Insider Sell: BOBO DONALD E JR Sells 4,500 Shares of Edwards Lifesciences Corp

On September 14, 2023, BOBO DONALD E JR, CVP, Strategy/Corp Development of Edwards Lifesciences Corp (NYSE:EW), sold 4,500 shares of the company. This move comes as part of a series of transactions by the insider over the past year, during which he sold a total of 71,210 shares and made no purchases.

Edwards Lifesciences Corp is a leading global provider of patient-focused medical solutions for structural heart disease, as well as critical care and surgical monitoring. The company's innovative technologies and services are designed to help clinicians deliver the best possible patient care and improve patient outcomes.

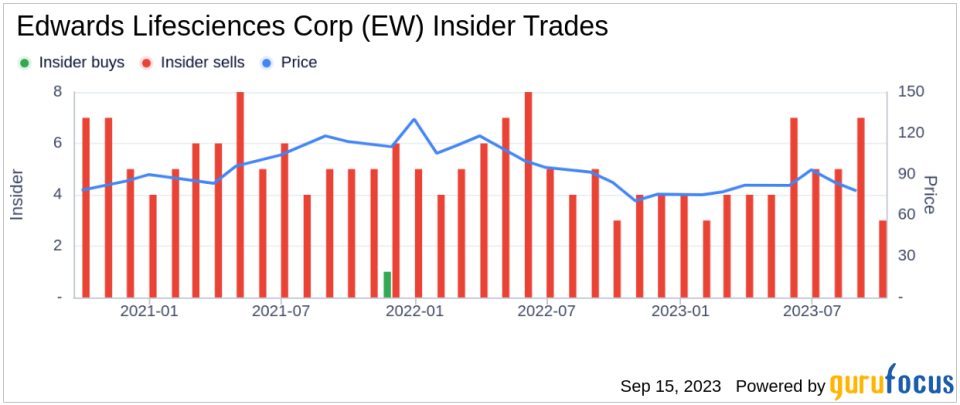

The insider's recent sell has raised questions about the company's stock performance and its relationship with insider trading activities. Over the past year, there have been 57 insider sells and no insider buys at Edwards Lifesciences Corp.

As shown in the insider trend image above, the insider's sell activities have been consistent over the past year. This could be an indication of the insider's confidence in the company's future performance or a strategic move to diversify his investment portfolio.

On the day of the insider's recent sell, shares of Edwards Lifesciences Corp were trading at $73.71, giving the company a market cap of $45.23 billion. The stock's price-earnings ratio was 32.92, higher than the industry median of 28.08 but lower than the company's historical median price-earnings ratio.

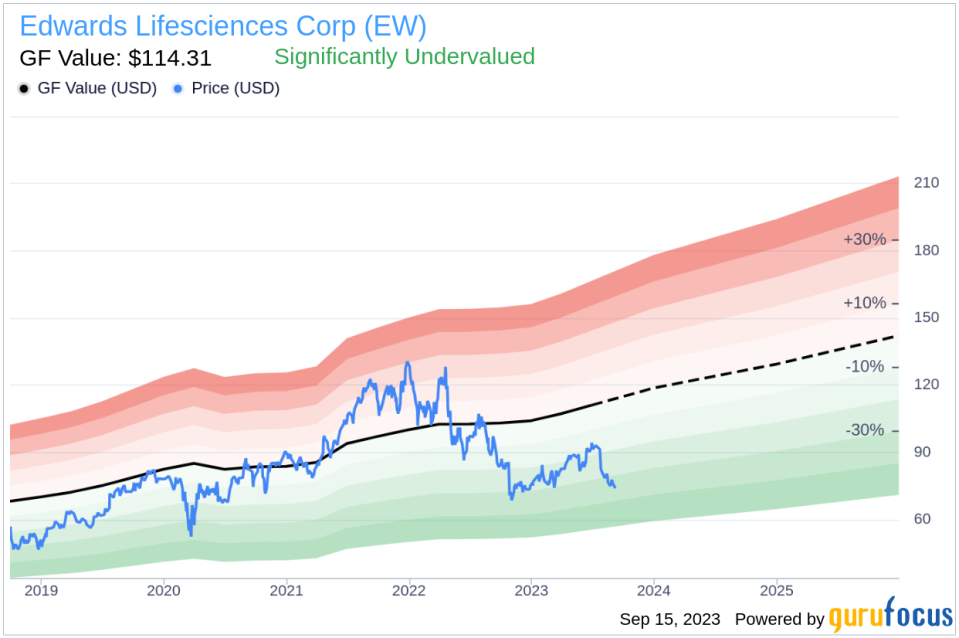

According to the GF Value image above, with a price of $73.71 and a GuruFocus Value of $114.31, Edwards Lifesciences Corp has a price-to-GF-Value ratio of 0.64. This suggests that the stock is significantly undervalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the insider's recent sell of Edwards Lifesciences Corp shares, coupled with the company's undervalued status based on its GF Value, presents an interesting scenario for investors. While the insider's sell activities could be seen as a lack of confidence in the company's future performance, the stock's undervalued status suggests potential for growth. As always, investors are advised to conduct their own thorough research before making any investment decisions.

This article first appeared on GuruFocus.