Insider Sell Alert: Vulcan Materials Co's Chief Strategy Officer Stanley Bass Sells Shares

Vulcan Materials Co (NYSE:VMC), a major player in the construction materials industry, has recently seen a notable insider transaction. Chief Strategy Officer Stanley Bass has sold 1,601 shares of the company's stock. This move by a key insider has prompted market watchers and investors to take a closer look at the implications of such a sale and its potential impact on the stock's performance.

Who is Stanley Bass of Vulcan Materials Co?

Stanley Bass serves as the Chief Strategy Officer at Vulcan Materials Co. In his role, Bass is responsible for shaping the strategic direction of the company, identifying growth opportunities, and ensuring that Vulcan's business plans are aligned with long-term objectives. His insights and decisions are critical to the company's success, making his trading activities in the company's stock of particular interest to investors and analysts alike.

Vulcan Materials Co's Business Description

Vulcan Materials Co is the nation's largest producer of construction aggregatesprimarily crushed stone, sand, and graveland a major producer of aggregates-based construction materials, including asphalt and ready-mixed concrete. The company's products are essential for infrastructure and residential and nonresidential construction projects. Vulcan's extensive network of facilities and strategic distribution capabilities make it a key supplier in the markets it serves.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, such as the recent sale by Stanley Bass, can provide valuable insights into a company's internal perspective on its stock's valuation. Over the past year, Bass has sold a total of 1,601 shares and has not made any purchases. This one-sided activity could suggest that insiders might believe the stock is fully valued or potentially overvalued at current prices.

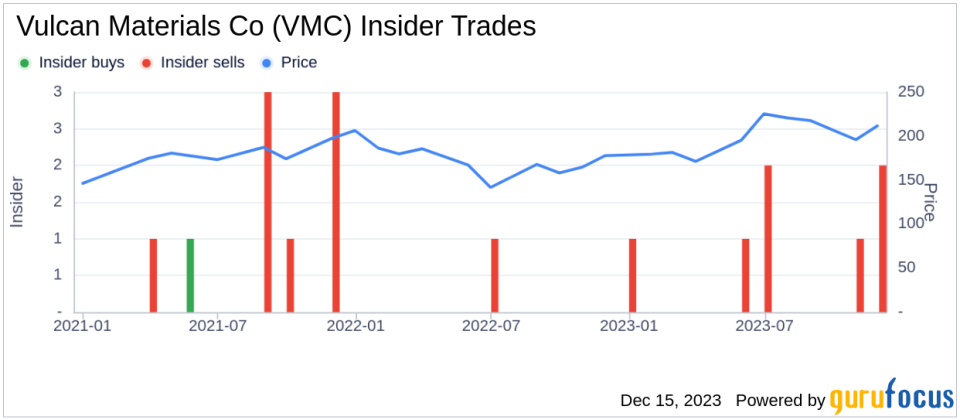

When examining the broader insider transaction history for Vulcan Materials Co, we observe that there have been no insider buys over the past year, contrasted with 7 insider sells. This trend could indicate a consensus among insiders that the stock's growth prospects or current valuation does not present a compelling buy opportunity at this time.

On the day of Bass's recent sale, shares of Vulcan Materials Co were trading at $221.09, giving the company a market cap of $29.86 billion. The price-earnings ratio of 36.43 is higher than the industry median of 14.93, suggesting that the stock is trading at a premium compared to its peers. However, it is lower than the company's historical median price-earnings ratio, which could imply that the stock is relatively undervalued based on its own historical standards.

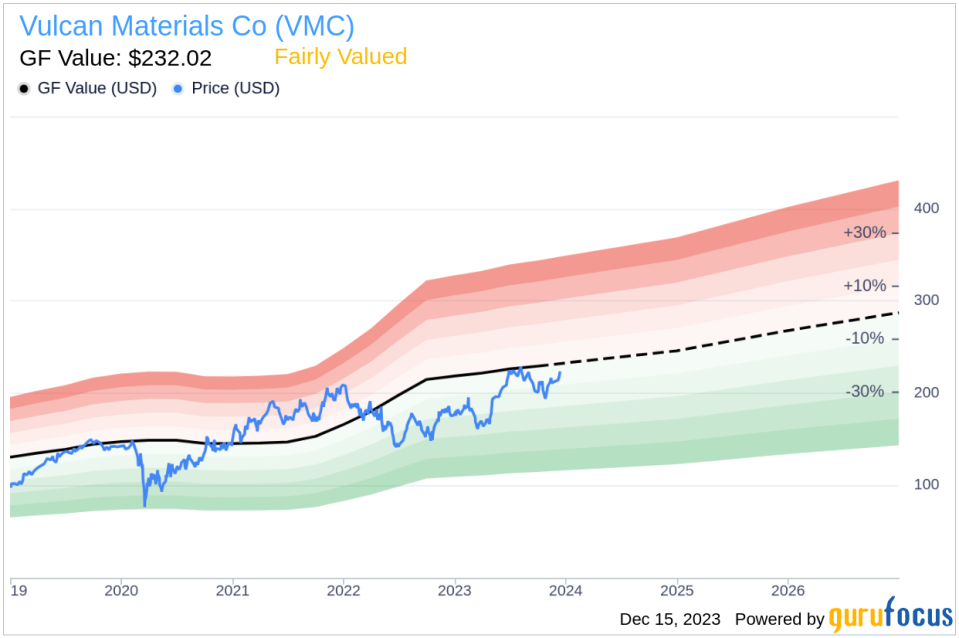

Considering the price-to-GF-Value ratio of 0.95, Vulcan Materials Co is deemed to be Fairly Valued according to the GF Value estimate. This intrinsic value estimate takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The insider trend image above provides a visual representation of the insider trading activities, reinforcing the pattern of more sales than purchases among insiders. This could be interpreted as a lack of confidence in the stock's ability to provide significant returns in the near term.

The GF Value image further illustrates the stock's valuation status. With a GF Value of $232.02 and a current trading price of $221.09, the stock appears to be trading close to its intrinsic value. This alignment suggests that the market has efficiently priced Vulcan Materials Co's stock, taking into account its current financials and growth prospects.

Conclusion

The recent insider sell by Stanley Bass, the Chief Strategy Officer of Vulcan Materials Co, has caught the attention of the market. While insider sells can be motivated by various personal financial needs and do not always signal a bearish view on the company, the lack of insider buying over the past year combined with multiple sells could be a sign that insiders are cautious about the company's stock at current levels.

Investors should consider the insider trading trends, the company's valuation metrics, and the broader market conditions when making investment decisions. Vulcan Materials Co's position as a leading supplier in the construction materials industry, coupled with its current fair valuation, suggests that the stock may be appropriately priced for those with a long-term investment horizon. However, potential investors should keep an eye on insider trading activities as they can provide important clues about the future direction of the stock.

As always, it is recommended to conduct thorough research and consider a diversified investment strategy to mitigate risks. The insider trading activities at Vulcan Materials Co will continue to be monitored closely by investors and analysts for any further developments that could impact the stock's performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.