Insider Sell: CEO Daniel Leib Sells 40,000 Shares of Donnelley Financial Solutions Inc (DFIN)

Donnelley Financial Solutions Inc (NYSE:DFIN), a company specializing in risk and compliance solutions, has recently witnessed a significant insider sell by its CEO, Daniel Leib. On November 13, 2023, Daniel Leib sold 40,000 shares of the company, a move that has caught the attention of investors and market analysts alike. This article delves into the details of the transaction, the insider's history, the company's business description, and the potential implications of this insider activity on the stock's valuation and price.

Who is Daniel Leib?

Daniel Leib has been at the helm of Donnelley Financial Solutions Inc as its Chief Executive Officer. His leadership has been instrumental in steering the company through the dynamic landscape of financial compliance and risk management. With a keen understanding of the industry and a strategic vision for the company, Leib's actions, especially in the stock market, are closely monitored for insights into the company's performance and future prospects.

Donnelley Financial Solutions Inc: A Business Overview

Donnelley Financial Solutions Inc is a company that operates at the intersection of finance and technology. It provides software and services that facilitate compliance and communication for its clients with regulatory requirements. The company's offerings include digital solutions, data analytics, and risk assessment tools that are essential for financial reporting and ensuring compliance with complex regulations. As businesses navigate the intricacies of financial regulations, Donnelley Financial Solutions Inc's role becomes increasingly critical, making it a key player in the financial services industry.

Analysis of Insider Buy/Sell and Stock Price Relationship

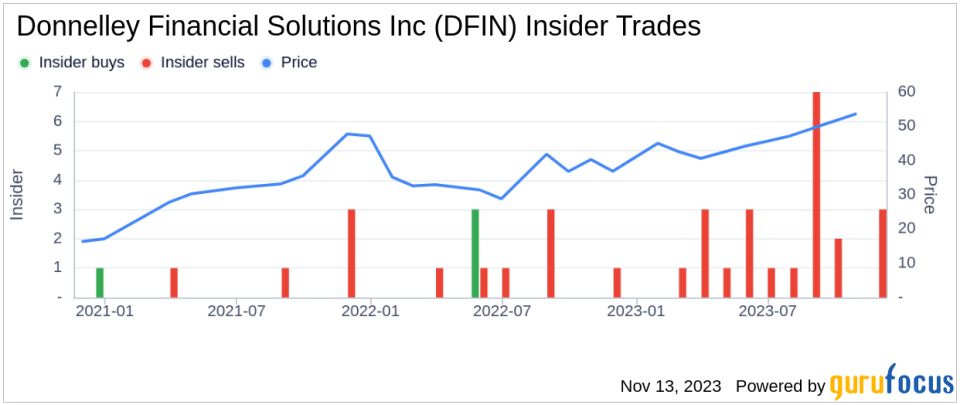

Insider transactions are often considered a barometer of a company's health and future performance. Over the past year, Daniel Leib has sold a total of 90,000 shares and has not made any purchases. This pattern of behavior could suggest a variety of things, including personal financial management or a belief that the stock may be currently overvalued.

The overall insider transaction history for Donnelley Financial Solutions Inc shows a trend of more insider selling than buying. In the past year, there have been 23 insider sells and no insider buys. This could indicate that insiders, who are privy to the most intimate knowledge of the company's workings, might perceive the stock's current price as being on the higher side.

On the day of the insider's recent sell, shares of Donnelley Financial Solutions Inc were trading at $53.51, giving the company a market cap of $1.602 billion. This valuation places the company in a strong position within the market, reflecting investor confidence in its business model and future growth potential.

The price-earnings ratio of Donnelley Financial Solutions Inc stands at 20.24, which is higher than the industry median of 18.34 and also above the company's historical median. This elevated P/E ratio could be indicative of the market's high expectations for the company's earnings growth or a sign that the stock is overpriced relative to its earnings.

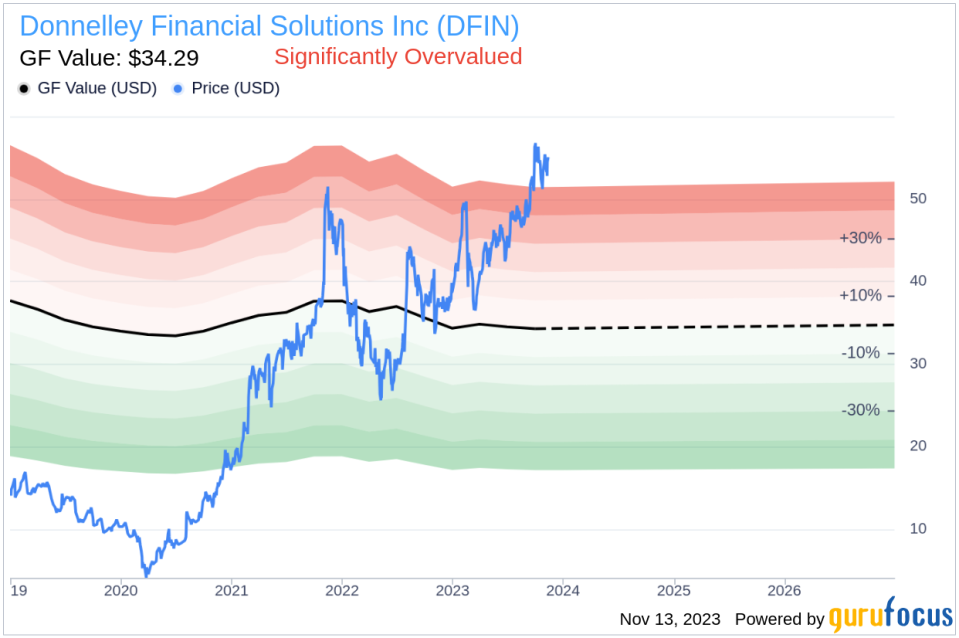

When considering the GuruFocus Value, which is set at $34.29, the stock's price-to-GF-Value ratio is 1.56. This suggests that Donnelley Financial Solutions Inc is significantly overvalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the selling and buying patterns of insiders at Donnelley Financial Solutions Inc. The predominance of selling transactions could be a signal for investors to consider the potential reasons behind this trend and its implications for the stock's future performance.

The GF Value image further illustrates the discrepancy between the stock's current trading price and its estimated intrinsic value. This significant overvaluation may prompt investors to exercise caution, as the stock price might adjust downwards to align with its fundamental value.

Conclusion

The recent insider sell by CEO Daniel Leib of Donnelley Financial Solutions Inc represents a notable event for the company's shareholders and potential investors. While insider selling does not always imply negative prospects for a company, the consistent pattern of insider sells over the past year, coupled with the stock's high price-earnings ratio and overvaluation relative to the GF Value, suggests that investors should closely monitor the stock and consider the broader market context when making investment decisions. As always, it is important to conduct thorough research and consider a multitude of factors before drawing conclusions based on insider activity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.