Insider Sell Alert: Vice President Stephen Drake Sells 10,000 Shares of Kulicke & Soffa ...

In a notable insider transaction, Vice President Stephen Drake of Kulicke & Soffa Industries Inc (NASDAQ:KLIC) sold 10,000 shares of the company's stock on November 30, 2023. This sale is part of a series of transactions over the past year, during which Stephen Drake has sold a total of 20,000 shares and made no purchases. The recent sale has caught the attention of investors and market analysts, prompting a closer look at the insider's actions and the potential implications for the stock's performance.

Who is Stephen Drake?

Stephen Drake has been serving as a Vice President at Kulicke & Soffa Industries Inc, a company with a rich history in the semiconductor industry. Drake's role within the company involves significant responsibilities, including strategic decision-making and overseeing various operational aspects. His insider status provides him with a deep understanding of the company's performance, future prospects, and the semiconductor market at large.

About Kulicke & Soffa Industries Inc

Kulicke & Soffa Industries Inc is a leading provider of semiconductor packaging and electronic assembly solutions. The company supports the global automotive, consumer, communications, computing, and industrial segments. Kulicke & Soffa's products include a wide range of equipment and tools used in the process of attaching semiconductor devices to packages, ensuring high-quality and efficient production for their clients. With a focus on innovation and technology, the company has established itself as a key player in the semiconductor industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

The recent sale by Vice President Stephen Drake is part of a broader trend of insider selling at Kulicke & Soffa Industries Inc. Over the past year, there have been no insider buys but 10 insider sells. This pattern of insider selling can sometimes raise concerns among investors, as it may suggest that those with the most intimate knowledge of the company's prospects are choosing to reduce their holdings.

On the day of the insider's recent sale, shares of Kulicke & Soffa Industries Inc were trading at $51.52, giving the company a market cap of $2.975 billion. The price-earnings ratio of 52.99 is higher than both the industry median of 27.1 and the company's historical median, indicating that the stock may be priced at a premium compared to its peers and its own past valuation.

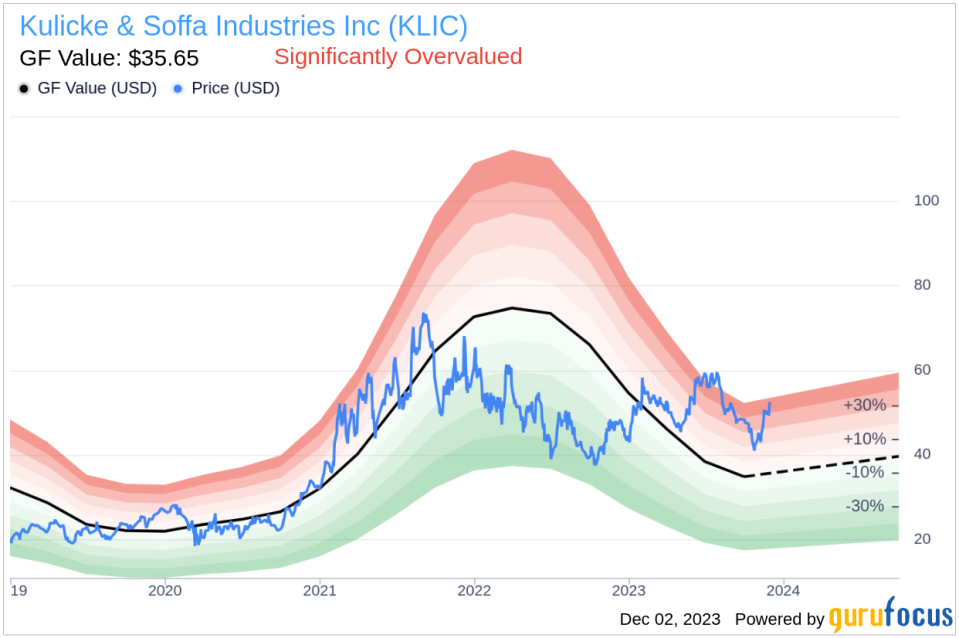

Moreover, with a price of $51.52 and a GuruFocus Value of $35.65, Kulicke & Soffa Industries Inc has a price-to-GF-Value ratio of 1.45. This suggests that the stock is significantly overvalued based on its GF Value, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the selling pattern, which could be interpreted as a lack of confidence by insiders in the stock's current valuation or future prospects. However, it is also important to consider that insiders may sell shares for various reasons unrelated to their outlook on the company, such as personal financial planning or diversifying their investment portfolio.

The GF Value image further illustrates the disparity between the current stock price and the estimated intrinsic value. This discrepancy can be a warning sign for potential investors, as it may indicate that the stock's price has outpaced its underlying value, potentially leading to a correction in the future.

Conclusion

The recent insider sale by Vice President Stephen Drake at Kulicke & Soffa Industries Inc is a significant event that warrants attention. While the insider's actions alone should not be the sole factor in making investment decisions, they do provide valuable context when assessing the stock's valuation and future potential. Given the high price-earnings ratio and the stock's significantly overvalued status based on the GF Value, investors may want to exercise caution and conduct further research before making any investment decisions regarding KLIC shares.

It is also crucial for investors to monitor any further insider transactions, as well as the company's performance in the coming quarters, to better understand the potential impact on the stock's price. As always, a diversified investment approach and a thorough analysis of a company's fundamentals should be the cornerstone of any investment strategy.

For those interested in following Kulicke & Soffa Industries Inc and other semiconductor industry players, staying informed about insider transactions and valuation metrics can provide an edge in navigating the stock market's complexities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.