Insider Sell: Aterian Inc's CTO Roi Zahut Sells 11,489 Shares

On September 12, 2023, Roi Zahut, the Chief Technology Officer of Aterian Inc (NASDAQ:ATER), sold 11,489 shares of the company. This move is part of a larger trend of insider selling at Aterian Inc, as evidenced by the insider transaction history.

But who is Roi Zahut? Zahut is the Chief Technology Officer at Aterian Inc, a leading technology-enabled consumer products platform that builds, acquires, and partners with best-in-class e-commerce brands by harnessing proprietary software and an agile supply chain to create top selling consumer products. Zahut's role is pivotal in driving the technological advancements that keep Aterian at the forefront of the e-commerce industry.

Over the past year, Zahut has sold a total of 92,774 shares and has not purchased any shares. This trend is not unique to Zahut, as there have been 10 insider sells and 0 insider buys at Aterian Inc over the same timeframe.

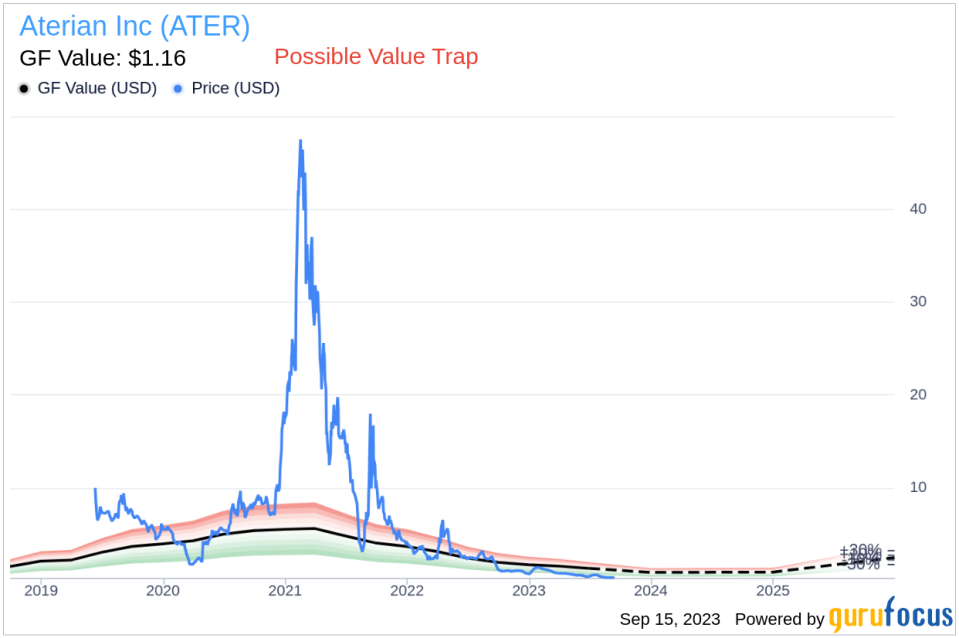

The insider's recent sell occurred when Aterian Inc's shares were trading at $0.34, giving the stock a market cap of $28.706 million. Despite the insider's sell, the stock's price-to-GF-Value ratio of 0.29 suggests that it may be undervalued. The GF Value, an intrinsic value estimate developed by GuruFocus, is calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. With a GF Value of $1.16, Aterian Inc's stock appears to be a possible value trap, warranting careful consideration before investment.

The relationship between insider selling and stock price can be complex. While insider selling can sometimes indicate a lack of confidence in the company's future prospects, it can also be a personal decision based on the insider's financial needs or investment strategies. Therefore, while the insider's recent sell and the overall trend of insider selling at Aterian Inc may raise some concerns, it does not necessarily indicate a negative outlook for the company.

Investors should always consider a variety of factors when evaluating a potential investment, including the company's financial health, market conditions, and industry trends. In the case of Aterian Inc, despite the insider's sell, the stock's low price-to-GF-Value ratio suggests that it may still hold potential value for investors.

This article first appeared on GuruFocus.