Insider Sell: Cedric Pech Sells 616 Shares of MongoDB Inc

On September 29, 2023, Cedric Pech, the Chief Revenue Officer of MongoDB Inc (NASDAQ:MDB), sold 616 shares of the company. This latest transaction follows a series of sales by the insider over the past year, bringing the total number of shares sold to 51,727.

MongoDB Inc is a US-based general-purpose database platform. The company provides database platform to run applications at scale across on-premise, hybrid, and cloud-based environments. It also provides professional services including consulting and training. The company's platform addresses the performance, scalability, flexibility, and reliability demands of modern applications while maintaining the core capabilities of legacy databases.

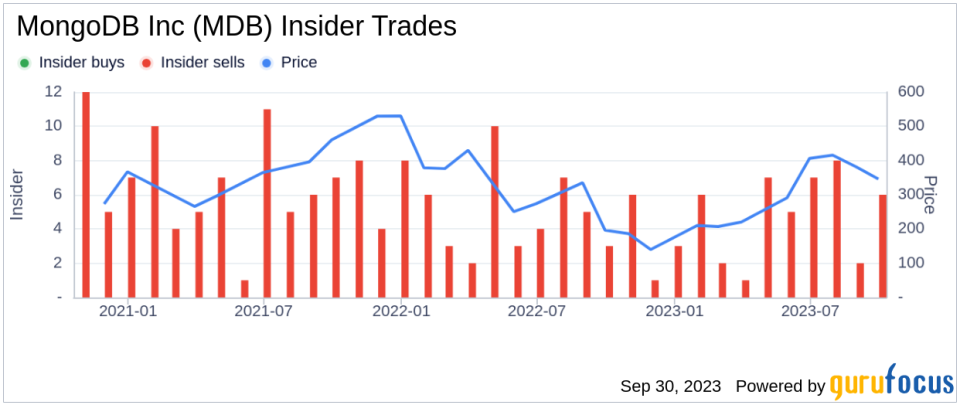

The insider's recent sell-off raises questions about the company's current valuation and future prospects. To understand the implications of this insider activity, it's essential to analyze the relationship between insider buy/sell transactions and the stock price.

The insider transaction history for MongoDB Inc shows a clear trend of insider selling over the past year. There have been 54 insider sells and 0 insider buys. This could indicate that insiders believe the stock is currently overvalued, prompting them to sell their shares.

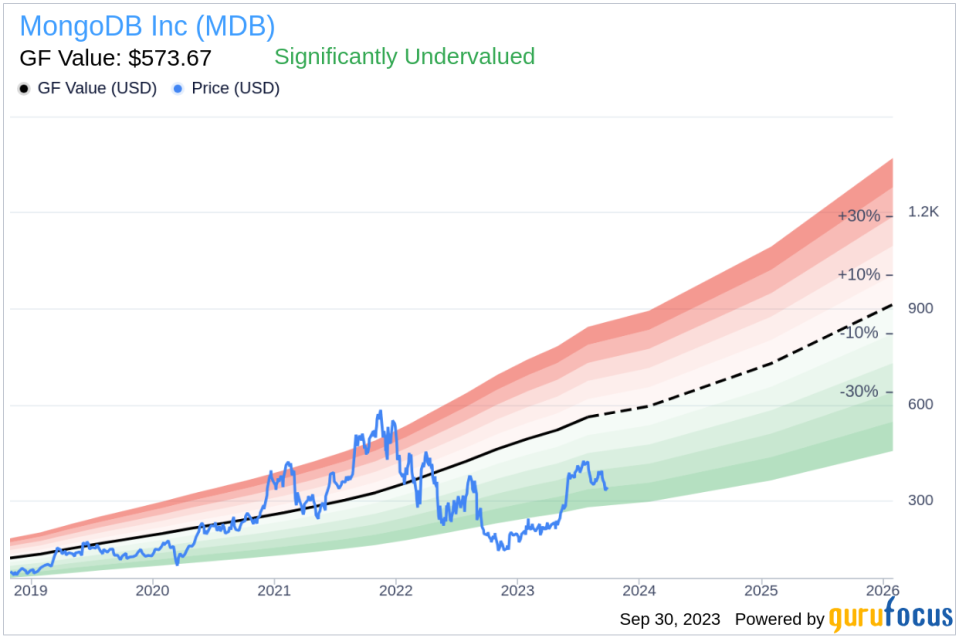

On the day of the insider's recent sell, shares of MongoDB Inc were trading at $339.66, giving the company a market cap of $24.68 billion.

However, according to the GuruFocus Value, the stock is significantly undervalued. The GF Value of MongoDB Inc is $573.67, resulting in a price-to-GF-Value ratio of 0.59.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

Despite the insider's recent sell-off, the GF Value suggests that MongoDB Inc's stock is significantly undervalued. This discrepancy between the insider's actions and the GF Value could be due to a variety of factors. The insider might have personal financial needs that necessitate the sell-off, or they might have a different perspective on the company's future prospects.

In conclusion, while the insider's recent sell-off might raise some concerns, the GF Value suggests that MongoDB Inc's stock is significantly undervalued. Investors should consider both these factors and conduct further research before making investment decisions.

This article first appeared on GuruFocus.