Insider Sell Alert: VP & CHIEF INFORMATION OFFICER Vito Legrottaglie Sells Shares of Climb ...

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep an eye on to gauge the confidence level of a company's executives and directors in their own firm's prospects. In a recent transaction that caught the attention of market analysts, Vito Legrottaglie, the VP & Chief Information Officer of Climb Global Solutions Inc (NASDAQ:CLMB), sold a notable number of shares in the company.

On November 16, 2023, Vito Legrottaglie parted with 3,387 shares of Climb Global Solutions Inc, a move that has sparked discussions among investors and analysts alike. Before delving into the implications of this insider sell, let's explore who Vito Legrottaglie is and the business landscape of Climb Global Solutions Inc.

Who is Vito Legrottaglie?

Vito Legrottaglie holds the position of VP & Chief Information Officer at Climb Global Solutions Inc. With a career spanning several years in the technology and information sectors, Legrottaglie has been instrumental in shaping the IT infrastructure and digital strategy of the company. His role involves overseeing the technological advancements and cybersecurity measures that are crucial for the company's operations and growth.

Climb Global Solutions Inc's Business Description

Climb Global Solutions Inc is a company that specializes in providing innovative technology solutions to businesses worldwide. Their services encompass a broad range of offerings, including cloud computing, data analytics, cybersecurity, and enterprise software development. With a focus on cutting-edge technology and customer-centric approaches, Climb Global Solutions Inc has established itself as a key player in the tech solutions industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, such as the recent sell by Vito Legrottaglie, can provide valuable insights into a company's internal perspective on its stock's value and future performance. Over the past year, Legrottaglie has sold a total of 3,387 shares and has not made any purchases, indicating a potential shift in confidence or a personal financial decision to liquidate part of his holdings.

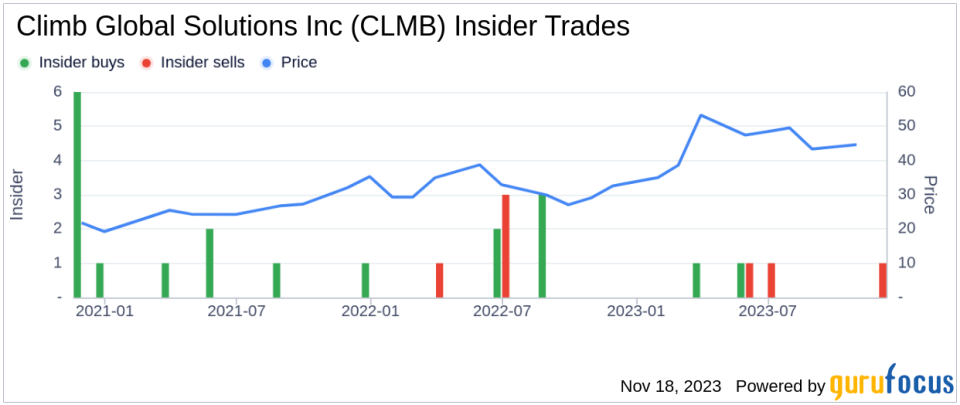

The insider transaction history for Climb Global Solutions Inc shows a mixed pattern of insider sentiment. With 2 insider buys and 3 insider sells over the past year, it's challenging to draw a definitive conclusion about the overall insider stance. However, the recent sell by a high-ranking executive like Legrottaglie can lead to speculation about the company's valuation and future prospects.

On the day of Legrottaglie's sell, shares of Climb Global Solutions Inc were trading at $47.01, giving the company a market cap of $224.173 million. This price point is particularly interesting when considering the company's valuation metrics.

The price-earnings ratio of Climb Global Solutions Inc stands at 18.61, which is lower than the industry median of 22.03. This could suggest that the stock is undervalued compared to its peers. However, when compared to the company's historical median price-earnings ratio, the current ratio is higher, indicating that the stock might be more expensive than its historical average.

Adding another layer to the valuation analysis is the GuruFocus Value (GF Value). With a stock price of $47.01 and a GF Value of $36.26, Climb Global Solutions Inc has a price-to-GF-Value ratio of 1.3. This indicates that the stock is significantly overvalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

The insider trend image above provides a visual representation of the insider trading activities at Climb Global Solutions Inc, which can be a useful tool for investors trying to understand the sentiment of the insider.

The GF Value image further illustrates the valuation discrepancy, highlighting the current stock price in relation to the estimated intrinsic value.

Conclusion

The recent insider sell by Vito Legrottaglie, the VP & Chief Information Officer of Climb Global Solutions Inc, has certainly raised eyebrows in the investment community. While the insider's decision to sell shares could be influenced by a variety of personal or professional reasons, it is an event that warrants attention, especially when juxtaposed with the company's valuation metrics and insider trading trends.

Investors should consider the mixed signals from the insider trading activities, the company's price-earnings ratio, and the GF Value assessment when making investment decisions regarding Climb Global Solutions Inc. As always, insider trades are just one piece of the puzzle, and a comprehensive analysis should include a review of the company's financial health, market position, and growth prospects.

Keeping an eye on further insider trading activities and any forthcoming news or financial reports from Climb Global Solutions Inc will be crucial for investors looking to understand the full picture and make informed decisions about their investments in the company.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.