Insider Sell Alert: SVP Michael Whitehead of Lincoln Electric Holdings Inc (LECO) Sells 1,000 Shares

Recent filings with the SEC have revealed that Michael Whitehead, Senior Vice President and President of Global Automation at Lincoln Electric Holdings Inc (NASDAQ:LECO), has sold 1,000 shares of the company's stock. The transaction took place on December 15, 2023, marking a notable insider sell event for the company. This article will delve into the details of the transaction, provide background on Michael Whitehead and Lincoln Electric Holdings Inc, and analyze the implications of insider selling activity on the stock's valuation and price.

Who is Michael Whitehead of Lincoln Electric Holdings Inc?

Michael Whitehead serves as the Senior Vice President and President of Global Automation at Lincoln Electric Holdings Inc. In his role, Whitehead is responsible for overseeing the company's global automation strategy, which is a critical component of Lincoln Electric's growth and innovation initiatives. With a career spanning several years in the industry, Whitehead has accumulated extensive experience in automation and manufacturing, making him a key executive within the company.

Lincoln Electric Holdings Inc's Business Description

Lincoln Electric Holdings Inc is a leading manufacturer of welding, cutting, and joining products. The company operates on a global scale, providing a wide range of equipment and consumables used in various industrial sectors, including automotive, construction, and energy. Lincoln Electric is known for its commitment to innovation, quality, and expertise in the field of welding technology, which has established it as a trusted name among professionals and industries worldwide.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider trading activity, particularly insider sells, can provide valuable insights into a company's internal perspective on its stock's valuation. Over the past year, Michael Whitehead has sold a total of 2,100 shares and has not made any purchases. This could be interpreted in several ways, but without additional context, it is difficult to draw definitive conclusions about the insider's sentiment towards the company's future prospects.

Looking at the broader insider transaction history for Lincoln Electric Holdings Inc, there have been no insider buys and 15 insider sells over the past year. This trend of insider selling could suggest that those with intimate knowledge of the company's operations believe the stock may be fully valued or that they are taking profits after a period of stock price appreciation.

On the day of Whitehead's recent sell, shares of Lincoln Electric Holdings Inc were trading at $215.97, giving the company a market cap of $12.376 billion. The stock's price-earnings ratio of 25.34 is higher than both the industry median of 22.61 and the company's historical median, indicating that the stock may be trading at a premium compared to its peers and its own historical valuation.

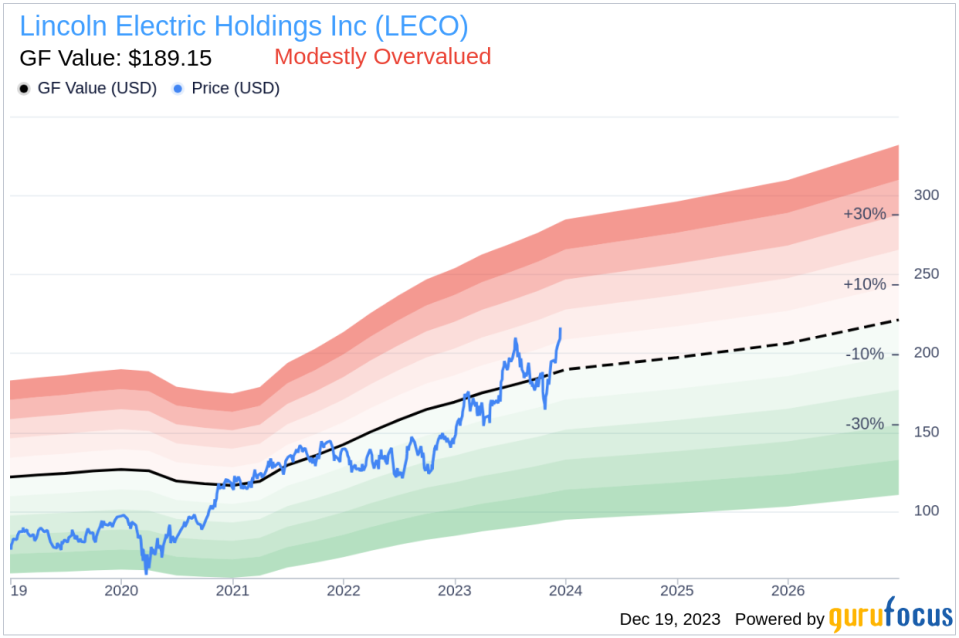

Furthermore, with a price-to-GF-Value ratio of 1.14, Lincoln Electric Holdings Inc is considered modestly overvalued based on its GF Value of $189.15. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The current price-to-GF-Value ratio suggests that the stock's market price is slightly above what is considered its fair value.

The GF Value chart above illustrates the stock's valuation relative to its intrinsic value estimate. The modest overvaluation could be a contributing factor to the insider's decision to sell shares, as it may indicate a strategic move to capitalize on the current market price.

The insider trend image provides a visual representation of the insider selling activity over time. The consistent selling pattern could be indicative of a collective sentiment among insiders that the stock's current valuation does not present a compelling buy opportunity, or it could simply reflect individual financial planning decisions.

Conclusion

Michael Whitehead's recent insider sell transaction at Lincoln Electric Holdings Inc aligns with a broader pattern of insider selling over the past year. While insider sells are not always indicative of a lack of confidence in the company's future, the current valuation metrics and the price-to-GF-Value ratio suggest that the stock may be trading at a slight premium. Investors should consider these insider transactions and valuation analyses as part of a broader investment decision-making process, keeping in mind that insider activity is just one of many factors that can influence stock performance.

As always, it is important for investors to conduct their own due diligence and consider the context of insider transactions within the broader scope of market conditions, company performance, and individual investment strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.