Insider Sell: CEO Dhrupad Trivedi Sells 15,729 Shares of A10 Networks Inc (ATEN)

In a notable insider transaction, CEO Dhrupad Trivedi sold 15,729 shares of A10 Networks Inc (NYSE:ATEN) on December 6, 2023. This sale has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's prospects and the confidence level of its top executives.

Who is Dhrupad Trivedi?

Dhrupad Trivedi is the President and CEO of A10 Networks Inc, a position he has held since December 2019. With a strong background in technology and leadership, Trivedi has been instrumental in steering the company through the evolving landscape of cybersecurity and networking solutions. Prior to his current role, Trivedi served as the Executive Vice President and Chief Technology Officer at Belden Inc., where he was responsible for corporate strategy and development.

A10 Networks Inc's Business Description

A10 Networks Inc is a technology company that specializes in providing advanced cybersecurity and networking solutions. The company's suite of products includes application delivery controllers, DDoS protection, threat intelligence, and network management tools. A10 Networks Inc is known for its high-performance solutions that help organizations ensure their data center applications and networks remain highly available, accelerated, and secure.

Analysis of Insider Buy/Sell and Relationship with Stock Price

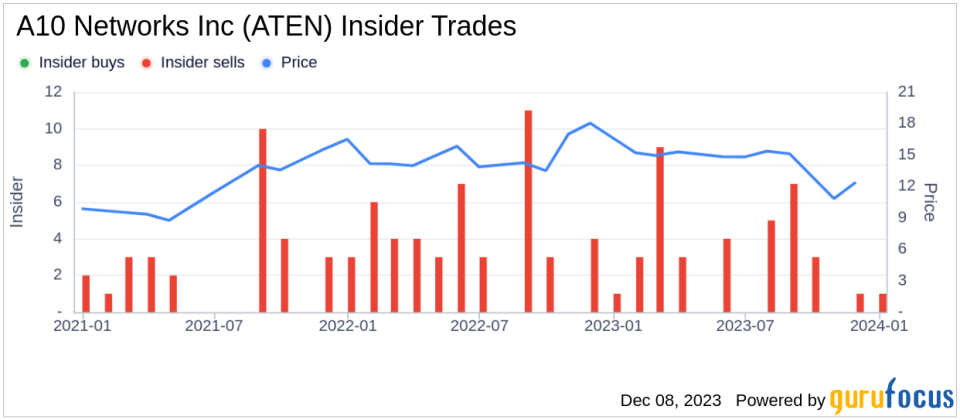

Insider transactions, particularly those involving high-ranking executives like CEOs, can be a strong indicator of a company's internal perspective on its stock's value. Over the past year, Dhrupad Trivedi has sold a total of 163,745 shares and has not made any purchases. This pattern of selling without corresponding buys could signal that the insider may perceive the stock's current price as being on the higher end of its value spectrum, or it could be part of a personal financial strategy.

It is important to note that there have been 36 insider sells and no insider buys over the past year for A10 Networks Inc. This trend of insider selling could suggest that those with the most intimate knowledge of the company's workings are choosing to liquidate some of their holdings. However, without additional context, it is difficult to draw definitive conclusions from this activity alone.

On the day of the insider's recent sale, shares of A10 Networks Inc were trading at $12.71, giving the company a market cap of $944.521 million. The price-earnings ratio stood at 24.04, which is lower than both the industry median of 26.68 and the company's historical median price-earnings ratio. This could indicate that the stock is undervalued compared to its peers and its own historical valuation.

Adding another layer to the valuation analysis, A10 Networks Inc's price-to-GF-Value ratio is 0.87, with a GF Value of $14.65. This suggests that the stock is modestly undervalued, which could be an attractive entry point for investors seeking value opportunities.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The insider trend image above provides a visual representation of the selling and buying activities of insiders over time. The absence of buys and the consistent pattern of sells could be interpreted in various ways, but it is essential for investors to consider the broader market and economic context when evaluating these actions.

The GF Value image further illustrates the stock's valuation relative to its intrinsic value estimate. When the market price is below the GF Value line, as it is in the case of A10 Networks Inc, it indicates that the stock may be undervalued.

Conclusion

Insider transactions, such as the recent sale by CEO Dhrupad Trivedi, provide valuable data points for investors. While a pattern of insider selling can raise questions about a stock's future prospects, it is crucial to consider the broader valuation context. A10 Networks Inc's current price-earnings ratio and price-to-GF-Value ratio suggest that the stock may be undervalued, potentially offering an attractive opportunity for value investors. As always, investors should conduct their own due diligence and consider insider transactions as one of many factors in their investment decision-making process.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.