inc were trading at $45.11, giving the company a market cap of $939.953 million. The price-earnings ratio of 10.72 is lower than both the industry median of 22.96 and the company's historical median, suggesting that the stock may be undervalued based on earnings.

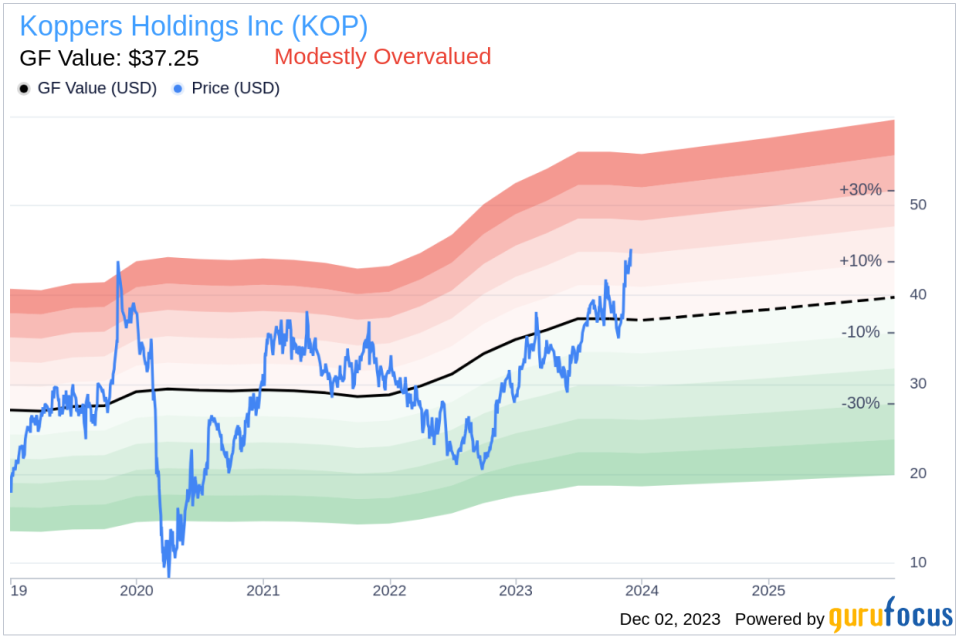

However, with a price of $45.11 and a GuruFocus Value of $37.25, Koppers Holdings Inc has a price-to-GF-Value ratio of 1.21, indicating that the stock is modestly overvalued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above reflects the recent insider selling activity, which could be a factor for investors to consider when evaluating the stock's current valuation and future prospects.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value estimate. The modest overvaluation suggested by the price-to-GF-Value ratio may be a point of concern for value-oriented investors.

Conclusion

The recent insider sell by Leslie Hyde at Koppers Holdings Inc raises questions about the stock's valuation and future performance. While the company's price-earnings ratio suggests it may be undervalued based on earnings, the price-to-GF-Value ratio indicates a modest overvaluation. Investors should consider the insider selling trend, the company's business fundamentals, and the broader market conditions when making investment decisions regarding Koppers Holdings Inc.

It is important to note that insider transactions are just one piece of the puzzle when it comes to stock analysis. They should be considered alongside other financial metrics and market indicators before drawing any conclusions about the stock's potential trajectory. As always, investors are encouraged to conduct their own due diligence and consult with financial advisors before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.