Insider Sell: Atlassian Corp's Chief Revenue Officer Cameron Deatsch Offloads 3,890 Shares

Atlassian Corporation Plc (NASDAQ:TEAM), a leading provider of team collaboration and productivity software, has witnessed a significant insider sell by Chief Revenue Officer Cameron Deatsch. On November 24, 2023, Deatsch sold 3,890 shares of the company, a move that has caught the attention of investors and market analysts alike. This transaction is part of a series of insider activities that can provide valuable insights into the company's financial health and future prospects.

Who is Cameron Deatsch?

Cameron Deatsch is a key executive at Atlassian Corp, serving as the Chief Revenue Officer. In his role, Deatsch is responsible for driving the company's revenue growth and overseeing the global sales and marketing teams. His strategic decisions and leadership are crucial for Atlassian's continued expansion and market penetration. With a deep understanding of the company's products and market dynamics, Deatsch's actions, including his trading activities, are closely monitored by investors for indications of the company's performance and outlook.

Atlassian Corp's Business Description

Atlassian Corp is renowned for its suite of productivity and collaboration tools designed to enhance team efficiency and project management. The company's flagship products include Jira, Confluence, Bitbucket, and Trello, among others, which cater to a wide range of customers from small businesses to large enterprises. Atlassian's solutions are pivotal in helping teams organize, discuss, and complete shared work, making the company a staple in the software development and project management sectors.

Analysis of Insider Buy/Sell and Relationship with Stock Price

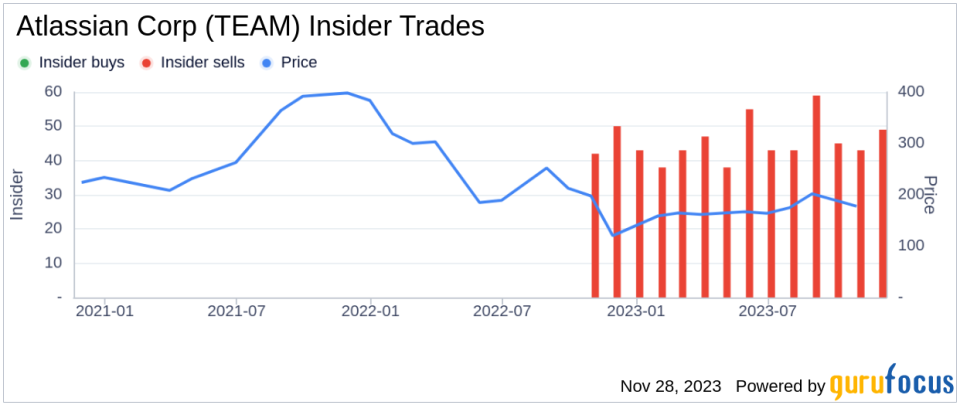

Insider trading activities, such as buys and sells, can be a barometer for a company's internal perspective on its stock's value. Over the past year, Cameron Deatsch has sold a total of 62,661 shares and has not made any purchases. This one-sided activity could suggest that insiders, including Deatsch, may believe the stock is fully valued or potentially overvalued at current prices, prompting them to lock in profits.

Conversely, the absence of insider buys over the past year could also indicate a lack of compelling buying opportunities at current price levels, or it may reflect a strategic decision by insiders to diversify their investment portfolios.

When analyzing the relationship between insider trading and stock price, it's important to consider the context of the market and the company's performance. Atlassian Corp's stock price on the day of Deatsch's recent sell was $181.04, giving the company a market cap of $48.565 billion. This valuation places the company among the larger players in the software industry.

The insider transaction history for Atlassian Corp shows a trend of more insider sells than buys over the past year, with 555 insider sells and no insider buys. This trend could be interpreted in several ways, but it often suggests that insiders are taking advantage of the stock's price to realize gains.

Valuation and GF Value Analysis

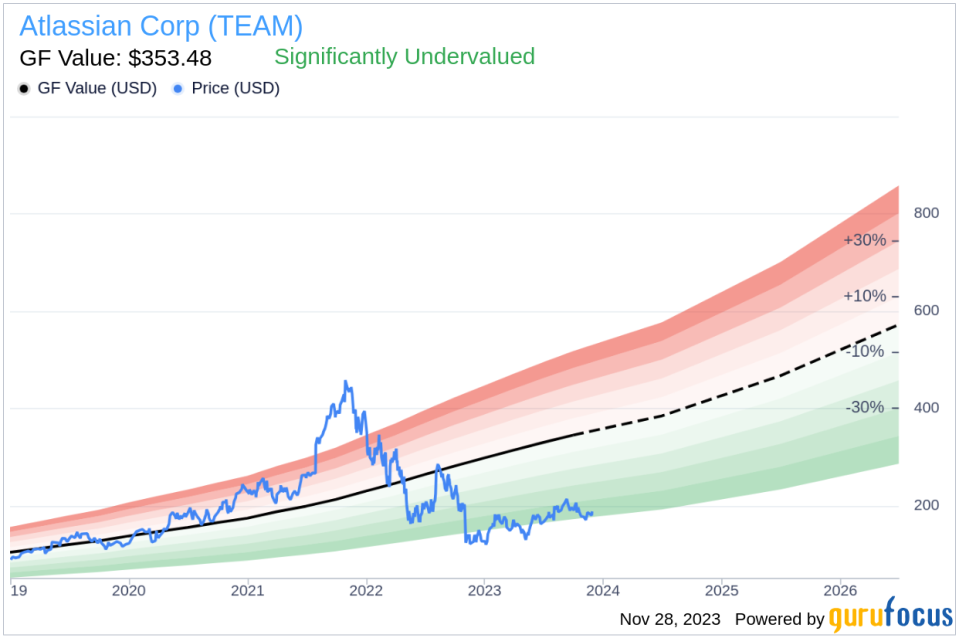

Atlassian Corp's stock valuation, as indicated by the price-to-GF-Value ratio of 0.51, suggests that the stock is significantly undervalued based on its GF Value of $353.48. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

This significant undervaluation could imply that the stock has considerable upside potential, making it an attractive investment opportunity for value investors. However, the insider selling activity may raise questions about whether internal stakeholders share this optimistic valuation perspective.

It's also possible that the insider's decision to sell shares is not solely based on the company's valuation but could be influenced by personal financial planning, tax considerations, or other individual factors.

Conclusion

The recent insider sell by Cameron Deatsch at Atlassian Corp provides investors with an opportunity to scrutinize the company's valuation and insider sentiment. While the GF Value suggests that the stock is significantly undervalued, the consistent insider selling activity could signal caution. Investors should consider both the insider trading trends and the company's intrinsic value estimate when making investment decisions.

As with any insider trading analysis, it's essential to look at the broader picture, including the company's financial performance, market conditions, and industry trends. Only by considering all these factors can investors make informed decisions about the potential risks and rewards of investing in Atlassian Corp's stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.