Insider Sell: Brandon Smith Sells 4,000 Shares of Prothena Corp PLC

On October 11, 2023, Brandon Smith, the Chief Operating Officer (COO) of Prothena Corp PLC (NASDAQ:PRTA), sold 4,000 shares of the company. This move is part of a broader trend of insider selling at Prothena Corp PLC, which we will explore in this article.

Prothena Corp PLC is a clinical-stage neuroscience company engaged in the discovery and development of novel therapies with the potential to fundamentally change the course of progressive, life-threatening diseases. Fueled by its deep scientific understanding built over decades of neuroscience research, Prothena is advancing a pipeline of therapeutic candidates for a number of indications and novel targets for which its ability to integrate scientific insights around neurological dysfunction and the biology of misfolded proteins can be leveraged.

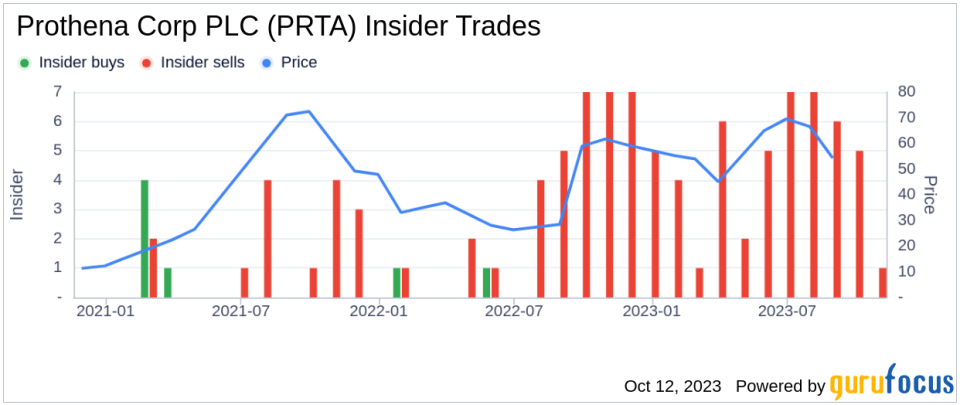

Over the past year, Brandon Smith has sold a total of 21,333 shares and has not purchased any shares. The insider's recent sale of 4,000 shares is part of a larger trend at Prothena Corp PLC, where there have been 60 insider sells and no insider buys over the past year. This trend could be a signal to investors about the insider's perspective on the company's future prospects.

On the day of the insider's recent sale, shares of Prothena Corp PLC were trading at $46.75, giving the company a market cap of $2.53 billion.

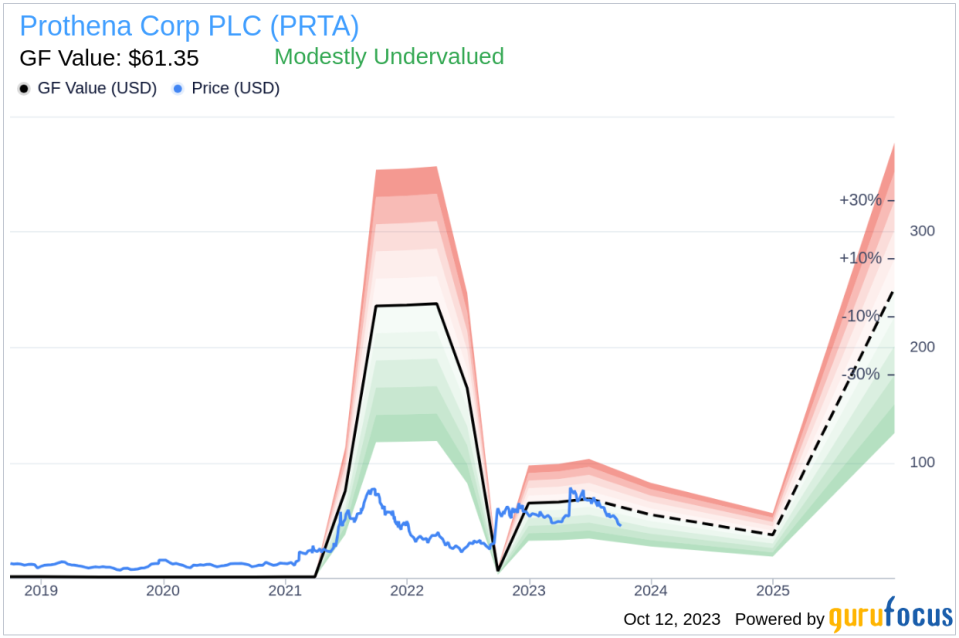

With a price of $46.75 and a GuruFocus Value of $61.35, Prothena Corp PLC has a price-to-GF-Value ratio of 0.76. This suggests that the stock is modestly undervalued based on its GF Value. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The insider's decision to sell shares could be influenced by a variety of factors, including personal financial needs or a belief that the company's stock is currently overvalued. However, it's important for investors to consider the broader context of the company's financial performance and market conditions when interpreting insider selling activity.

In conclusion, while the insider's recent sale of shares and the overall trend of insider selling at Prothena Corp PLC may raise some questions, the company's stock appears to be modestly undervalued according to GuruFocus Value. As always, investors should conduct their own thorough research before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.