Insider Sell Alert: VP & Chief Accounting Officer Sharon Villaverde Sells Shares of Dycom ...

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep an eye on to gauge the sentiment of those with the most intimate knowledge of a company's operations. Recently, Sharon Villaverde, the VP & Chief Accounting Officer of Dycom Industries Inc (NYSE:DY), sold 2,268 shares of the company's stock, an event that warrants a closer look to understand the potential implications for investors.

Who is Sharon Villaverde of Dycom Industries Inc?

Sharon Villaverde serves as the Vice President and Chief Accounting Officer at Dycom Industries Inc, a key executive role that places her at the heart of the company's financial operations. Her position involves overseeing the accounting practices, ensuring compliance with regulatory requirements, and maintaining the integrity of financial reports. Villaverde's actions, particularly in buying or selling stock, are closely monitored as they may reflect her confidence in the company's financial health and future prospects.

Dycom Industries Inc's Business Description

Dycom Industries Inc is a leading provider of specialty contracting services throughout the United States. These services include program management, engineering, construction, maintenance, and installation for telecommunications providers. The company's expertise lies in the infrastructure that supports telecom, including fiber optic lines, which are essential for high-speed internet and other communications technologies. Dycom's role in building and maintaining this infrastructure makes it a critical player in an industry that is continuously growing and evolving with technological advancements.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider trading patterns, such as those of Sharon Villaverde, can offer insights into a company's internal perspective. Over the past year, Villaverde has sold a total of 2,268 shares and has not made any purchases. This one-sided activity could suggest that the insider sees the current stock price as favorable for selling or potentially believes that the stock may not see significant appreciation in the near term.

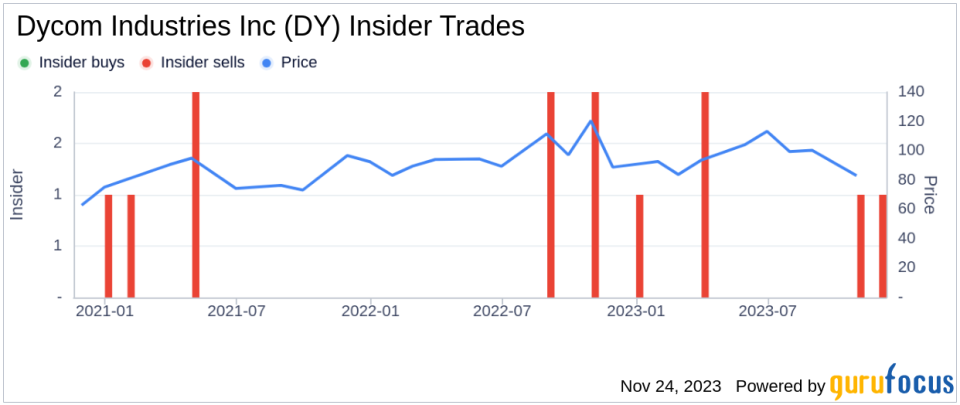

When examining the broader insider transaction history for Dycom Industries Inc, we observe that there have been no insider buys in the past year, contrasted with five insider sells over the same timeframe. This trend of insider selling could be interpreted as a lack of confidence among insiders about the company's market valuation or future growth prospects.

On the day of Villaverde's recent sale, shares of Dycom Industries Inc were trading at $102.1, giving the company a market cap of $2.973 billion. The price-earnings ratio stood at 22.25, higher than the industry median of 14.48 but lower than the company's historical median price-earnings ratio. This suggests that while the stock may be trading at a premium compared to the industry, it is still below its historical valuation levels.

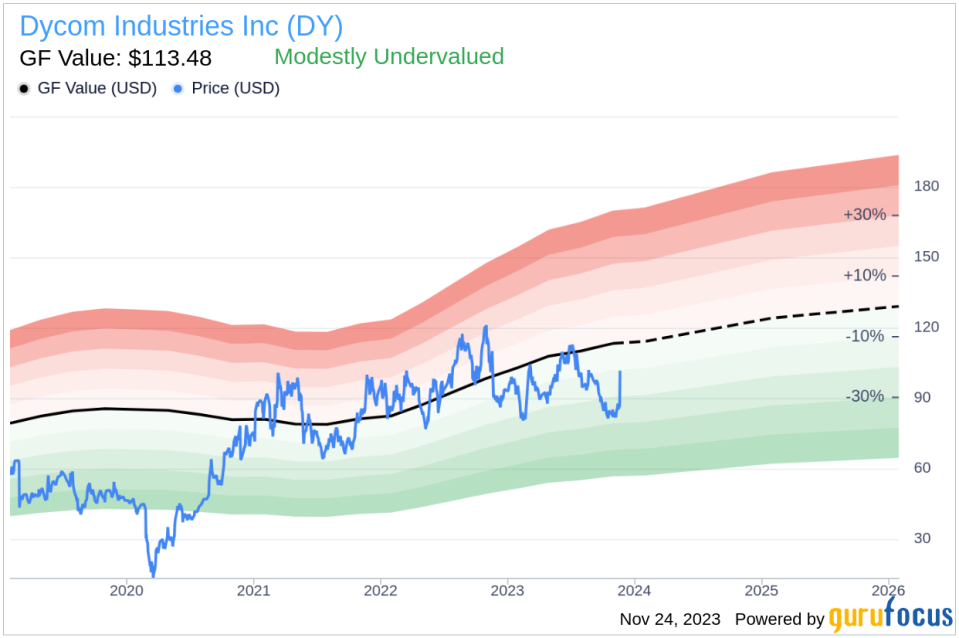

Considering the price-to-GF-Value ratio of 0.9, with the stock trading at $102.1 against a GF Value of $113.48, Dycom Industries Inc appears to be modestly undervalued. The GF Value, an intrinsic value estimate developed by GuruFocus, takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This valuation indicates that despite the insider selling activity, the stock may still hold potential for value investors.

The insider trend image above provides a visual representation of the selling pattern, which could be a signal for investors to consider the motivations behind such transactions and how they align with their investment strategy.

The GF Value image further illustrates the stock's current valuation in relation to its intrinsic value, offering another layer of analysis for investors to ponder.

Conclusion

Sharon Villaverde's recent sale of shares in Dycom Industries Inc may raise questions among investors about the insider's view of the company's valuation and future prospects. While the insider selling trend and the above-average price-earnings ratio could be seen as cautionary signals, the stock's modest undervaluation according to the GF Value suggests that there may still be an opportunity for investors. As always, it is crucial for investors to conduct their due diligence and consider insider trading activity as one of many factors in their investment decision-making process.

Investors should also keep in mind that insider transactions can be influenced by a variety of personal factors and may not always be indicative of the company's operational performance or long-term potential. Therefore, while insider trading data is valuable, it should be weighed alongside other fundamental and technical analyses to build a comprehensive investment thesis.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.