Insider Sell: American Group President Harrison Bane Sells 3,835 Shares of Surgery Partners Inc

On September 5, 2023, Harrison Bane, the American Group President of Surgery Partners Inc (NASDAQ:SGRY), sold 3,835 shares of the company. This move has sparked interest among investors and analysts alike, as insider trading activities often provide valuable insights into a company's prospects.

Harrison Bane is a key figure at Surgery Partners Inc, a leading healthcare services company. The company operates in the highly competitive healthcare industry, providing a range of surgical services to patients. Its operations include surgical facilities, ancillary services, and optical services. The company's mission is to improve healthcare delivery by providing superior patient care in a cost-effective manner.

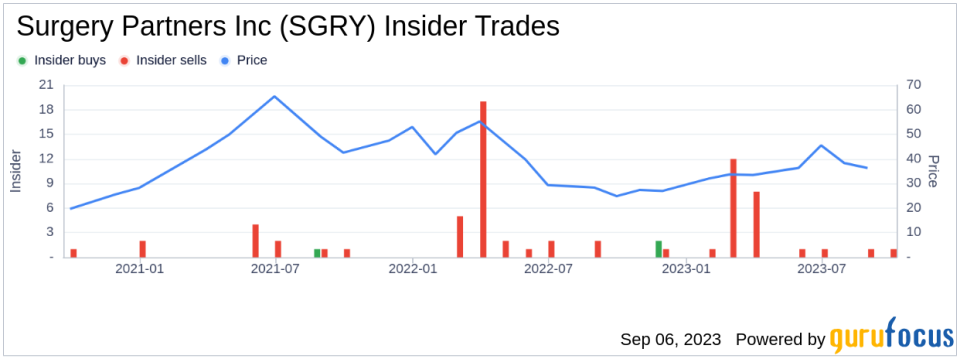

Over the past year, the insider has sold a total of 3,835 shares and has not made any purchases. This recent sale represents a significant portion of the insider's transactions over the past year.

The insider transaction history for Surgery Partners Inc shows a trend of more sells than buys over the past year. There have been 2 insider buys in total, compared to 26 insider sells. This could indicate that insiders believe the stock is currently overvalued.

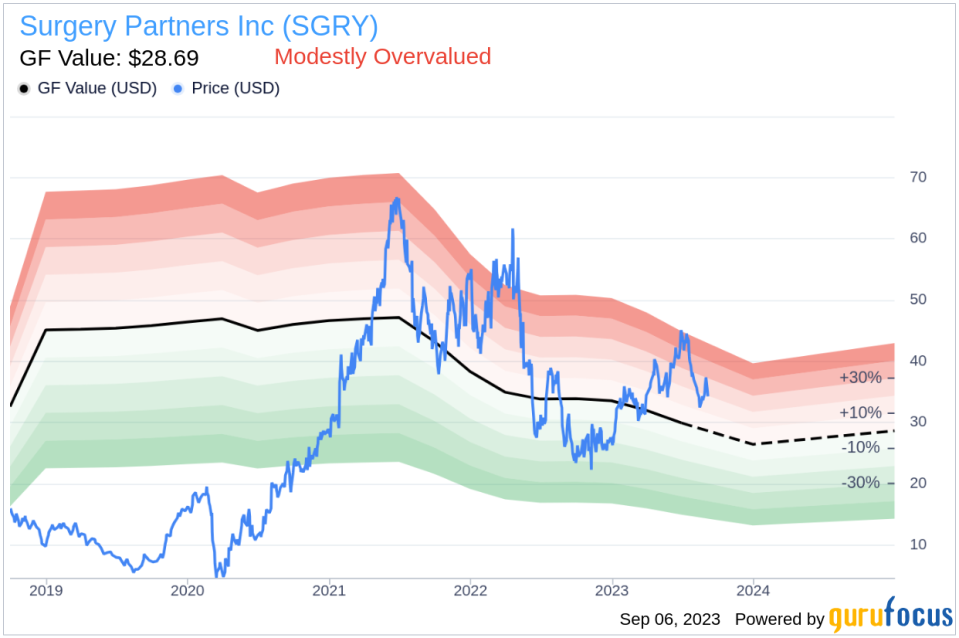

On the day of the insider's recent sale, shares of Surgery Partners Inc were trading for $35.98 each. This gives the stock a market cap of $4.34 billion.

With a price of $35.98 and a GuruFocus Value of $28.69, Surgery Partners Inc has a price-to-GF-Value ratio of 1.25. This suggests that the stock is modestly overvalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The recent insider sell by Harrison Bane, coupled with the stock's current valuation, could suggest that the stock is overpriced. However, investors should also consider other factors such as the company's financial health, market conditions, and future growth prospects before making investment decisions.

As always, insider trading activities should be only one of many tools used by investors when researching a company. It is always recommended to conduct thorough due diligence and consult with a financial advisor before making any investment decisions.

This article first appeared on GuruFocus.