Insider Sell: Aramark COO Marc Bruno Offloads 27,884 Shares

In a notable insider transaction, Marc Bruno, the Chief Operating Officer of U.S. Food & Facilities at Aramark (NYSE:ARMK), sold 27,884 shares of the company on December 13, 2023. This move has caught the attention of investors and analysts who closely monitor insider activities as an indicator of a company's financial health and future performance.

Who is Marc Bruno?

Marc Bruno is a seasoned executive with extensive experience in the food services and facilities management industry. As the COO of U.S. Food & Facilities at Aramark, Bruno is responsible for overseeing the operational strategies and execution for one of the company's most significant segments. His role is crucial in ensuring that Aramark maintains its reputation for delivering quality services and innovative solutions to its clients.

Aramark's Business Description

Aramark is a global leader in food, facilities, and uniform services. The company provides a wide range of services, including dining, catering, food retail management, and facility services, to clients in sectors such as education, healthcare, business, corrections, and leisure. Aramark's commitment to service excellence and innovation has made it a trusted partner for organizations looking to enhance their operations and customer experiences.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, particularly sells, can provide valuable insights into a company's internal perspective. While there can be various reasons for an insider to sell shares, such as personal financial planning or diversifying their investments, a sale of this magnitude by a high-ranking executive like Marc Bruno may prompt investors to scrutinize the company's current valuation and future prospects.

Over the past year, Marc Bruno has sold 27,884 shares in total and has not made any purchases. This one-sided activity could suggest that the insider sees the current stock price as a favorable selling point, possibly due to a belief that the stock is fully valued or due to other personal considerations.

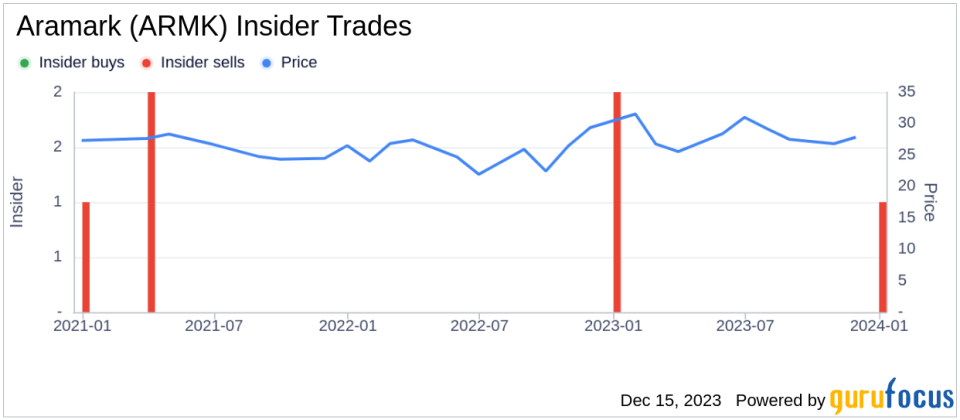

The insider transaction history for Aramark shows a lack of insider buying over the past year, with only one insider sell during the same timeframe. This trend could indicate a cautious stance from insiders regarding the company's stock, as they may not perceive the shares to be undervalued enough to warrant buying at current levels.

On the day of the insider's recent sell, shares of Aramark were trading at $26.67, giving the stock a market cap of $7,113,031,000. The price-earnings ratio stood at 10.63, lower than both the industry median of 17.175 and the company's historical median price-earnings ratio. This lower valuation could be interpreted as the stock being undervalued compared to its peers and historical performance.

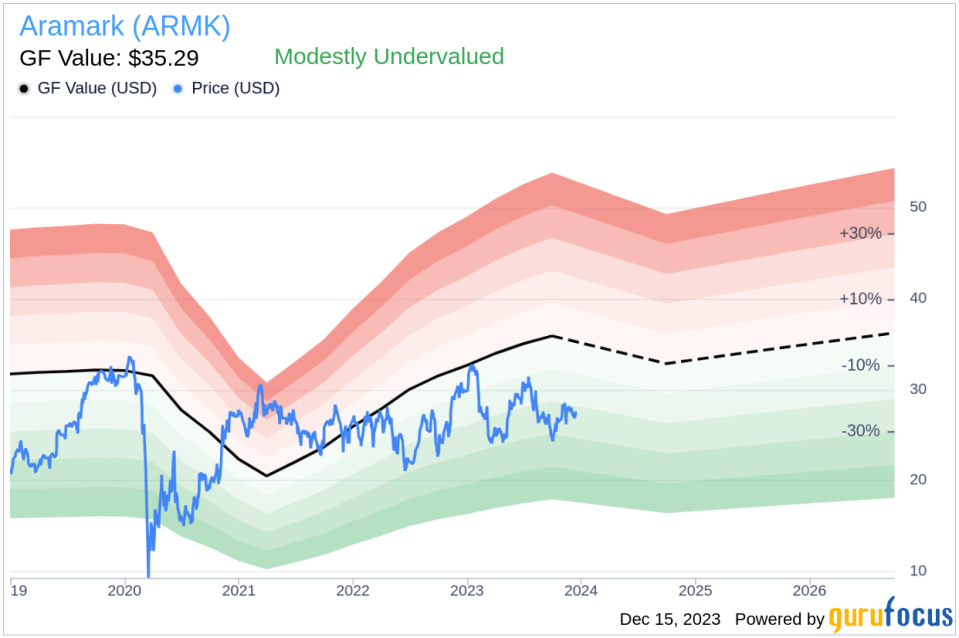

However, with a price of $26.67 and a GuruFocus Value of $35.29, Aramark has a price-to-GF-Value ratio of 0.76, indicating that the stock is modestly undervalued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above reflects the recent selling activity and the absence of buying, which could be a signal for investors to consider the potential reasons behind this pattern. It is essential to note that insider selling does not always predict a downturn in the stock's performance, as executives may have various personal reasons for selling that are unrelated to their outlook on the company's future.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value estimate. The current modest undervaluation suggests that the stock may have room for appreciation if the company continues to perform well and if market sentiment remains positive.

Conclusion

Marc Bruno's recent sale of 27,884 shares of Aramark is a significant insider transaction that warrants attention. While the company's stock appears to be modestly undervalued based on the GF Value, the lack of insider buying and the presence of insider selling over the past year could suggest a cautious outlook from those with intimate knowledge of the company. Investors should consider these insider trends alongside broader market analysis and individual investment strategies when evaluating Aramark's stock for their portfolios.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.