Insider Sell: CEO Deborah Weitzman Offloads Shares of Cardinal Health Inc

In the realm of stock market movements, insider trading activity is often a significant indicator for investors. Recently, Deborah Weitzman, the CEO of the Pharmaceutical Segment at Cardinal Health Inc (NYSE:CAH), sold a substantial number of shares, prompting a closer look at the implications of this insider action.

Who is Deborah Weitzman?

Deborah Weitzman is a prominent figure at Cardinal Health Inc, holding the position of CEO of the Pharmaceutical Segment. With a career spanning various leadership roles, Weitzman has been instrumental in driving the company's strategic initiatives and growth within the pharmaceutical industry. Her insights and decisions are closely watched by investors, as they can reflect her confidence in the company's future prospects.

Cardinal Health Inc's Business Description

Cardinal Health Inc is a global, integrated healthcare services and products company, providing customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, and physician offices worldwide. The company operates through two segments: Pharmaceutical and Medical. The Pharmaceutical segment distributes branded and generic pharmaceutical, specialty pharmaceutical, and over-the-counter healthcare and consumer products. This segment also provides services to pharmaceutical manufacturers and healthcare providers for specialty pharmaceutical products. Cardinal Health's Medical segment manufactures, sources, and distributes a broad range of medical, surgical, and laboratory products.

Insider Sell Analysis

According to the data provided, Deborah Weitzman sold 36,642 shares of Cardinal Health Inc on November 27, 2023. Over the past year, the insider has sold a total of 43,354 shares and has not made any purchases. This pattern of selling without corresponding buys could be interpreted in several ways. Investors often scrutinize such activity for clues about an insider's belief in the company's future performance.

The insider trend image above shows that there have been no insider buys and seven insider sells over the past year. This trend might suggest that insiders, including Weitzman, could perceive the stock as being fully valued or are taking profits after a period of appreciation.

Relationship with Stock Price

On the date of the most recent sell by the insider, shares of Cardinal Health Inc were trading at $106.31, giving the company a market cap of $25.962 billion. The price-earnings ratio stands at 173.72, significantly higher than the industry median of 16.97 and above the company's historical median price-earnings ratio. This elevated P/E ratio could indicate that the stock is priced optimistically relative to its earnings, which might be a contributing factor to the insider's decision to sell shares.

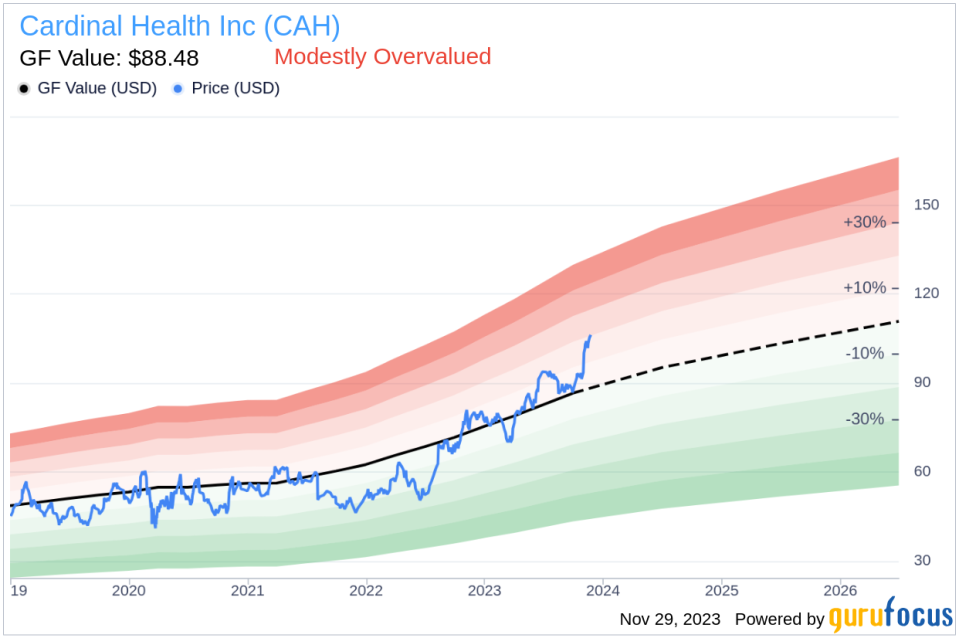

Valuation and GF Value

The stock's current price-to-GF-Value ratio is 1.2, with a GF Value of $88.48, suggesting that Cardinal Health Inc is modestly overvalued. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The GF Value image above illustrates the stock's valuation relative to its intrinsic value. When the market price exceeds the GF Value, as it does in this case, it may signal that the stock is overpriced, potentially justifying the insider's decision to sell.

Conclusion

The recent insider sell by Deborah Weitzman at Cardinal Health Inc raises questions about the stock's valuation and future performance. While insider sells are not always indicative of a stock's decline, they can provide valuable context, especially when they follow a pattern or occur alongside other indicators of overvaluation. Investors would be wise to consider the high P/E ratio, the absence of insider buys, and the stock's modest overvaluation relative to the GF Value when making investment decisions regarding Cardinal Health Inc. As always, insider trades are just one piece of the puzzle, and a comprehensive analysis should include a review of the company's fundamentals, industry trends, and broader market conditions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.