Insider Sell: Breanne Antich Sells 300 Shares of Timberland Bancorp Inc

On September 7, 2023, Chief Technology Officer and Executive Vice President of Timberland Bancorp Inc (NASDAQ:TSBK), Breanne Antich, sold 300 shares of the company. This move is part of a broader trend of insider selling at the company, which we will explore in more detail.

Breanne Antich is a key figure at Timberland Bancorp Inc, serving as the Chief Technology Officer and Executive Vice President. Her role involves overseeing the technological direction of the company, ensuring that it stays competitive in an increasingly digital banking landscape.

Timberland Bancorp Inc is a Washington-based holding company for Timberland Bank. The bank provides a wide range of banking solutions such as mortgage loans, commercial business loans, and various consumer loans. It also offers other banking services, including online banking and treasury management services.

Over the past year, the insider has sold a total of 300 shares and has not made any purchases. This trend is mirrored in the broader insider transaction history for Timberland Bancorp Inc, which shows 1 insider buy and 7 insider sells over the past year.

The relationship between insider selling and stock price can be complex. In some cases, insider selling can be a bearish signal, suggesting that insiders believe the stock is overvalued. However, it's also important to note that insiders may sell shares for a variety of reasons unrelated to their outlook on the stock, such as personal financial needs or portfolio diversification.

On the day of the insider's recent sell, shares of Timberland Bancorp Inc were trading for $28.44, giving the stock a market cap of $236.379 million. The price-earnings ratio is 8.80, which is higher than the industry median of 8.22 but lower than the companys historical median price-earnings ratio.

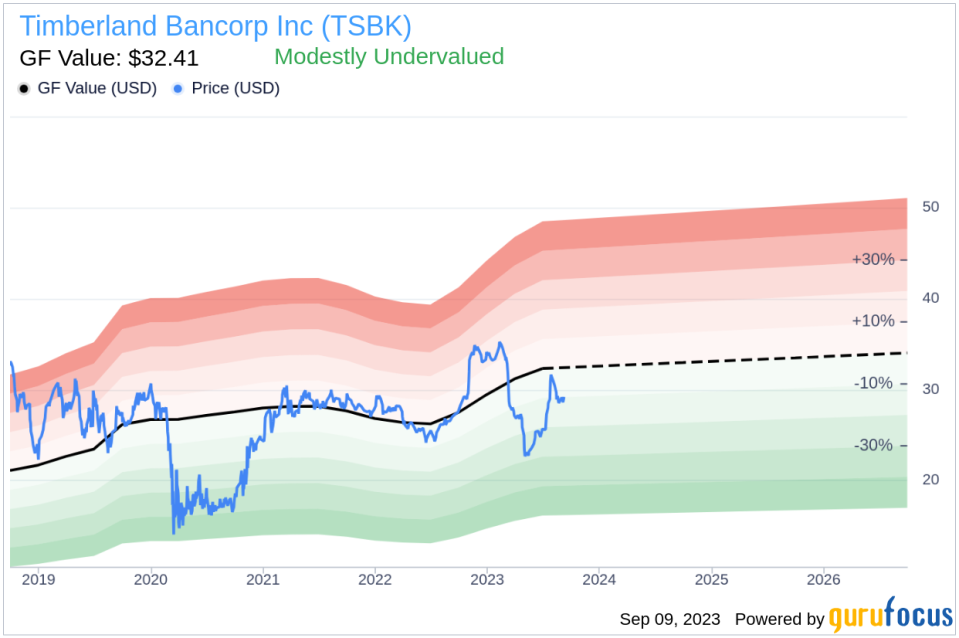

According to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance, Timberland Bancorp Inc is modestly undervalued. With a price of $28.44 and a GuruFocus Value of $32.41, the stock has a price-to-GF-Value ratio of 0.88.

In conclusion, while the insider's recent sell may raise some eyebrows, it's important to consider the broader context. The stock appears to be modestly undervalued according to the GuruFocus Value, and the company's fundamentals remain strong. As always, investors should do their own research and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.