Insider Sell: CEO Andy Nemeth Sells 15,000 Shares of Patrick Industries Inc (PATK)

In a notable insider transaction, CEO Andy Nemeth of Patrick Industries Inc (NASDAQ:PATK) sold 15,000 shares of the company's stock on December 6, 2023. This move has caught the attention of investors and market analysts, as insider sales can provide valuable insights into a company's internal perspective.

Who is Andy Nemeth?

Andy Nemeth serves as the President and Chief Executive Officer of Patrick Industries Inc, a key player in the manufacturing and distribution of building products and materials for the recreational vehicle, manufactured housing, and industrial markets. With a tenure that has seen the company grow and adapt to market changes, Nemeth's leadership has been instrumental in steering Patrick Industries towards its current market position.

About Patrick Industries Inc

Patrick Industries Inc, traded under the ticker NAS:PATK, is a prominent name in the manufacturing sector, specializing in a wide array of products including laminated panels, cabinetry, hardwood furniture, fixtures, and countertops for the RV and manufactured housing industries. The company also extends its reach into the industrial market, providing high-quality materials for customers in the marine, hospitality, and institutional sectors.

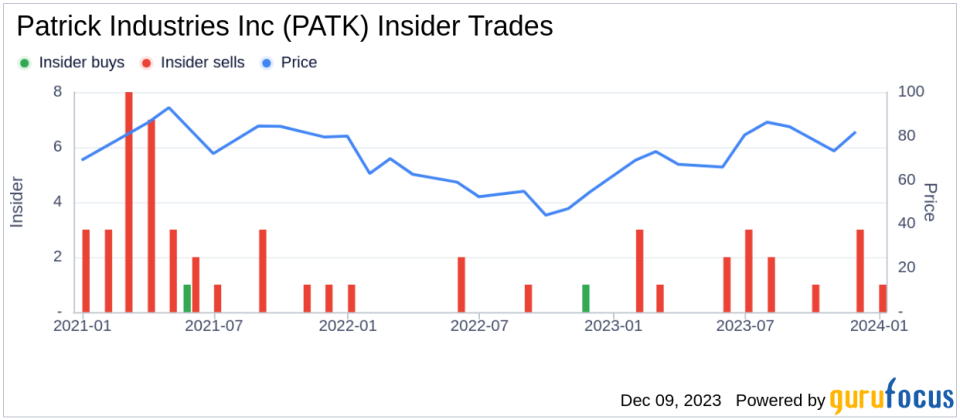

Analysis of Insider Buy/Sell and Stock Price Relationship

The insider transaction history for Patrick Industries Inc reveals a pattern of more insider sells than buys over the past year. Specifically, there have been 16 insider sells and no insider buys, indicating a potential sentiment among insiders that the stock may be fully valued or that they are taking profits off the table.

The insider's recent sale of 15,000 shares follows a year where Andy Nemeth has sold a total of 39,990 shares and has not made any purchases. This could suggest that the insider is less optimistic about the company's short-term growth prospects or simply diversifying their personal investment portfolio.

Valuation and Market Cap

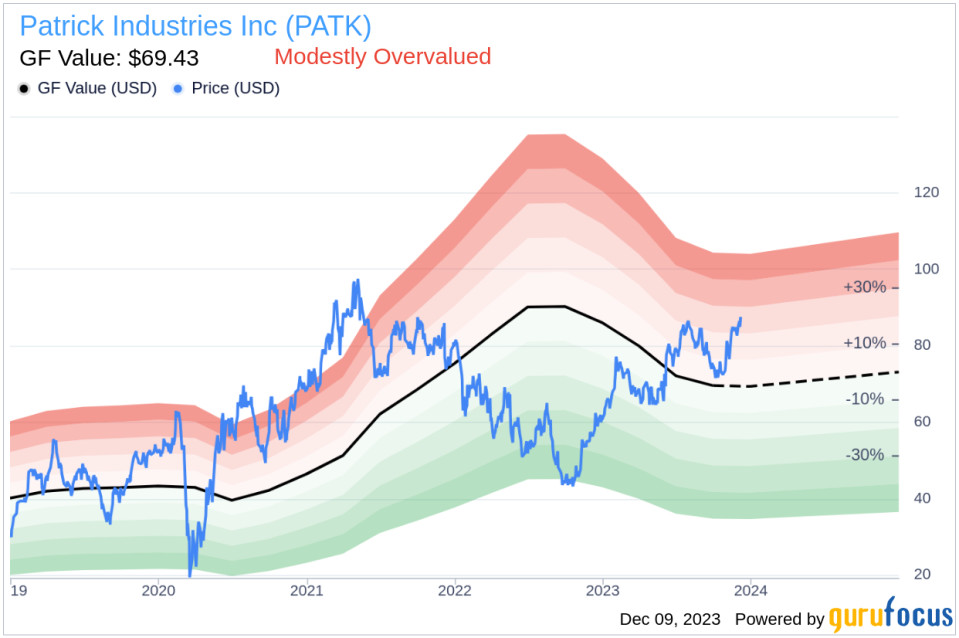

On the day of the insider's recent sale, shares of Patrick Industries Inc were trading at $87, giving the company a market cap of $1.944 billion. This valuation places the company's price-earnings ratio at 12.96, which is lower than both the industry median of 18.52 and the company's historical median price-earnings ratio. This could indicate that the stock is undervalued based on earnings potential.However, with a price-to-GF-Value ratio of 1.25, Patrick Industries Inc is considered modestly overvalued according to the GF Value metric. The GF Value, which stands at $69.43, is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The discrepancy between the current trading price and the GF Value suggests that investors are willing to pay a premium for Patrick Industries Inc shares, possibly due to the company's strong market position and potential for future growth.

Conclusion

The insider sell activity by CEO Andy Nemeth at Patrick Industries Inc, particularly the recent sale of 15,000 shares, provides an interesting data point for investors. While the company's valuation metrics present a mixed picture, with a lower than average price-earnings ratio but a modest overvaluation based on the GF Value, the insider's actions may signal a cautious approach to the stock at current levels.Investors should consider the insider trends, the company's valuation, and their own investment strategy when evaluating Patrick Industries Inc as a potential addition to their portfolio. As always, insider transactions are just one piece of the puzzle, and a comprehensive analysis should include a review of the company's financial health, market position, and growth prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.